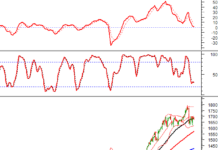

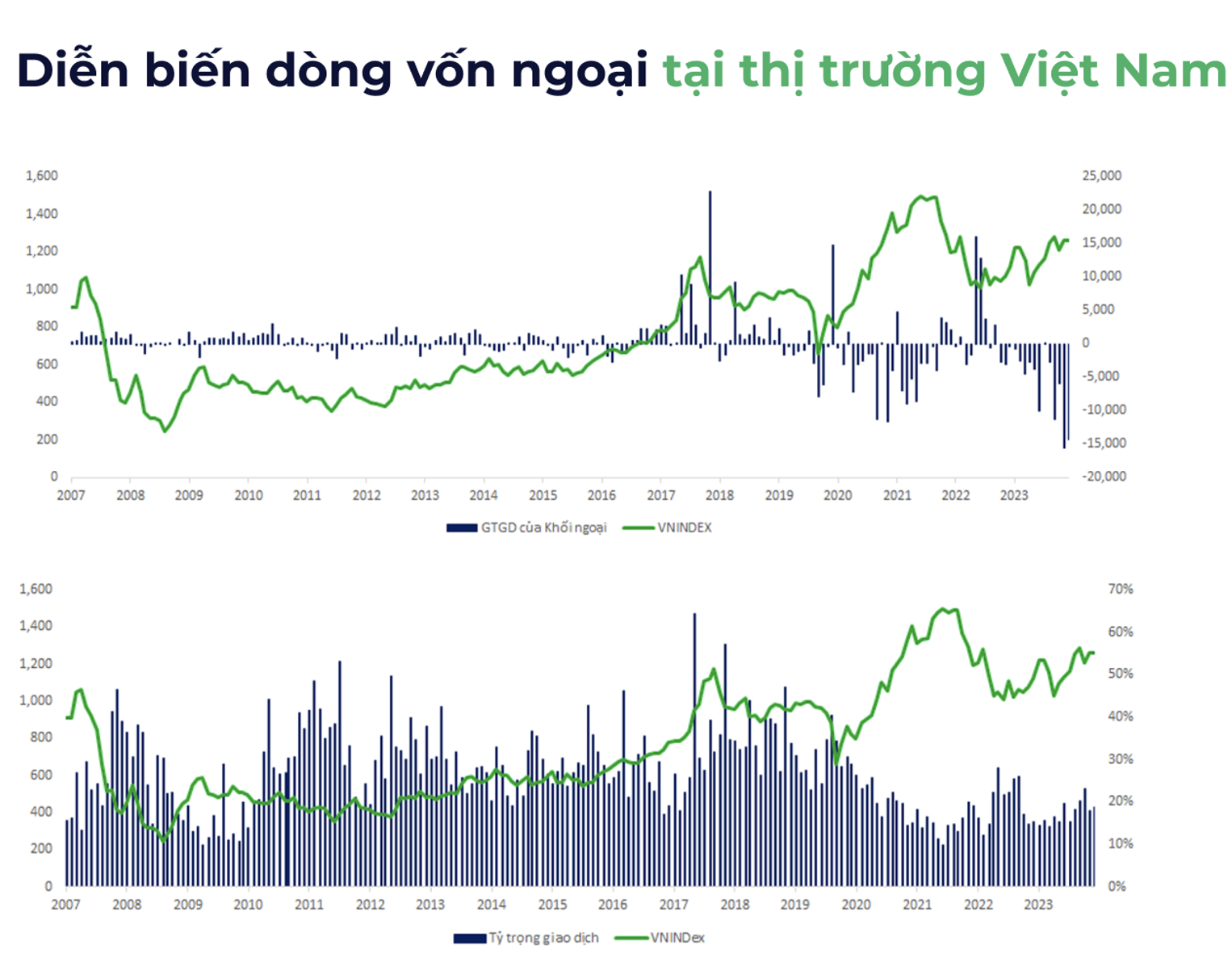

Foreign investors’ massive sell-off has become a focal point in the Vietnamese stock market. Recently, foreign investors had their strongest selling session of the year so far on July 8, with a net sell-off value of nearly VND 2,500 billion.

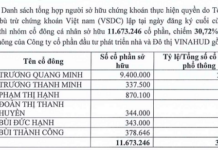

Since the beginning of the year, the net sell-off value of foreign investors in the market has exceeded VND 54,000 billion on HoSE, 2.2 times higher than the net sell-off value in 2023. This figure is also close to the record net sell-off value in history in 2021, which was over VND 58,000 billion. After a long period of net selling, when will foreign capital reverse its trend?

At a recent investment workshop on the theme “Welcoming the Recovery Cycle in the Second Half of 2024” organized by DSC Securities, Mr. Bui Van Huy – Executive Director of the Southern Branch of DSC Securities Joint Stock Company, opined that foreign investors had net sold over VND 50,000 billion since the beginning of the year, but the impact on the Vietnamese market was not significant.

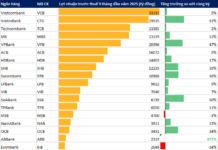

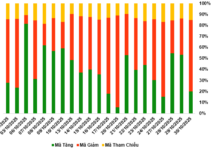

Despite the persistent net selling by foreign investors, the market did not fall but remained above the 1,280-point level. The trading volume of foreign investors accounts for only about 18-20% of the total trading volume in the entire market, much lower than the pre-2020 period, when it reached 30-50% of the total market volume.

Some of the reasons for the net selling pressure from foreign investors in the past time include interest rate differentials between economies; foreign funds’ assessment of valuation and expected profit ratios between investment regions; the withdrawal and liquidation of some ETFs; the lack of diversity in Vietnam’s stock market in terms of products and investment sectors.

However, Mr. Huy noticed that the net selling pressure from foreign investors has eased recently. The expert expects the net selling pressure from foreign investors to cool down and even reverse as Vietnam’s market upgrade story draws nearer.

Delving deeper into this issue, Mr. Nguyen Tu Anh, Director of the Center for Information, Analysis, and Economic Forecast (Central Economic Committee), attributed the continuous interest rate differential to the continuous outflow of domestic and foreign capital from Vietnam. To solve this problem, there needs to be a balance between interest rates and exchange rates.

The State Bank of Vietnam’s recent actions show that the central bank is selling foreign exchange reserves while raising interest rates in the interbank market to stabilize the exchange rate. Although cautious about the exchange rate in the last months of the year, the expert expects the Fed’s interest rate cut to ease exchange rate pressure.

According to the expert, the correlation between exchange rates and stocks is not significant, and interest rates are the most critical factor influencing the stock market. Foreign capital will flow back when other investment environments are no longer attractive. In an environment of low-interest rates and an economy recovering with Vietnam’s top global growth rate, the stock market is expected to attract capital inflows.

However, foreign investors are very wary of exchange rate fluctuations rather than high or low exchange rates. Therefore, stabilizing the exchange rate is crucial to attracting capital inflows into Vietnam.

Sharing the same view, Mr. Nguyen Trung Hieu – CEO of NTP-AM Fund Management Joint Stock Company, stated that foreign capital has returned to some Southeast Asian countries such as Indonesia and Malaysia. Accordingly, the expert expects foreign capital to reduce net selling in the third quarter and possibly return in the fourth quarter.