According to Vietcombank, from July 1st to 15th, over 4 million transactions were authenticated using biometrics (Facepay) as per regulations. These transactions included amounts over VND 10 million per transaction, over VND 20 million per day, and bill payments for goods and services exceeding VND 100 million per day, as well as initial activations or changes to devices using VCB Digibank.

The number of transactions authenticated by Facepay accounts for approximately 4% of the total financial transactions processed on VCB Digibank.

Regarding the number of customers who have completed biometric registration as required, Vietcombank reported that over 3 million customers have successfully registered, mostly via online updates on the application. The number of customers updating their information at physical bank branches accounted for nearly 4% of the total registered customers.

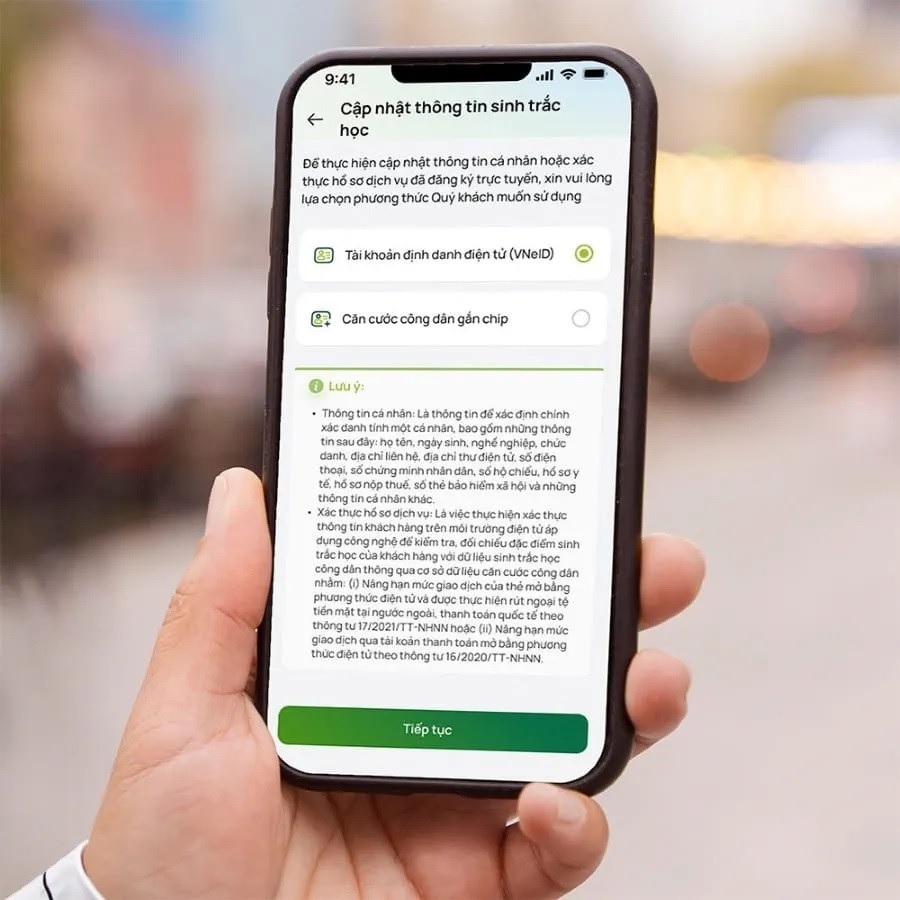

Illustrative image. VCB. |

Ms. Doan Hong Nhung, Director of Vietcombank’s Retail Division, shared that with over 3 million customers successfully registered for biometrics, Vietcombank is among the top banks in terms of the number of customers registered for biometrics according to statistics from the State Bank of Vietnam.

Vietcombank began collecting customer biometric data on June 18th.

Prior to this, Vietcombank and the Research and Application Center for Population Data and Civil Status (RAR) signed an agreement for “Electronic Authentication Services.” Vietcombank is the first bank to integrate the Ministry of Public Security’s Electronic Authentication Services into its customer data collection, cleaning, and biometric authentication processes for digital banking services.

According to Decision No. 2345 of 2023 by the State Bank of Vietnam, from July 1st, 2024, mandatory biometric authentication is required for individual customers’ online transactions, including amounts over VND 10 million per transaction, over VND 20 million in total daily transactions, international money transfers, and bill payments exceeding VND 100 million per day.

Banks advise customers to update their biometric information only through the official applications or at physical branches of their respective banks and to refrain from using any other websites or applications to avoid potential fraud or scams.

Tuân Nguyễn

An HR member of the Big4 team with higher salary and bonus than the Chairman and CEO

Vietcombank, the Joint Stock Commercial Bank for Foreign Trade of Vietnam, has recently released its financial report for the fourth quarter of 2023. In this report, the bank has disclosed the figures for the salaries, wages, and bonuses of the executives within the Board of Directors and the Executive Board.