Illustrative image

In its recently published strategy report, KBSV Securities stated that the USD/VND interbank exchange rate has been under pressure, consistently testing and surpassing the State Bank of Vietnam’s (SBV) selling rate of 25,450, and appreciating by 4.9% year-to-date.

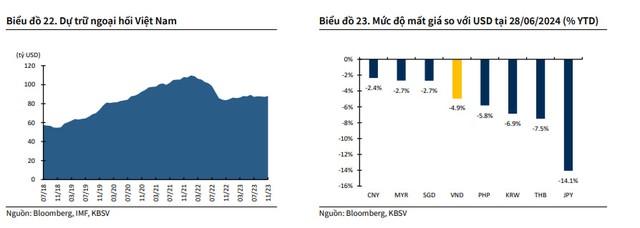

According to KBSV, despite the SBV’s intervention by directly selling substantial amounts of foreign currency (estimated at $6 billion as of June 26), the exchange rate has shown no signs of cooling down. Moreover, the exchange rate is expected to remain under pressure due to: (1) the high demand for imported raw materials and inputs for production; (2) the tendency of export-oriented enterprises and FDI companies to hold USD overseas; and (3) the strong position of the US dollar index (DXY) amid the weakening of other currencies.

To address the exchange rate pressure, which is anticipated to persist until at least mid-Q3 (around the time the Fed cuts interest rates), the analysis team foresees the SBV employing a combination of three strategies.

First, continuing to sell foreign currency. This strategy has been employed by the SBV over the past three months. However, with current estimates, foreign reserves are approaching the IMF-recommended level equivalent to three months of imports. As such, the SBV’s room to continue selling foreign reserves is limited if it wants to maintain the country’s creditworthiness. Therefore, the SBV will need to simultaneously implement the following two strategies to curb the market’s demand for USD.

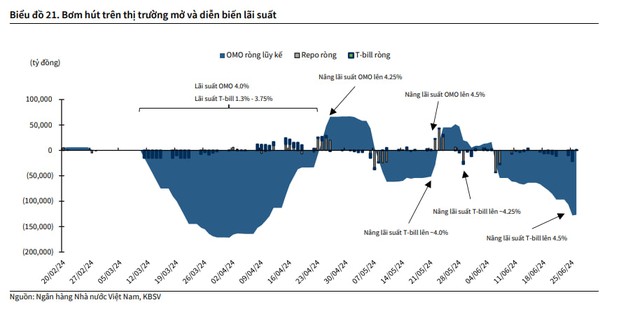

Second, increasing the VND interest rate. The SBV has already raised the OMO and bill rates by 0.5 and 3.1 percentage points, respectively, compared to the beginning of 2024. KBSV believes that these moves will continue to ensure relatively high market interest rates, minimizing exchange rate speculation, while also impacting deposit interest rates appropriately, thereby increasing the attractiveness of holding VND.

Third, raising the USD selling price. Given that the VND’s depreciation remains relatively low compared to other currencies in the region, and with inflation expectations remaining manageable in the last months of the year, KBSV believes that the SBV can and is likely to increase the USD selling price (and thus the mid-point rate), allowing for a VND depreciation of more than the current 5%.

KBSV also forecasts that the exchange rate will gradually ease in Q4, with a full-year appreciation of 4.5%, reaching 25,360 VND/USD. The analysis team attributes this to an expected improvement in foreign currency supply in Q4 due to increased exports and remittances, along with the potential easing of pressure on the exchange rate as a result of anticipated Fed interest rate cuts.

4 Factors Putting Pressure on USD/VND Exchange Rate in Q1/2024

With the currency exchange rate fluctuating in the first few weeks of 2024, Mr. Ngo Dang Khoa, Director of Foreign Exchange, Capital Markets and Securities Services at HSBC Vietnam, highlights four factors putting pressure on the USD/VND exchange rate in Q1/2024…

USD prices in banks and the free market rise after the Tet holiday

On the first day of trading after the Lunar New Year holiday, the USD price increased both in banks and on the free market.