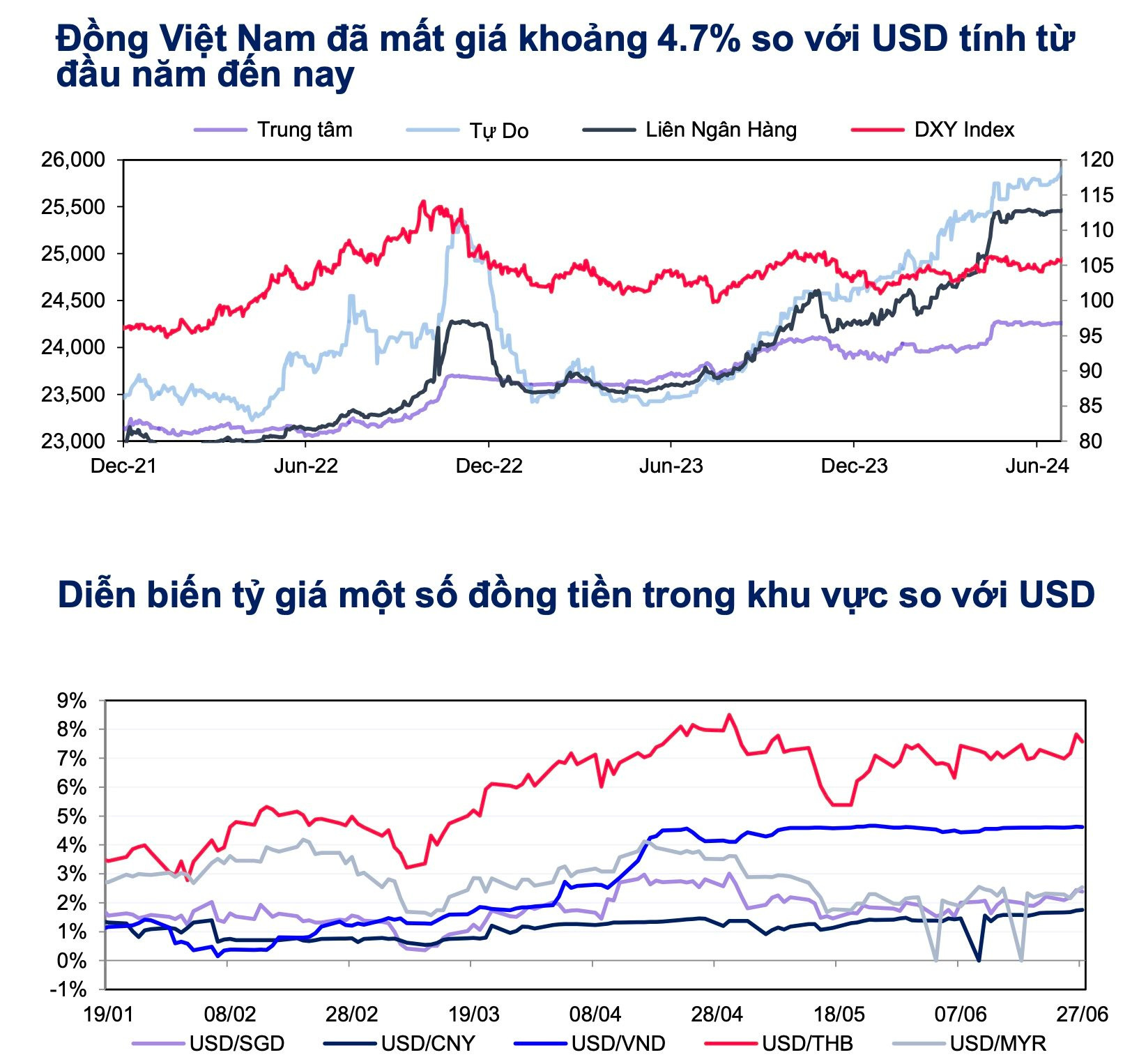

The foreign exchange rate has been a key focus since March 2024. According to MBS Research, the VND has depreciated by 4.7% against the USD year-to-date. The movement of the VND is quite similar to that of other currencies in the Asian region.

On the other hand, experts believe that the negative interest rate differential between Vietnam and the US is an important factor. Increased production activities have boosted the demand for USD for convenient import of raw materials. Moreover, the interest rate gap encourages speculative activities such as hoarding foreign currencies to take advantage of the differential.

In the first half of this year, the State Bank of Vietnam has implemented several measures to ease the pressure on the exchange rate.

From March 11, 2024, the auction channel for government bonds was activated to counter speculation on the exchange rate by reducing the amount of VND in circulation and narrowing the interest rate gap between the VND and USD in the interbank market.

Starting in mid-April 2024, the State Bank began selling USD to banks with negative foreign currency balances at a lower rate to ease market concerns and calm liquidity. According to estimates by Rong Viet Securities (VDSC), the State Bank has sold more than $5.8 billion in intervention, equivalent to about 30% of the 2022 rate.

“We believe that the fluctuation of the exchange rate is mainly due to the strength of the USD, exacerbated by the negative interest rate differential with the US for some currencies,” MBS Research said.

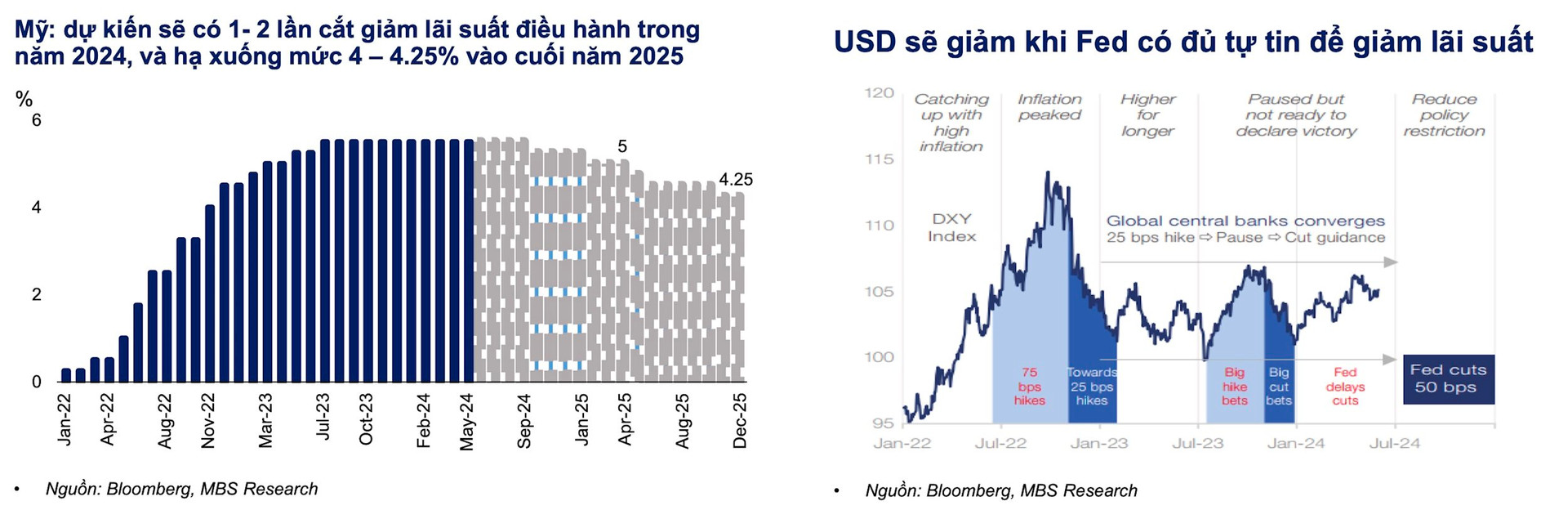

MBS experts analyzed that the dynamic factors that made the USD “particularly” strong globally in the first four months of 2024 have begun to weaken. Historical data suggests that the US dollar is likely to depreciate when the US Federal Reserve (FED) begins to loosen monetary policy by cutting interest rates by 25 basis points each quarter from Q3 2024 to 2025 (according to many global financial market forecasts).

“We believe that the pressure on the VND will ease and expect the USD/VND exchange rate to fluctuate between 25,100 and 25,300 in Q4 2024. The stability of the economy is likely to be maintained and improved, which will form the basis for stabilizing the exchange rate in 2024,” MBS Research emphasized.

Specifically, the supportive factors for the VND include: Positive trade surplus (about $8.4 billion in the first half of 2024), net FDI inflows ($15.2 billion, up 13% over the same period last year) and the recovery of international tourist flows (up 58% over the same period last year).

However, there are still quite a few potential risks that could keep the pressure on the exchange rate high. VDSC has a cautious view, believing that exchange rate pressure will persist. This is due to the strength of the USD, which is expected to be maintained by the interest rate differential between the US and other countries, as the Fed cuts rates more slowly and less frequently than other central banks.

In addition, according to VDSC experts, many economists believe that if Donald Trump wins the upcoming US presidential election, inflation will rise again, affecting the Fed’s interest rate decisions.

Moreover, prolonged geopolitical risks lead to a demand for USD hoarding as a safe haven, and due to seasonal factors, foreign currency demand (for imports) may surge again in Q3 2024, before the Fed officially reverses its interest rate policy.

Overnight interbank interest rates surge over 4%, reaching the highest level in 9 months

Compared to the recorded level last weekend, the overnight interbank interest rate has increased nearly fourfold.