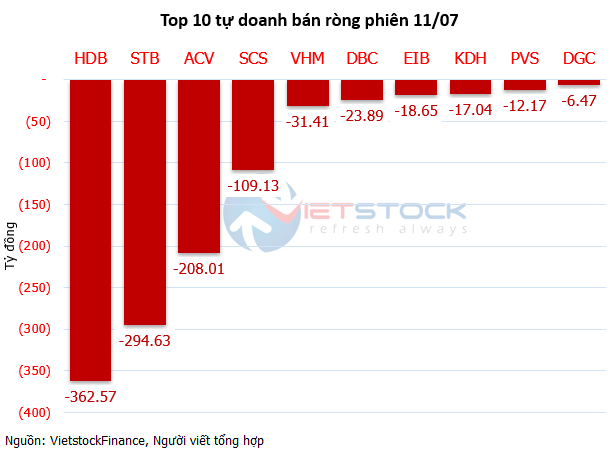

During the selling session, securities companies’ proprietary trading activities saw the strongest selling pressure on two bank stocks, HDB and STB, with values of over VND362.5 billion and nearly VND295 billion, respectively. ACV also witnessed substantial selling, with a value of over VND208 billion, followed by SCS at more than VND109 billion.

On the buying side, securities companies’ proprietary trading activities focused on purchasing FPT stocks, with a value of approximately VND89 billion. This was followed by MWG (VND73 billion) and HPG (VND40 billion). Additionally, proprietary trading activities mainly involved buying bank stocks, including TCB (VND49 billion), ACB (VND36 billion), VPB (VND28 billion), and VIB (VND19 billion).

| Foreigners’ net buying ends |

A bright spot in the stock market on July 11 was the unexpected net buying by foreign investors, with a value of over VND230.5 billion, ending a 25-session net selling streak.

During the buying session, foreign investors focused on purchasing two bank stocks, HDB and STB, with values of over VND450 billion and nearly VND330 billion, respectively. This was followed by ACV, which was also heavily bought at around VND206 billion, along with SAB (VND170 billion) and SCS (VND108 billion).

On the selling side, FPT faced the strongest selling pressure from foreign investors, with a value of over VND386 billion. This was followed by TCB and VNM, which were sold off for more than VND170.5 billion and VND96 billion, respectively.

|

Top 10 stocks with the highest foreign trading volume on July 11 |

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.