Cautious and discerning customers place their trust wisely

According to recent reports by McKinsey & Company and the Deloitte Financial Services Center, despite rising global banking profits, financial institutions worldwide are still trimming jobs amid market volatility. Facing the strong transformation of AI technology with creativity, high interest rates, tight institutional oversight, and rising customer expectations – banks need to adjust their business and operating models. Some surveys indicate that after last year’s major bank failures – such as the collapse of First Republic Bank and Silicon Valley Bank in the US, and Credit Suisse in Switzerland – consumer confidence in banks has taken a hit.

Cloris Chen, CEO of Cogito Finance, a provider of institutional-grade investment products via blockchain, stated, “Customers need to have faith in the financial stability of banks and the safety of their money. Trust, safety, and technological innovation are three of the most critical factors in making a good bank for all customers, whether they are businesses or individuals, international or local.”

The latest report by Vietnam Report indicates that potential threats from cyber-attacks and financial crimes impact customers’ perceptions. According to the survey, the three most important factors affecting a bank’s reputation today are: Safe and secure customer data handling (82.6%); Providing high-quality products and services (60.9%); and Effective and timely resolution of customer issues/complaints (55.5%).

According to the CEO of Decision Lab, amid market fluctuations, consumers tend to gravitate towards banks with established reputations that have stood the test of time. This explains why these banks remain resilient no matter how challenging the market becomes. It underscores the importance of brand health – a priceless asset for any business.

TPBank meets customer expectations in prestigious domestic and international rankings

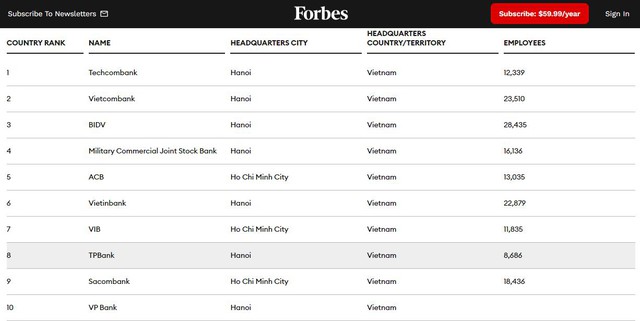

Surpassing many large-scale banks, TPBank ranked 8th in Forbes’ list of the World’s Best Banks. This recognition was based on a survey of over 49,000 individuals across 33 countries, using 17 different languages. Participants were asked to rate their overall satisfaction with each bank and whether they would recommend it to others, based on five criteria: trustworthiness, terms and conditions (fees and interest rates), customer service (waiting times and staff helpfulness), digital services (website and app usability), and financial advice.

Meanwhile, Decision Lab’s ranking of the Best Banks in 2024 was based on data from 18,000 interviews with Vietnamese consumers through YouGov’s online survey community in Vietnam. The brands were ranked using an Index to assess overall brand health, taking into account factors such as Impression, Quality, Value, Satisfaction, Recommend, and Reputation. According to the results, TPBank ranked 7th, moving up one place from 2023.

Mr. Nguyen Hung, CEO of TPBank, shared, “Since its inception, TPBank has always built its foundation on understanding its customers to deliver leading-quality banking services. Understanding leads to empathy, shared journeys, and the creation of the best and most suitable products and services that bring the highest value to our customers. This has been our guiding star for sustainable development.”

In 2023 alone, TPBank continued its rapid customer growth trajectory, adding over 3.5 million new accounts and surpassing the 12-million customer mark. Over the past three years, with its pioneering and comprehensive digital banking strategy, TPBank has attracted more than 8.6 million customers, doubling its total customer base accumulated over the previous 12 years. This testifies to the trust placed in the bank by tens of millions of people.

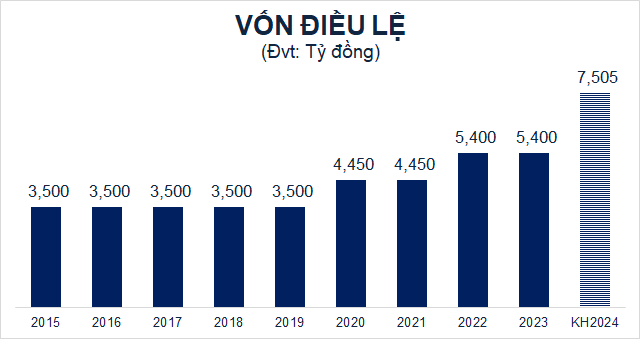

The bank also maintained its top position in Vietnam for the second consecutive year in The Asian Banker’s list of “Strongest Banks in the Asia-Pacific Region,” upholding its excellent risk management foundation. TPBank’s total assets exceeded VND 356,600 billion, with a charter capital of over VND 22,000 billion. Additionally, for the first time, TPBank’s loan balance surpassed VND 210,000 billion, a 19% increase, far exceeding the industry average.

Recently, Vietnam Report also announced its banking industry rankings, with TPBank once again making it to the Top 10 Most Reputable Commercial Banks in Vietnam and being recognized as one of the Top 5 Most Reputable Private Joint-Stock Commercial Banks. The awards will be presented at a ceremony hosted by Vietnam Report and VietNamNet Newspaper in Hanoi in August 2024.

Manulife pioneers the use of technology to ensure customers’ full understanding and accurate purchases

Manulife Vietnam is thrilled to announce the official implementation of the information verification and contract issuance monitoring process for all M-Pro policyholders, effective from January 1, 2024. This comes after a successful pilot phase, demonstrating our commitment to ensuring accuracy and transparency in our insurance policies.

Capital Contribution and Potential Criminal Risks

The registered capital is the initial resource to maintain business operations and record investor investments. It also serves as the limited liability foundation for assets within the company’s registered capital in the face of legal obligations. However, recent noncompliance cases regarding registered capital contributions in certain securities market businesses have revealed the potential criminal risks if regulations are not strictly adhered to.

The Secrets to Women Achieving Financial Stability

The ability of women to financially support themselves and their future generations has become an important factor in achieving their goals in life. In fact, various studies have shown that women generally have a strong motivation to improve their quality of life by prioritizing personal happiness, spending time with loved ones, and ensuring financial security.