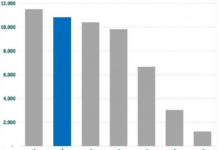

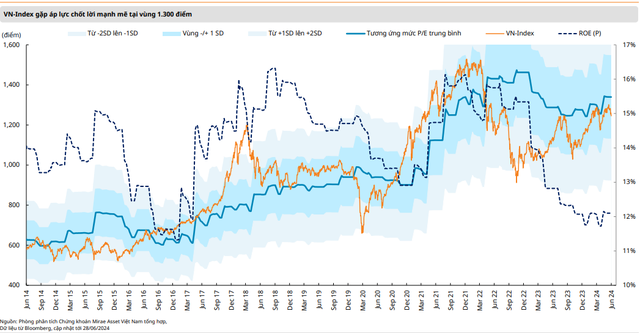

“A review of Q2 trading activity and the overall picture for the first half of 2024 reveals that the Vietnamese market has begun to show signs of profit-taking, despite maintaining some of the impressive gains from Q1 2024,” according to Mirae Asset Securities (MASVN) in their recently published strategic report.

Currently, the VN-Index is trading below the 10-year average P/E ratio, leaving room for further gains in the latter half of 2024. However, the market will need new catalysts to realize this upside potential. Additionally, the analysts believe that the growth momentum will be relatively weaker, with price action likely to fluctuate within a wide range, leading to a period of consolidation. This trend is expected to continue until mid-July, as the market enters a quiet news period, and trading sentiment is expected to be cautious ahead of the Q2 earnings season.

Nevertheless, Mirae Asset remains optimistic about the VN-Index’s ability to maintain its upward trajectory, targeting a range of 1,320 – 1,340 points for the second half of 2024, corresponding to the 10-year average P/E ratio.

Q2 earnings landscape presents a significant hurdle for the VN-Index in the coming months

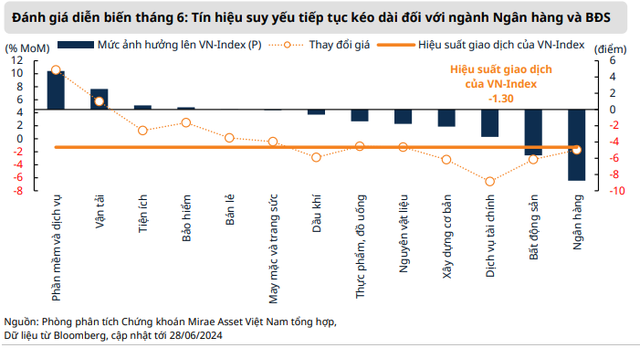

On the other hand, the lack of strong upward momentum in the market can be largely attributed to the trading performance of large-cap stocks in the Banking and Real Estate sectors. While other sectors may show more positive prospects, their overall impact is still limited compared to the market capitalization weight of 51% held by Banking and Real Estate.

Specifically, for the Banking sector, despite accelerated credit growth in the first half of June, reaching 3.79% from the end of 2023 (an improvement from 2.41% at the end of May), this development is unlikely to be reflected in Q2 earnings.

The report also mentions that the positive news from Q1 2024 earnings has already been priced in, while the outlook for Q2 2024 is relatively muted. Therefore, there could be pressure on bank profits in Q2, which may constrain the overall profit growth of the VN-Index.

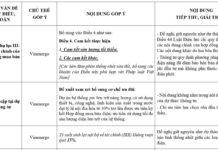

Additionally, the outlook for the Real Estate sector remains subdued while awaiting clearer information on the early implementation of three critical laws: the 2024 Land Law, the 2023 Housing Law, and the 2023 Real Estate Business Law. As a result, the analysts believe that the Q2 earnings landscape presents a significant hurdle for the VN-Index in the coming months.

3 Macro Factors to Watch in the Second Half of 2024

MASVN highlights several factors for investors to monitor in the latter half of 2024, including: Credit Growth, Exports and Imports, and Public Investment.

Regarding credit growth, Mirae Asset believes that lending rates are not the main obstacle to credit growth in the first half of 2024. Instead, the more challenging issue is credit demand. The brokerage firm expects credit growth to accelerate in the remaining months of 2024 due to Vietnam’s continued monetary and credit policy easing to support economic recovery and signs of recovery in the manufacturing sector, as evidenced by increased imports of raw materials since May.

Additionally, the story of exports and imports is the main driver of GDP growth this year. The analysts expect exports to regain growth momentum in the coming months, driven by increased imports of raw materials since May.

Lastly, on public investment, MASVN predicts that the disbursement pace of public investment will significantly accelerate in the coming months. In the first half of the year, investment from the state budget only reached 27.51% of the overall plan and 29.39% of the allocation plan approved by the Prime Minister for 2024.

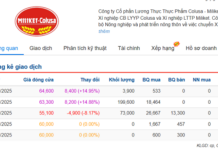

The Power of Lizen: Consistently Winning Massive Bids

Lizen has achieved a significant milestone by successfully deploying and implementing major high-speed construction projects in 2023. The company’s revenue has reached 2,030.5 billion VND, which is twice the amount compared to 2022. However, the post-tax profit has reached its lowest point in the past 6 years, dropping down to only 118.3 billion VND.