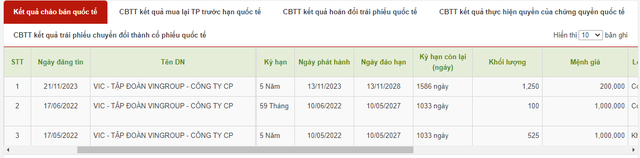

Vingroup, one of Vietnam’s leading conglomerates (stock code: VIC), has recently delisted the remaining 1,250 bonds from its 2021 international bond issue at the Singapore Exchange. This move comes as Vingroup repurchased the entire bond issue prior to its maturity date. The estimated total repurchase value stands at $250 million.

Initially, Vingroup issued $500 million worth of convertible bonds in September 2021, with a five-year maturity. These unsecured bonds carried a fixed interest rate of 3% and a face value of $200,000 per bond. The company had previously redeemed half of this bond issue.

These bonds offered the option to convert them into shares of CTCP Vinhomes, listed on the Ho Chi Minh City Stock Exchange (VHM shares). The conversion rate at the time of issuance was 37,515.82 VHM shares for each $200,000 bond.

Vingroup currently has two other international bond issues in circulation.

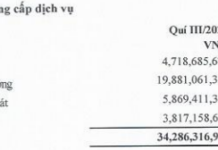

In 2022, the company issued international bonds worth $625 million. Earlier this year, bondholders agreed to extend the maturity of more than half of these exchangeable bonds, valued at $625 million, by an additional 18 months. Specifically, while the bonds were originally due in May of this year, Vingroup will only repay half of the amount, with the remaining half extended by 18 months. This bond issue can be exchanged for VinFast shares by a group of reputable institutional investors. The offer price for each bond is $1 million.

Most recently, on October 25, 2023, Vingroup successfully completed the offering of $250 million in international exchangeable bonds. These bonds can be exchanged for Vinhomes shares owned by Vingroup and will mature in 2028. The interest rate is variable, ranging from 9.5% to 10% per annum, paid quarterly, and denominated in US dollars. The exchange price for Vinhomes shares is expected to be between 51,635 and 53,880 VND per share.

This year, the conglomerate, led by billionaire Pham Nhat Vuong, has planned a private placement of bonds worth 8,000 billion VND. These non-convertible, non-warrant-attached, unsecured corporate bonds will have a maximum term of 24 months from the issuance date, and the proceeds will be used to restructure Vingroup’s debt obligations.

The bond issuance will be divided into four tranches, scheduled to take place from April 2024 to June 2024.