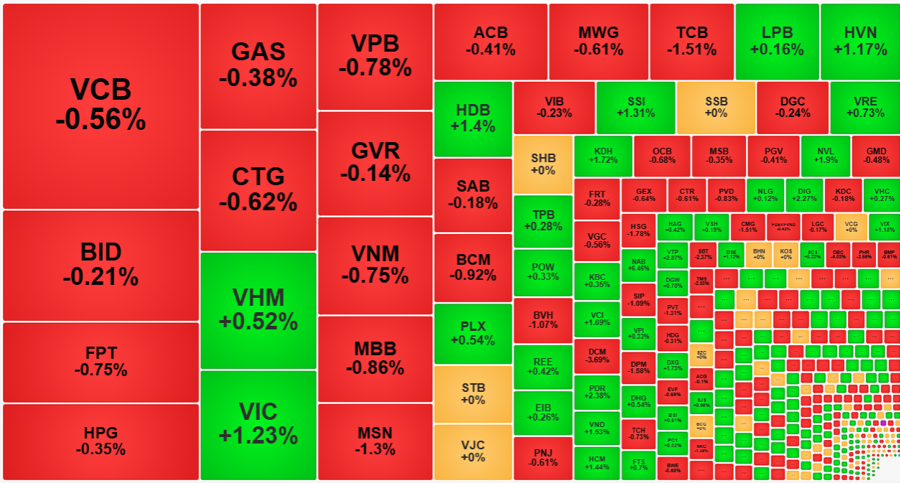

Blue-chip stocks performed poorly this afternoon as VN30 basket liquidity plummeted to a 7-session low, even dropping over 6% from the morning session. The vast majority of stocks in the basket fell to lower price levels, with the reversed breadth causing the VN30-Index to close 4.69 points lower.

Only two pillar stocks ended the day in positive territory: VIC rose 1.23% and VHM gained 0.52%. All other 8 codes in the top 10 capitalization declined. Even expanding to the top 15 largest stocks, there were no additional green codes. The breadth of the VN30 group at the end of the session stood at 8 gainers/18 losers, compared to 15 gainers/9 losers at the end of the morning session. The VN30-Index closed down 4.69 points, equivalent to -0.36% from the reference level.

Statistics show that up to 25/30 stocks in this blue-chip basket slipped in the afternoon session. Even the strongest pillar, VIC, was pressured to close just 1.23% higher, equivalent to 0.6% lower than the morning closing price. Stocks that improved in the afternoon included PLX, up 1.41%, successfully reversing to surpass the reference price by 0.54%. SSI rose 0.72%, expanding its intraday gain to 1.31%.

Securities stocks unexpectedly outperformed real estate stocks this afternoon. Unofficial information about the second-quarter business results of some securities companies stimulated strong buying demand. The group saw dozens of codes rise over 1%, with MBS and VDS climbing over 3%. Large trading volume was observed in SSI with VND382.5 billion, VCI with VND228.1 billion, HCM with VND198.3 billion, and VIX with VND165.8 billion, and their prices all increased significantly.

However, the market’s differentiation this afternoon was significantly weaker than in the morning as many stocks were pushed down to lower price levels. The excitement in the securities group was not sufficient to stimulate the market, as many blue-chips declined, dragging the indices lower. The breadth on the HoSE floor at the end of the session stood at 198 gainers/242 losers, compared to 199 gainers/188 losers at the morning close. On a positive note, not many stocks were pushed too deeply, and only 62 codes declined over 1%, slightly higher than the morning session. The vast majority of stocks fell with a narrow range and low liquidity, reflecting a typical fluctuating state.

On the contrary, today’s gainers signaled a shift in money flow as expected. Real estate stocks surprised in the morning, and the securities group joined in the afternoon. Meanwhile, only 9 out of 27 banking stocks stayed in positive territory, and most blue-chips turned red. HDB and TPB were the only two banking stocks in the VN30 group that closed above the reference price. The decline among blue-chips led to a general weakening of market liquidity. The HoSE floor matched 7.6% lower in the afternoon session compared to the morning, and including HNX, the decline was nearly 7%.

The shift in money flow, amid overall weak liquidity, resulted in trading concentration in a few stocks. For instance, in the gainers’ group, the VN-Index recorded 82 codes that closed over 1% higher, but liquidity was mostly evident in the securities and real estate groups. KDH, DIG, SSI, VCI, HCM, VIX, PDR, VND, NVL, VIC, HDC, and DXG were the best-performing stocks, all trading over VND100 billion. Just the top 20 liquid stocks in this group accounted for nearly 80% of the trading value, while the majority matched a few billion to a few dozen million VND.