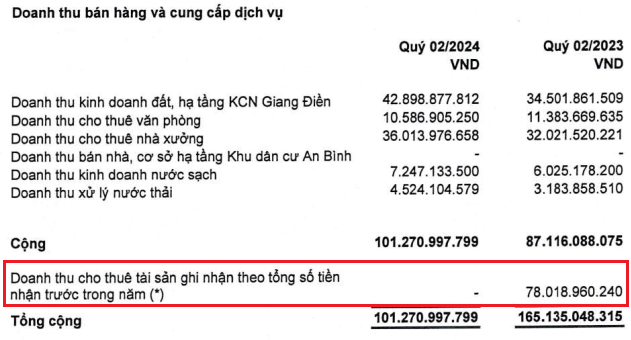

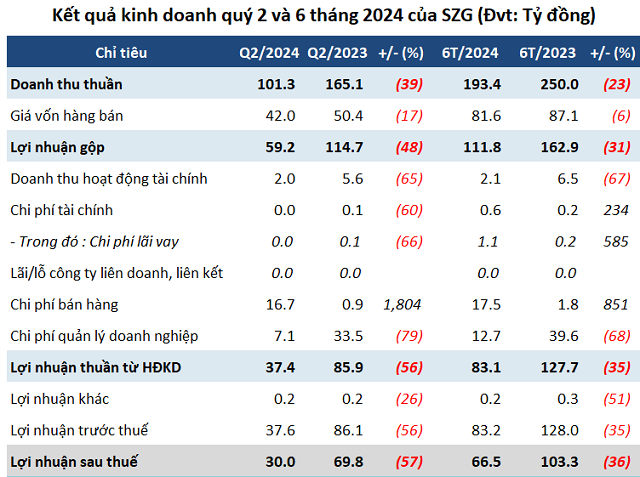

The second quarter of 2024 saw a notable difference in Sonadezi Giang Dien’s revenue structure, with no revenue from asset rentals recognized as the total amount of advance payments received in the year. In contrast, the figure was over VND 78 billion in the same period last year. This change led to a 39% year-on-year decrease in the company’s net revenue, which stood at over VND 101 billion. Gross profit, after deductions, amounted to more than VND 59 billion, a 48% decline.

Source: SZG

|

Additionally, financial activity revenue decreased by nearly 65%, reaching VND 2 billion, as the company did not receive dividend income from traded securities in the same period as last year.

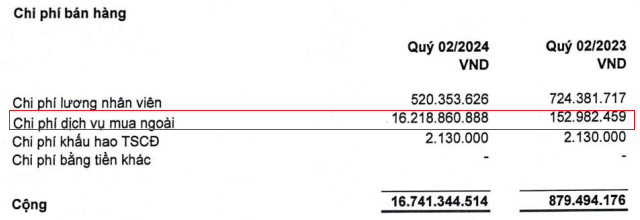

Notably, selling expenses surged to nearly VND 17 billion, a nineteen-fold increase compared to the previous year, due to a significant rise in external service costs, totaling over VND 16 billion (VND 153 million in the same period last year). However, this increase was offset by a substantial 79% reduction in administrative expenses, which amounted to over VND 7 billion.

Source: SZG

|

Sonadezi Giang Dien reported a net profit of VND 30 billion, a 57% decrease compared to the previous year. For the first six months of 2024, the company’s net revenue reached over VND 193 billion, with a net profit of nearly VND 67 billion, representing a 23% and 36% year-on-year decrease, respectively.

Source: VietstockFinance

|

For the full year 2024, Sonadezi Giang Dien has set a cautious target, with total revenue of over VND 417 billion and a net profit of more than VND 122 billion, reflecting a 5% and 35% decrease, respectively, compared to the previous year’s performance. The company plans to maintain a 15% dividend payout ratio for this year.

Additionally, SZG aims to lease 9 hectares of industrial land and rent or transfer three workshops, depending on the actual progress of basic construction, in 2024.

As of the first six months, the company has achieved 62% of its annual total revenue target and 55% of its net profit target.

Becoming Debt-Free

As of June 30, 2024, Sonadezi Giang Dien’s total assets reached nearly VND 3,824 billion, a 4% increase compared to the beginning of the year. This growth was primarily driven by a significant jump in cash and cash equivalents, which soared to VND 414 billion, ten times higher than at the start of the year. The majority of these assets are held as bank deposits. Inventory stood at over VND 115 billion, a 3% increase, mainly comprising production and business operating costs (VND 115 billion), with the An Binh residential project accounting for more than VND 16 billion and other projects making up the rest.

Construction work in progress decreased by 59% compared to the beginning of the year, amounting to over VND 11 billion. This reduction was mainly due to the completion of the new workshop cluster on Lot 02A&14, which decreased from over VND 19 billion to just over VND 2 billion, along with the Giang Dien residential-service area project, which accounted for VND 6 billion.

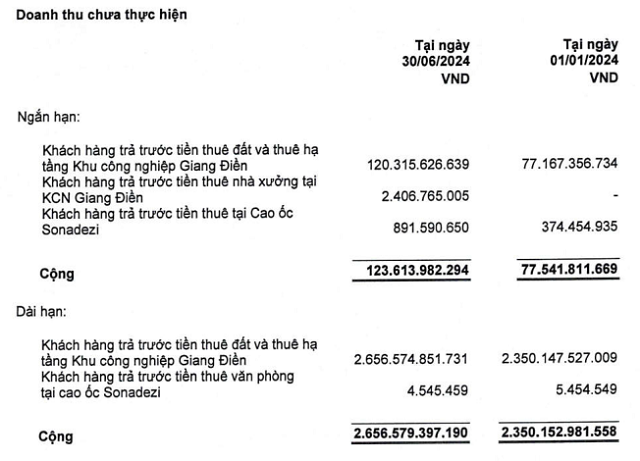

Sonadezi Giang Dien’s total liabilities stood at over VND 3,034 billion, a 5% increase. The majority of these liabilities are attributable to unearned revenue, totaling more than VND 2,780 billion, which accounts for 92% of the total debt.

Source: SZG

|

A notable achievement for the company during this period is becoming debt-free, as it successfully repaid its bank loans, which stood at nearly VND 250 billion at the beginning of the year.