The Vietnamese stock market witnessed a slight dip in the afternoon session, despite a positive start in the morning. Profit-taking pressures caused the VN-Index to adjust downwards, closing 2.14 points lower at 1,283.8 points on July 11. Trading liquidity on HoSE also decreased compared to the previous session, with a value of over VND 18,500 billion.

Contrary to the overall market’s subdued performance, foreign trading unexpectedly turned positive as it switched to net buying, with a value of VND 275 billion across the market, ending a 24-consecutive-session net selling streak.

On the HoSE, foreign investors net bought VND 69 billion.

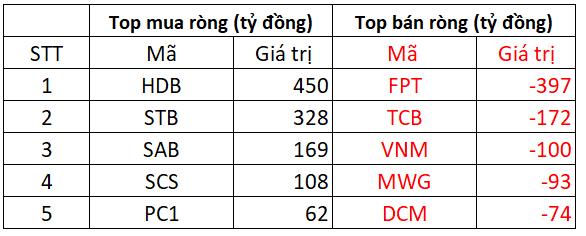

HDB and STB stocks were the main focus of net buying by foreign investors, with values of VND 450 billion and VND 328 billion, respectively. This was followed by SAB, which saw net buying of VND 169 billion. Additionally, SCS and PC1 were also net bought, with values of VND 108 billion and VND 62 billion, respectively.

On the other hand, FPT faced the strongest selling pressure from foreign investors, with nearly 3 million shares sold, equivalent to a value of VND 397 billion. TCB and VNM also witnessed net selling of VND 172 billion and VND 100 billion, respectively.

On the HNX, foreign investors net sold nearly VND 8 billion

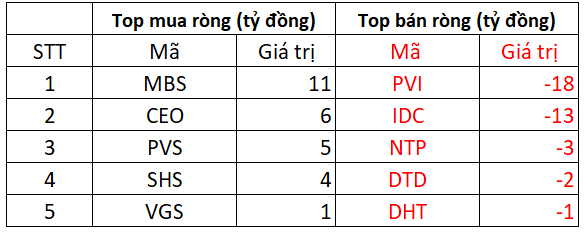

MBS was the most net bought stock on the HNX, with a value of VND 11 billion. CEO followed closely, with net buying of VND 6 billion. Foreign investors also spent a few billion each to net buy PVS, SHS, and VGS.

On the opposite side, PVI faced the most significant net selling pressure from foreign investors, with a value of nearly VND 18 billion. IDC, NTP, and DTD also witnessed net selling, ranging from a few billion to over ten billion dong.

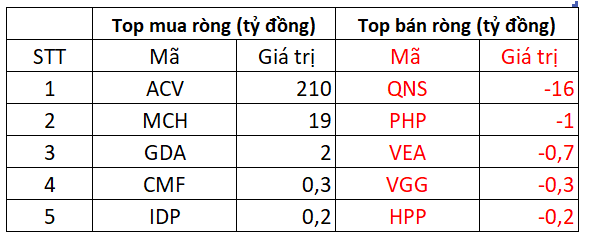

On the UPCOM, foreign investors net bought VND 213 billion

Conversely, QNS faced net selling pressure from foreign investors, with a value of VND 16 billion. PHP, VEA, and VGG were also among the stocks that witnessed net selling by foreign investors.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”