Buy PLX with a target price of VND 55,000/share

On July 4, the Ministry of Industry and Trade approved an increase in the allowance for gasoline and diesel oil from VND 60 and 140 to VND 1,140 (up 6%, double the increase in 2023) and VND 1,170 (up 14%, 4.7 times the increase in 2023) per liter, respectively. This is expected to result in higher gasoline prices. Vietcap Securities believes that these increases will improve PLX’s ability to cover actual business expenses.

In July 2023, the allowance for gasoline and diesel oil was increased by VND 30 to VND 1,080 and VND 1,030 per liter, respectively, leading to a 73% year-on-year increase in Vietnam National Petroleum Group (HOSE: PLX)’s first-quarter after-tax profit for 2024. Vietcap estimates that PLX’s actual gross profit per liter is around 80% of the total cost and allowance during 2020-2023 due to volatile oil prices, in contrast to the gross profit per liter of about 95% of operating costs and allowance before the COVID-19 pandemic.

Vietcap has increased its assumption of PLX’s stable growth rate from 2% to 3%, as they expect PLX to benefit in the long term from the expansion of aviation fuel distribution when the Long Thanh International Airport (LTA) commences operations. At the recent Annual General Meeting, PLX’s management announced plans to supply aviation fuel to airlines at LTA as part of their 2020-2030 business plan. The distribution of aviation fuel contributes approximately 10% to PLX’s pre-tax profit through their 59%-owned subsidiary, Petrolimex Aviation.

Additionally, PV Oil (OIL) shared during a recent investor meeting that entering the aviation fuel business is challenging due to the dominance of Skypec and Petrolimex Aviation, highlighting PLX’s competitive position in this business.

Vietcap finds PLX’s valuation attractive, with a 2025 P/E of 12.4 times, 24% lower than that of its closest peer (PTT Retail & Oil of Thailand) and 37% lower than PLX’s 5-year average P/E. Vietcap forecasts a doubling of cash dividends per share in 2025 compared to 2023 (a yield of 6.5%) due to PLX’s increasing net cash position. As such, they recommend buying PLX with a target price of VND 55,000/share.

Read more here

Accumulate TNG with a target price of VND 31,100/share

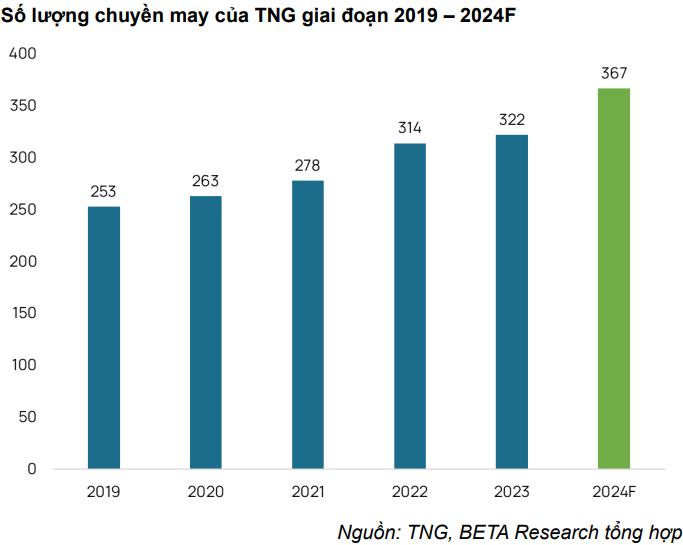

While TNG’s first-quarter 2024 financial results were below expectations, BETA Research maintains a positive view on TNG for 2024. TNG has completed the expansion of 45 production lines, increasing their total capacity to 367 lines, a 15% year-on-year increase, to meet rising order demand from customers.

Secondly, TNG’s order book is currently full until the third quarter of 2024, thanks to increased orders from regular customers like Decathlon, TCP, and Asmara, driven by recovering demand in major markets, especially the US, due to low inventory levels and retailers’ year-end stock-up. Additionally, TNG has attracted new orders from Bangladesh and old customers by meeting green factory standards and benefiting from labor wage protests and unrest in Bangladesh.

TNG’s management shared that in 2024, their new order prices increased by about 5% year-on-year due to (1) focusing on producing high-value-added FOB items to meet the rising demand of old customer groups (Decathlon, Asmara, Sportmaster, etc.), and (2) reducing the number of low-value CMT orders (in 2023, TNG added many CMT orders to ensure work for their employees).

Moreover, export unit prices have already improved in the first quarter of 2024, estimated to increase by 1-2% year-on-year. BETA Research attributes the lower-than-expected price increase in the first quarter to (1) the impact of low-priced orders from 2023 that were carried over to January 2024, and (2) some orders being postponed in March 2024 due to ongoing shipping cost negotiations with customers.

Therefore, BETA Research expects TNG’s business results to improve starting in the second quarter of 2024 and maintain this positive trend in 2024-2025. Consequently, they recommend investors accumulate TNG with a target price of VND 31,100/share.

Read more here

Buy HDG with a target price of VND 34,036/share

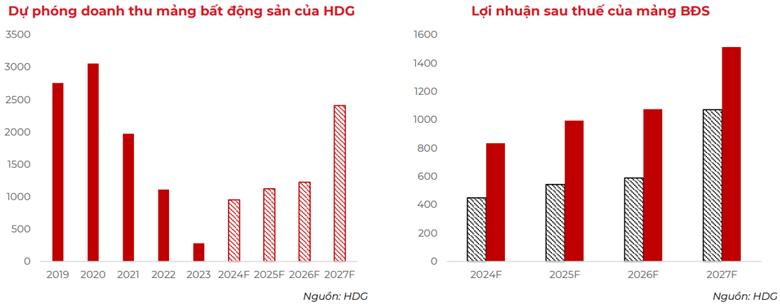

HDG is expected to launch the third phase of its Hado Charm Villas project in the second half of 2024, offering approximately 108 remaining units (an estimated area of 13,000 sq. m.). Aseansc assumes an average selling price of around VND 100 million per sq. m. for this phase, resulting in an estimated revenue of VND 1,300 billion for HDG. They anticipate the delivery of about 80 units from this project in 2024, equivalent to a revenue of VND 950 billion (completing 95% of HDG’s plan).

HDG’s Hado Minh Long and Hado Green Lane projects are facing legal issues related to land-use conversion. The current Land Law and the amended Land Law of 2024 (passed by the National Assembly on January 18, 2024, effective from January 1, 2025) require investors who want to convert land use for commercial housing projects to have residential land-use rights for part or all of the project area. However, these projects do not meet this condition as they do not have any residential land-use portion.

At HDG’s recent Annual General Meeting, the company expressed their expectation to complete the legal procedures for these projects in 2025 and launch sales in 2026. Therefore, Aseansc anticipates contributions to the group’s revenue from these projects in the 2027-2029 period.

For other real estate projects like Dich Vong Complex, 30 Ta Quang Buu, and 62 Phan Dinh Giot, Aseansc only includes Dich Vong Complex in their valuation model using the comparative method, as it has an approved 1/500 planning and no clear launch timeline. For the other two projects, they use the Book Value method due to the lack of clear planning.

Additionally, HDG has been surveying potential industrial zones since 2023 in provinces like Hung Yen, Thai Binh, Long An, Can Tho, and Ninh Thuan (a total area of 1,000 ha). They have received planning approval for two industrial clusters in An Thi district (Hung Yen province, 450 ha) and Ben Luc district (Long An province, 265 ha).

From 2024 onwards, HDG plans to accelerate investments in this segment, particularly in northern provinces like Hung Yen, Thai Binh, Nam Dinh, and Quang Ninh. In early 2024, the company submitted a proposal to the Ninh Thuan Department of Industry and Trade for approval to invest in the Phuoc Nam 1 and Phuoc Nam 2 industrial clusters (each spanning about 50 ha). However, Aseansc has not included this segment in their valuation as these industrial real estate projects are not yet reflected in HDG’s financial statements.

Regarding the energy segment, HDG’s Son Linh and Son Nham hydropower projects are expected to commence operations in 2025-2026. According to HDG, the 7A expansion and Phuoc Huu projects are the most feasible among their energy projects as they are included in the Power Development Plan VIII. Compared to the Phuoc Huu project, the development of the 7A expansion wind farm may take less time as it can leverage the existing infrastructure of HDG’s 7A wind farm. However, Aseansc has not included these new energy projects in their valuation due to the absence of new pricing frameworks for renewable energy projects.

Aseansc values HDG using the SOTP (Sum-Of-The-Parts) method, applying the discounted cash flow method to energy projects already under development and the Book Value method to the Son Linh-Son Nham hydropower project. For the real estate segment, they use the RNAV (Re-valued Net Asset Value) approach for projects with clear legal status and launch timelines. Thus, they recommend buying HDG shares with a target price of VND 34,036/share.

Read more here