Last week, the market sentiment shifted significantly after the US released its CPI data for June 2024, which unexpectedly dropped for the first time in four years. This data indicated a 0.1% decrease compared to May 2024, and a 3% increase year-over-year, the lowest in over three years. Prior to this, the CPI for May remained unchanged from April and increased 3.3% year-over-year.

Following this data, the FedWatch CME tool indicated a 93% probability of the Fed cutting interest rates in September 2024, up from 70% before the CPI data release.

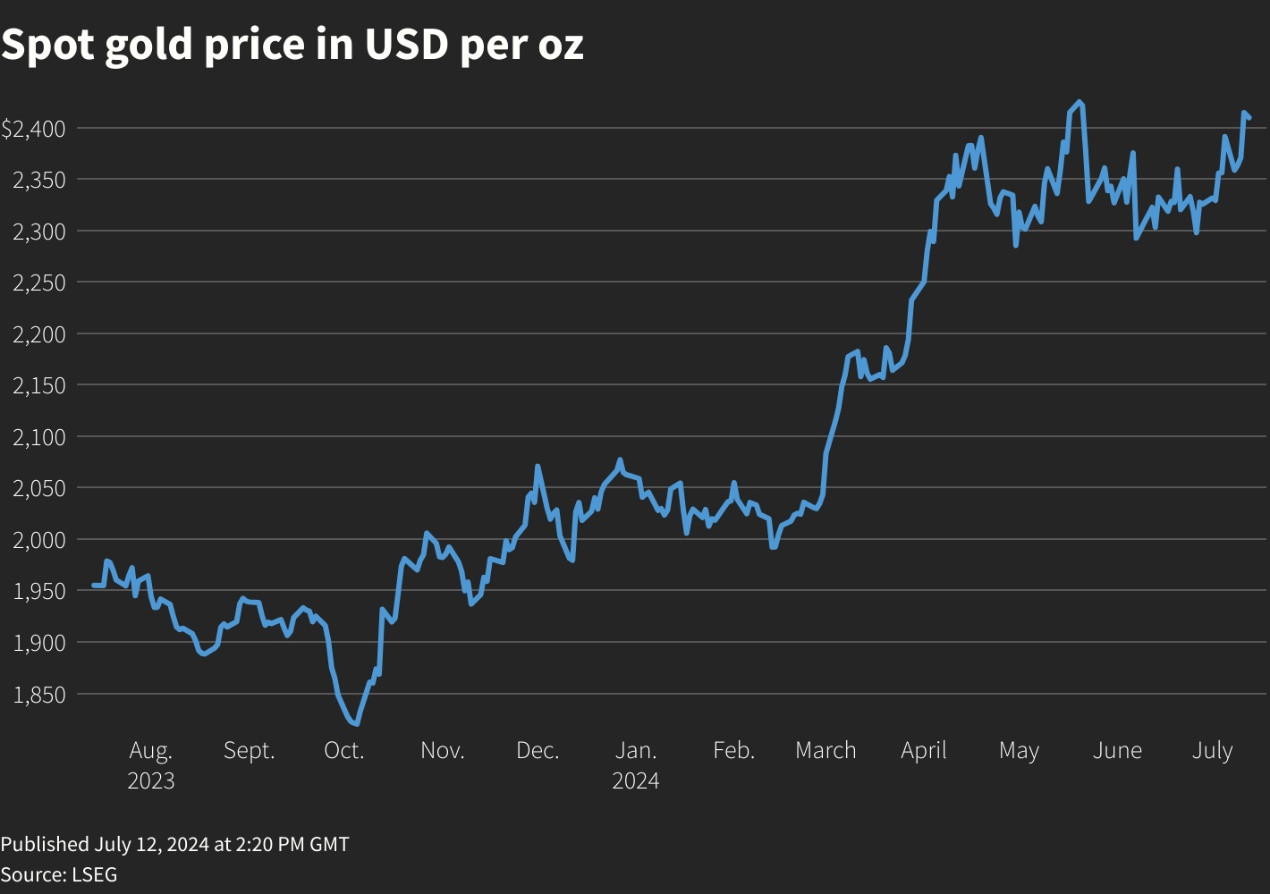

Spot gold prices ended the week at $2,417.36 an ounce, while gold for August 2024 delivery settled at $2,420.70. Overall, spot gold prices rose 1% for the week, extending its winning streak to a third straight week.

Domestic gold bar prices on Saturday (July 13) were listed at VND 75.48-76.98 million/tael (buy-sell), an increase of about VND 1 million/tael compared to the previous week’s rates of VND 74.98-76.98 million/tael.

World Gold Price Movements

The latest Kitco News survey revealed a consensus among experts that gold prices are likely to rise in the coming week, with retail investors also expressing confidence in this scenario.

Out of 13 Wall Street analysts participating in the Kitco News survey, 12 or 92% predicted that gold prices would rise next week, while only one analyst, or 8%, expected prices to fall. None of the analysts forecasted prices to hold steady for the week.

Meanwhile, 178 retail investors on Main Street also participated in the survey, with the majority maintaining their optimistic outlook. Among them, 119 or 67% predicted that gold prices would rise in the coming week, while 32% or 18% anticipated a price decline, and the remaining 27 or 15% expected prices to hold steady.

Marc Chandler, CEO of Bannockburn Global Forex, commented on the continued upward trend of gold prices: “Gold rose for the third straight week, supported by expectations of US interest rate cuts and a weaker US dollar.” He added, “Prices rose to nearly $2,425 after the CPI showed a slight decline, fueling speculation that the Fed might cut rates more than twice this year (~40% chance of a third rate cut).”

Mr. Chandler further noted, “Ironically, the reason for the price rise is not because inflation continues to rise as feared, but because of the impact of falling inflation (on the US dollar and interest rates).” He also mentioned, “In addition, although the PBOC (People’s Bank of China) may not have purchased gold in June, other central banks in Asia and Europe continued to do so. A UBS survey of 40 central banks revealed that their top concern is geopolitical tensions and the weaponization of reserves.”

As China’s demand for gold has been a key driver of record-high prices in recent times, Adam Button, a currency strategist at Forexlive.com, expressed surprise that gold prices have not dropped significantly in recent months despite the PBOC’s absence from the market for two consecutive months.

James Stanley, Senior Market Strategist at Forex.com, shared a similar prediction: “Up.” In his opinion, “The uptrend remains intact and the fact that it has held support throughout Q2, even with numerous headwinds, is impressive. I think $2,500 is still very achievable.”

Darin Newsom, Senior Analyst at Barchart.com, was the only analyst in the survey who doubted a price increase in the coming week. He stated, “Down.” From a technical perspective, he explained that “the weekly chart suggests that August could turn to a short-term downtrend after reaching a target range of $2,411.10 to $2,440.10.”

Sean Lusk, co-director of commercial risk management at Walsh Trading, focused his analysis on US economic data to determine the potential trajectory of gold prices. He observed, “Weaker PPI, a slightly stronger US dollar, and weaker consumer sentiment. These factors could offset each other.” Lusk added, “Gold’s path ahead seems to have fewer obstacles, and prices are sure to rise. My prediction is a 20% increase this year, reaching $2,485.”

Kitco News Survey Results on Gold Price Predictions for the Week of July 15-19

Next week, the market focus will shift from the Federal Reserve to the European Central Bank (ECB), which will announce its interest rate decision on Thursday (July 18). The market generally expects the ECB to maintain interest rates at the current level following its rate cut in June, but the statements made during the meeting will be closely watched for any hints of future rate cut possibilities.

The most important data to be released in North America will be the US retail sales figures for June (announced on Tuesday, July 16). If consumer spending continues to weaken, it could provide further impetus for the Fed to cut interest rates in September.

Overall, the rise in gold prices above $2,400 is seen as a positive sign, paving the way for further gains towards the end of the year.

Reference: Kitco News