Banks hit their lending growth targets in the first half of the year. Illustration: LE VU |

A Surge in June

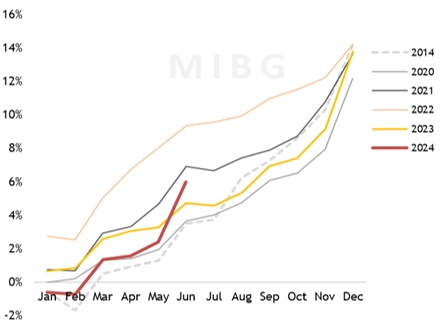

Recent information reveals that the Credit Department of the State Bank of Vietnam reported a 6% lending growth for the entire banking industry as of the end of June, reaching nearly VND 14.4 quadrillion. This amounts to over VND 810 trillion injected into the economy since the beginning of the year.

This figure is consistent with Ho Chi Minh City’s data, which accounts for nearly 30% of the country’s total outstanding balance. Accordingly, lending growth in June reached 2.03% compared to the previous month, a significant increase from the 0.61% recorded in May. Thus, outstanding loans in the country’s economic hub have increased by 4% compared to the end of last year.

Mr. Nguyen Duc Lenh, Deputy Director of the State Bank of Vietnam’s Ho Chi Minh City Branch, assessed that this growth rate aligns with the city’s economic growth picture in the first six months. Consequently, the GRDP index grew by 6.46%, an impressive figure in the past five years. Additionally, the credit support policies in the area are still being disbursed quite well by the banks.

Maybank Securities Company’s analysis team considered the 6% credit growth figure “beyond expectations.” Meanwhile, the 4% growth rate is already in line with the current context, corresponding to a 13% increase compared to the same period. On the other hand, a 6% growth rate implies a 15.2% year-over-year increase for the system.

Previously, according to data from the General Statistics Office (GSO), credit growth as of June 24 had only increased by 4.45% compared to the beginning of the year, meaning it had risen by 1.55 percentage points in the last week of June, equivalent to over VND 200 trillion.

Interestingly, the 6% figure aligns with the target set by the government during the meeting to promote credit with banks in June. In this meeting, the SBV’s leaders stated that they would consider evaluating banks with slow growth and transfer opportunities to those with growth potential.

Last year, banks also experienced a slow credit growth phase in the early months, with a significant increase towards the end of the year. Specifically, credit growth reached 13.78% in the fourth quarter.

Banks achieve their lending growth targets in the first half. Illustration: LE VU |

Disbursement Pressure

As previously reported by KTSG Online, banks are facing disbursement pressure in a low-interest-rate environment, while market demand has weakened significantly.

In the latest updates, state-owned commercial banks are still “lagging” in terms of asset size and loan market share. Meanwhile, the estimated growth in the recent second-quarter reports of banks mostly revolves around 6-9% in the first half of this year, slightly higher than the average.

At banks, the pressure to recover debts remains high amid bad debt concerns. However, a positive sign emerged at the beginning of June, as many bank leaders shared off the record that credit growth regained momentum.

According to the results of the Quarter 3-2024 Business Trend Survey conducted by the Statistics Department of the State Bank, credit institutions expected the system’s outstanding balance to increase by an average of 3.7% in the third quarter and 14.1% for the whole of 2024. The forecast figure increased by 0.47 percentage points compared to the previous survey.

In the second half of the year, most analysts believe that the market will become more positive, with demand recovering as the real estate market becomes more vibrant and government support programs are implemented.

However, from another perspective, rapid credit growth in a short period can also lead to issues. Besides possibly failing to reflect the broader market demand picture, the loan disbursements must also align with their intended purposes rather than flowing into speculative assets due to disbursement pressure.

Dung Nguyen