MBS is offering an incredible promotion for customers signing up in July: free transactions and an ultra-attractive interest rate of just 6.8% on all codes, valid for three months.

With the challenges of startup success and the universal desire to build wealth, young investors in their 20s and 30s are turning to the stock market, seeking knowledge and financial discipline. A recent survey of young people interested in the stock market revealed their desire for free transactions as a trial before committing a larger portion of their assets. Many also wish for low-interest margin loans for extended periods, giving them confidence in their investment strategies.

MBS has answered with a market-leading combo offer for customers aged 16-40. With this promotion, young investors can enjoy free transactions and a margin interest rate of just 6.8% on all codes for three months when using the MBS online active trading service. (For more details, visit: https://mbs.com.vn/vi/goc-truyen-thong/tin-tuc-mbs/mbs-uu-dai-khach-hang-mo-moi-tre-tuoi-su-dung-dich-vu-mbs-online/)

MBS offers market-leading promotions to young investors.

In its recently published mid-year strategy report for 2024, MBS forecasts economic growth of 6.6% and 6.5% in Q3 and Q4, respectively, driven by export recovery and increased investment efficiency. The research team also predicts that the VN-Index will reach 1,350-1,380 points by year-end, assuming a 20% profit growth for businesses in 2024 and a target P/E of 12-12.5. This presents an opportune time for investors to consider allocating funds to the stock market to capitalize on potential profits.

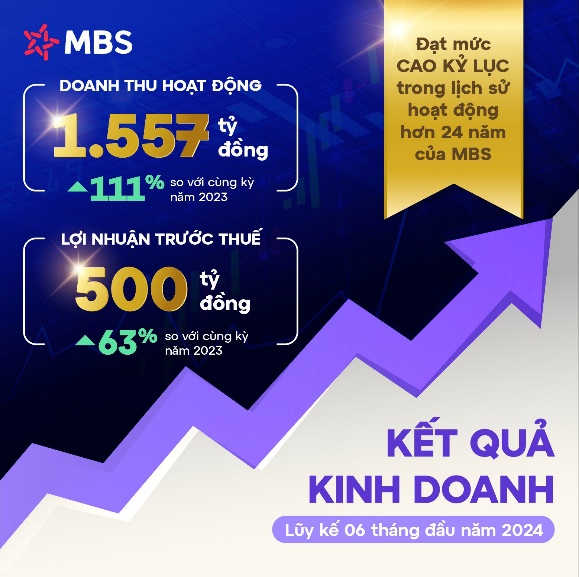

For the first half of 2024, MBS reported a remarkable performance with operating revenue more than doubling and a 63% increase in pre-tax profits compared to the same period in 2023, setting a new record.

Beyond its attractive promotions, MBS’s business performance in the first half of 2024 reinforces its position as a trusted investment partner. In the six months ending June 30, 2024, MBS’s operating revenue reached VND 1,557 billion, up 111% year-over-year. Pre-tax profit increased by 63% to VND 500 billion, marking a historic high for the company. Specifically, in Q2 2024, MBS achieved growth across its core business segments, with operating revenue of VND 883 billion, a 120% increase compared to the same period last year. Pre-tax profit reached VND 271 billion, up 75% year-over-year, while net profit climbed to nearly VND 217 billion, a 74% jump from Q1 2023 and the highest quarterly profit in MBS’s history.

MBS’s strong business performance underscores its reliability as an investment partner.

MBS’s robust and stable business performance is underpinned by unique strengths that set it apart from other securities companies. Backed by the Military Commercial Joint Stock Bank (MB), which leads the market in digital transformation and boasts a massive customer base of tens of millions, MBS offers unparalleled advantages. Combined with its professional and dedicated customer service, MBS is the trusted choice for investors seeking a reliable and reputable partner for their financial endeavors.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.