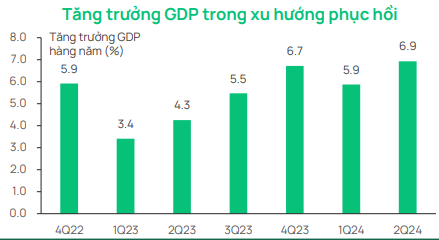

In its latest report, Dragon Capital asserts that Vietnam’s economy is on a solid recovery path, evidenced by impressive first-half results. The country’s GDP growth for the second quarter reached 6.93%, while the first quarter’s GDP was revised upwards to 5.9%, resulting in a 6.4% expansion for the first half of the year, the second-highest since 2020.

Both the manufacturing and services sectors outperformed expectations. The Industrial Production Index recorded two consecutive months of double-digit growth, with orders rebounding for most of Vietnam’s export items. Many companies in the textile industry have orders extending until September-October this year, while changing demands for electronics and mobile devices to accommodate new technology have boosted orders for electronic goods.

The PMI for June stood at 54.7, up from 50.3 in May, indicating a significant improvement in business conditions since June 2022. Domestic consumption also grew by 8.8% in the second quarter, with goods consumption increasing by 7.7%. Spending on food and beverages rose by 17.5%, alongside a 30% surge in tourism. This performance was partly supported by the positive recovery of Vietnam’s tourism industry, with monthly international visitor numbers consistently ranging between 1.2 and 1.4 million.

Based on the first-half results, the government has adjusted its GDP growth target for 2024 from 6.0-6.5% to 6.5-7.0%. Dragon Capital believes that this adjustment aligns with their forecast of 7.4% and 7.6% GDP growth for the third and fourth quarters, respectively.

Regarding monetary policy, Dragon Capital notes that Vietnam has maintained relatively stable interest rates. While lending rates have remained unchanged since late 2023, deposit rates have increased by 50-100 basis points across various tenors. With the strengthening of the US dollar, the Vietnamese dong has depreciated by 4.8% since the beginning of the year, and inflationary pressures have limited the room for monetary policy maneuvers. As a result, fiscal tools are expected to play a leading role in supporting and developing the economy in the second half of the year.

However, public investment disbursement as of June only reached 29.4% of the plan, implying significant room for growth in the remaining period. Additionally, infrastructure investment, tax and fee reductions, along with a 30% increase in the basic salary and a 6% rise in the regional minimum wage, are anticipated to boost domestic investment and consumption in the coming six months.

Stock market may continue to experience volatility

Despite net foreign selling pressure of up to $650 million, the stock market has maintained stability. In fact, strong net selling by foreign investors has been observed not only in Vietnam but also in most Asian markets. The liquidation of the iShares Frontier ETF, with total assets of about $120 million in Vietnam, has also contributed to this pressure.

Looking ahead, Dragon Capital believes that as the Fed approaches its interest rate cut, Vietnam’s stock market will benefit from more stable and favorable macroeconomic factors. Additionally, the second-quarter earnings season is expected to be positive, with estimated profit growth of 14-17% year-over-year, led by key sectors such as Retail, Securities, Steel, and Information Technology.

Moreover, the draft amendment to the regulations on pre-transaction margin, expected to be announced by the Ministry of Finance in July, will not only bring positive signals to the market but also reaffirm the government’s determination to upgrade the stock market by 2025.

“However, given the relatively high valuations of some sectors and the fact that expectations for growth have already been priced in, we maintain a cautious view on the market as a whole and prioritize stocks with safe valuations. Especially in the context of domestic investment cash flow absorbing and balancing foreign investors’ selling pressure, the market may continue to experience volatility,” said Dragon Capital experts.