The stock market opened with a near 6-point gap up but selling pressure to take profits increased later, causing VN-Index to weaken towards the end of the session. At the close, the VN-Index lost 2.14 points to 1,283.8 points. Liquidity on HoSE fell compared to the previous session, with a trading value of over VND18,500 billion.

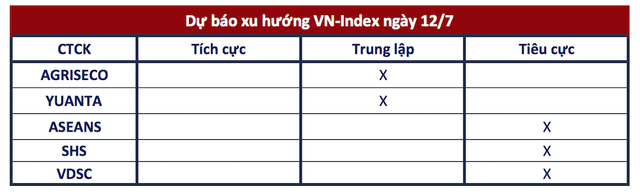

Regarding the trading session on July 12th, most securities companies believe that the recent correction was quite healthy and has not significantly affected the market’s short-term uptrend.

Healthy correction, consider disbursement

Agriseco Securities: On the technical chart, the VN-Index closed at the lowest price of the session, indicating that sellers are taking control as short-term profit-taking pressure tends to increase. This signal reinforces the Bearish Engulfing candle pair, suggesting a possible reversal from the previous session’s gains. However, Agriseco Research believes that the current correction is relatively healthy and has not significantly impacted the market’s short-term upward trend.

It is likely that active buying demand will increase again when the index dips towards the 1,270 (+-5) point region. Agriseco recommends that investors gradually increase their stock proportions at current price levels, prioritizing stocks in sectors expected to report strong Q2/2024 earnings such as retail, steel, and export industries (wood and textiles).

Continued sideways trend

Yuanta Securities: The market is likely to continue to fluctuate around current levels in the next session. At the same time, Yuanta assesses that short-term risks remain low, and the market is still in a corrective phase. If the correction continues for another 1-2 sessions, Yuanta expects low-price demand to increase again soon.

Positively, differentiation is taking place, indicating that money is rotating between stock groups and showing signs of focusing on Midcaps and Smallcaps, especially securities stocks. In addition, the psychological indicator continues to rise slightly, indicating that new buying opportunities continue to increase.

Further adjustment

ASEAN Securities: The correction was relatively mild, and there was no panic selling pressure. The breadth of the market improved among large-cap stocks with the participation of real estate and securities groups. Selling pressure was strong in groups that had previously rallied. However, the positive sign is that liquidity remained low, indicating that supply-side pressure is easing.

Therefore, the securities firm maintains the view that the index will continue to fluctuate and expects the VN-Index to find a balance in the 1,260-1,270 point region (MA20). Investors should consider disbursement.

SHS Securities: The short-term trend of the VN-Index is still accumulating positively in the 1,250-point – 1,300-point region. The VN-Index is facing corrective pressure around the equilibrium price of this accumulation channel at 1,275 points, corresponding to the 20-session moving average price, after heading towards the 1,300-point region, which is a strong resistance area and the June 2024 and August 2022 price peaks.

This corrective pressure is quite normal as prices fall and liquidity declines, especially after the VN-Index had seven consecutive gaining sessions. In a positive scenario, if the VN-Index recovers well at the short-term support zone of 1,270 – 1,275 points, it is likely to retest the 1,300-point resistance area.

VDSC Securities: The market failed to gain ground as it approached the 1,293-point resistance with caution. Liquidity decreased compared to the previous session, indicating that supply has not put significant pressure on the market, but supportive cash flow has temporarily cooled down. The corrective movement may continue in the next session, but the market is expected to be supported around 1,278 points, the recent sideways zone. Temporary expectations remain for a market recovery after the current correction due to supportive influences from the recent positive developments.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.