Without a solution to address the issue of large investors selling off large-cap stocks, market confidence will be further eroded, impacting the roadmap for the upgrade of Vietnam’s stock market. Photo: LE VU |

As an economy with a high degree of openness, Vietnam’s market is greatly influenced by international macroeconomic factors, ranging from interest rate policies and trade policies of major countries to key growth drivers such as FDI and import-export activities. Meanwhile, domestic macroeconomic factors, such as monetary policies and public investment policies, also play a role in affecting other fundamental growth factors.

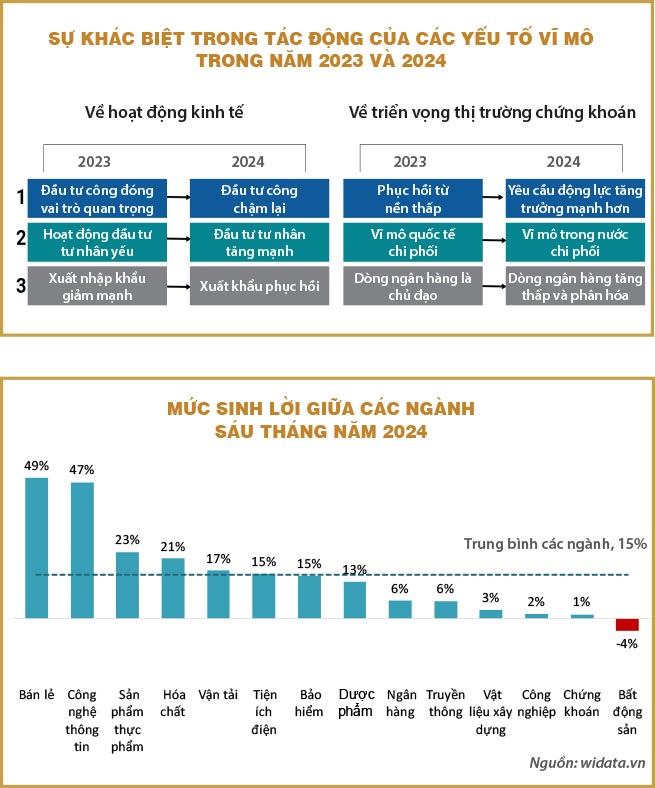

In 2023, international macroeconomic factors played a significant role in shaping the global stock market. However, as we transitioned into 2024, the focus shifted from international indices to domestic affairs, as there were no definite signs of the US Federal Reserve (Fed) lowering interest rates this year. Despite strong net selling by foreign investors, the stock market remained above the 1,200-point threshold. The factors driving the stock market this year are supported and boosted by investment activities stemming from relaxed credit policies.

A Shift in Macroeconomic Factors

Vietnam’s economy and stock market in 2023 were mainly impacted by the Fed’s interest rate policies. Consequently, most of the attention of investors and social media revolved around the Fed’s rate hikes and cuts, alongside regional instabilities affecting global trade.

|

The Fed raised interest rates multiple times in 2023 to curb inflation, causing significant turmoil in global financial markets. The Fed’s rate hikes triggered a series of fluctuations in the international macroeconomic environment. As a result, many countries’ currencies depreciated compared to the beginning of 2022, and the challenges of managing exchange rates and controlling domestic inflation became a pressing issue for numerous nations.

In response to the Fed’s interest rate fluctuations, Vietnam’s stock market also went through phases of differentiation. At the end of July 2023, when the Fed decided to raise rates by another 25 percentage points to 5.5%, the VN-Index dropped to 1,172 points, a nearly 6% decline from its peak earlier that month. The State Bank of Vietnam resumed the issuance of treasury bills from September 21 to November 8, 2023, with a strong net withdrawal of nearly VND 194,650 billion during this period, to reduce excess liquidity in the market and narrow the interest rate gap between Vietnam and the US.

Additionally, in the third quarter of 2023, conflicts between Israel and Hamas in the Middle East disrupted international trade, particularly exerting pressure on shipping rates in the Red Sea. The increase in transportation costs led to higher expenses for many businesses. In this context, the third quarter of 2023 marked the fourth consecutive quarter of declining profit growth for listed companies, with a 5% decrease compared to the previous year. The stock market witnessed an 8% decline during this period. It was only towards the end of the year that news about US inflation hinted at the possibility of a US rate cut in early 2024, bringing new optimism to the market. As a result, the VN-Index ended 2023 with a cumulative growth rate of 12.2%.

Entering 2024, the domestic macroeconomic landscape presented several bright spots. The amended Land Law, which was passed, raised hopes for resolving challenges faced by real estate businesses. Additionally, tighter regulations on risk management and lending limits in the Law on Credit Institutions 2024 enhanced the stability and quality of the banking system. These factors boosted the stock prices of real estate and banking sectors, which are two large-cap groups leading the VN-Index.

By April 2024, exchange rate pressure became the dominant narrative in the market. The event of a rising exchange rate triggered a downturn in the stock market, and within just five trading sessions from April 12 to 19, 2024, the VN-Index fell by 11.5%. However, the positive business results of the first quarter of 2024, led by key sectors such as information technology (software), industry, maritime transport, construction materials, and food retail, supported the VN-Index’s positive growth.

As of the end of June 2024, the market maintained a good cumulative growth rate thanks to a favorable macroeconomic environment, supported by factors such as the 6.93% GDP growth in the second quarter of 2024, inflation remaining within the target range of 4-4.5%, and fiscal and monetary policies like VAT reduction and low-interest-rate environment.

Divergence in Sector Profitability

Since the beginning of 2024, the growth momentum of the stock market has primarily relied on the buying power of domestic investors. The Fed’s decision to maintain high-interest rates for an extended period has significantly impacted global stock markets.

On the other hand, many sectors have demonstrated resilience in the face of strong net selling by foreign investors, contributing to the VN-Index’s price increase from the start of the year. Despite the lack of positive signs in the international macroeconomic environment, sectors with strong growth potential have witnessed price increases since the beginning of the year, as their valuations were already at low levels in 2023. The current credit policy plays a crucial role in driving growth in these sectors. The strategic allocation of capital to key sectors has created a new impetus for the stock market. While the growth momentum in 2023 was mainly concentrated in the banking sector, this year’s growth drivers have become more diverse.

For instance, the retail and information technology groups have surged more than 45% in the first half of 2024 due to new credit inflows. Sectors such as food, chemicals, transportation, and utilities have also posted growth rates ranging from 10% to 20%. In the case of the retail sector, Vietnam’s retail market is on the path to recovery, with total retail sales of goods and services in the first six months of 2024 estimated at over VND 3 quadrillion, marking an 8.9% increase compared to the same period last year.

This divergence in capital flows indicates a new trend in investment strategies, as investors are now focusing more on sectors with long-term growth potential rather than short-term cash flows. While the stock market recovery in 2023 was primarily a rebound from the low base of 2022, 2024 demands a much stronger growth impetus to propel the market forward. Rational credit policies not only directly support businesses but also create positive spillover effects for the entire economy. This helps improve investor confidence and encourages the participation of new investors in the market, fostering a more sustainable growth cycle.

Le Hoai An – Nguyen Thi Ngoc An

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.