|

First factory to export MDF products. Photo: MDF |

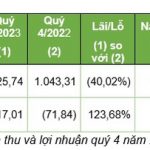

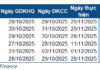

According to the Q2 2024 financial statements, MDF recorded revenue of over VND 239 billion, up 40% over the same period last year, mainly due to increased consumption volume. Due to the higher cost of goods sold than revenue, gross profit reached VND 28 billion, down 4%; gross profit margin narrowed to 12% from 17% in the same period last year.

A bright spot was the financial revenue of VND 1.5 billion, up 163%, and the emergence of other profits of nearly VND 5 billion.

This helped the increase in total revenue higher than total expenses, and MDF‘s Q2 net profit reached over VND 6 billion, 2.5 times higher than the same period last year, and a significant improvement from the loss of VND 11 billion in the previous quarter. This was also the quarter with the highest profit for the Company in the past 2 years, since Q2/2022.

The Company said that if considering the efficiency of the main business from wood, it was 44% lower than the same period last year due to the lower efficiency of the production and consumption of lower-grade goods.

In the first 6 months of the year, MDF‘s net revenue reached nearly VND 455 billion, up 36%, but the net loss was nearly VND 7 billion, down from a loss of over VND 18 billion in the same period in 2023, thereby increasing the accumulated loss as of June 30, 2024 to nearly 29 billion dong.

In 2024, MDF sets a target of minimum total revenue of VND 1,312 billion and profit after tax of VND 33.5 billion. The Company is currently “breaking” its profit plan.

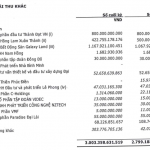

As of the end of Q2 2024, MDF‘s total assets were nearly VND 1,113 billion, down 9% from the beginning of the year. The change was due to a 27% decrease in inventory to nearly VND 198 billion; conversely, cash and bank deposits increased by 62% to over VND 26 billion.

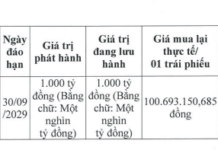

On the other side of the balance sheet, accounts payable decreased by 18% from the beginning of the year to nearly VND 478 billion. Short-term loans accounted for nearly 85% of the weight, with more than VND 406 billion, including 2 loans at Vietinbank (VND 137 billion) and Vietcombank (VND 269 billion).

In the market, MDF shares have fallen more than 15% in the last 2 months, along with average liquidity of less than 850 shares/day. MDF share price closed the session on July 13 at the reference price of VND 8,100/share.

| Price movement of MDF shares since the beginning of 2024 |

|

|

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.