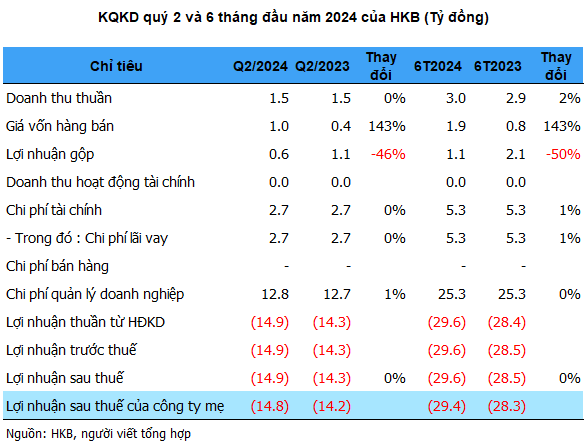

It is intriguing to see HKB’s share price surge, despite the company’s deep-rooted losses. According to the consolidated financial statements for Q2 2024, HKB’s net revenue remained stagnant at 1.5 billion VND, with a net loss of 15 billion VND, a slight increase from the 14 billion VND loss in the same period last year. This marks the 18th consecutive quarter of losses for the company since Q1 2020, amounting to over four years.

HKB attributes this to their ongoing restructuring phase, along with reorganizing credit sources with banks, resulting in insufficient short-term capital for production and business operations.

For the first six months of 2024, HKB’s net revenue barely reached 3 billion VND, with a net loss of over 29 billion VND. This pushed the cumulative loss as of June 30, 2024, to nearly 415.5 billion VND, a significant increase from the 143 billion VND loss in 2018.

For the full year of 2024, HKB aims for a slight increase in total revenue to 6.5 billion VND, with an expected loss of 11 billion VND. However, the company is currently falling short of their projected profit plan.

| HKB’s Net Profit for 2013-2023 |

As of Q2 2024, HKB’s total assets amounted to 295.5 billion VND, a decrease of 25 billion VND from the beginning of the year. Cash and bank deposits barely exceeded 1 billion VND, with short-term receivables of nearly 54 billion VND, and provisions of over 80 billion VND.

On the liabilities side, the company’s debt stood at approximately 179 billion VND, one and a half times the equity capital. Total borrowings exceeded 100 billion VND, accounting for over 55% of the weight, although HKB did not provide a detailed explanation for this.

Established in 2009, HKB primarily engages in wholesale rice trading and food production. Its chartered capital currently stands at 516 billion VND, with the Chairman of the Board of Directors and General Director, Duong Quang Lu, holding an 18.5% stake. HKB owns three subsidiaries, one associated company, and one directly affiliated unit.

HKB paid dividends for the first time in 2014, at a rate of 8% in shares. However, the company has not distributed dividends to shareholders for the past nine consecutive years.

By The Manh