At the seminar “Recovering Economy – Opportunities for Investors” recently organized by VinaCapital, Mr. Dinh Duc Minh – Investment Director and Fund Manager of VinaCapital, shared his insights on the stock market trends. He highlighted two crucial factors: exchange rates and interest rates.

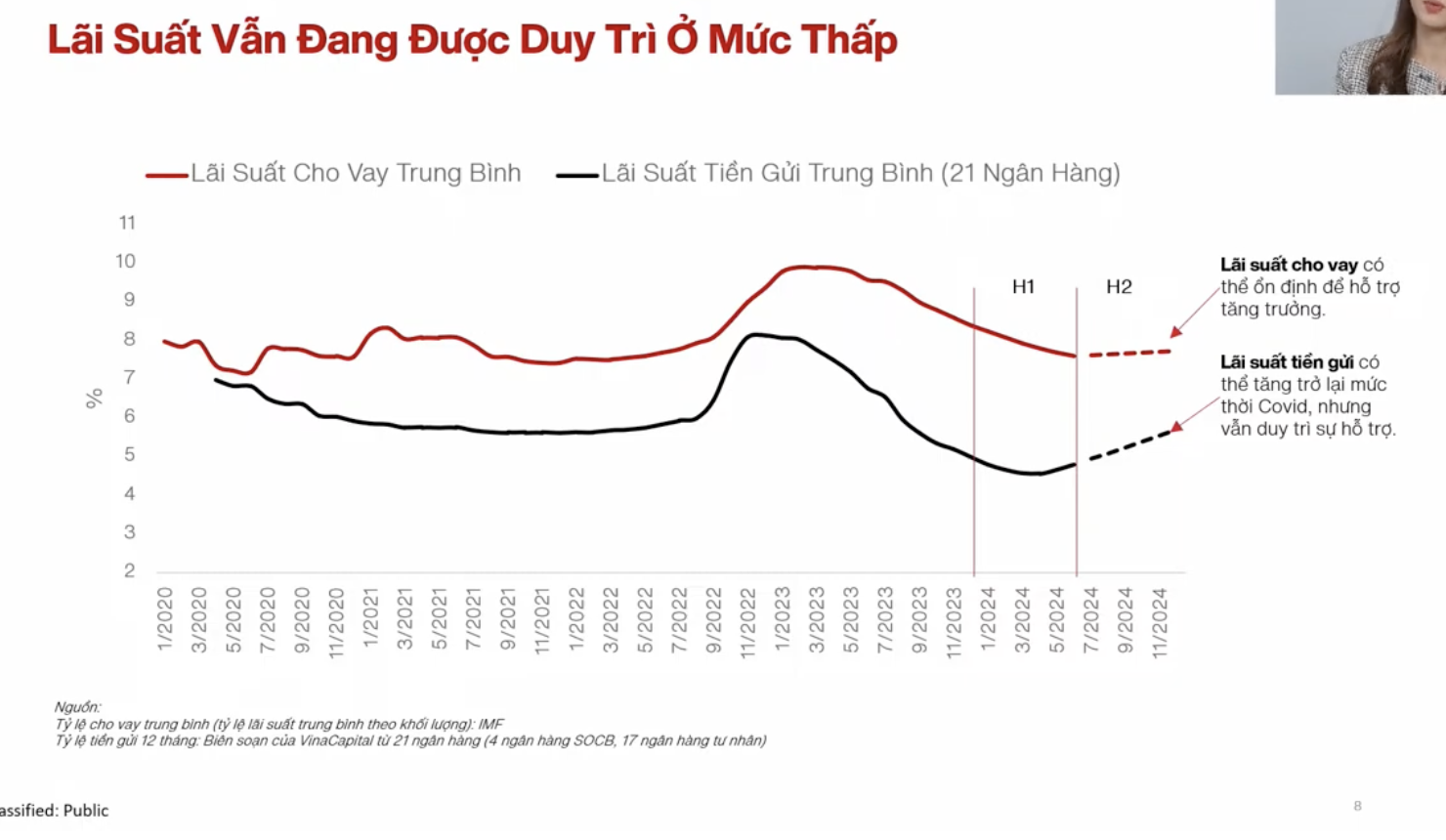

In 2023, the stock market’s growth was supported by low-interest rates and attractive valuations. Entering 2024, while interest rates have slightly increased, deposit channels are still less appealing compared to investing in the stock market. So far this year, the stock market has surged by over 10%, driven by the recovery of economic indicators and growing corporate profits.

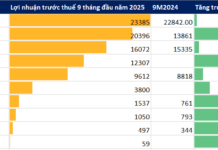

“GDP in 2024 is expected to grow by 6.5% with a rebound in production and consumption, and corporate profits are forecasted to increase by 21%. These factors will continue to be the main drivers for the stock market in the coming period,” said the VinaCapital expert.

Although the stock market has risen in the first half of the year, it has also experienced significant fluctuations, mainly due to exchange rate volatility. The difference between USD and VND interest rates and the strong performance of the USD index have caused the VND to depreciate by 4-5% since the beginning of the year. Given the close relationship, the stock market often undergoes significant adjustments when exchange rates fluctuate.

However, VinaCapital believes that exchange rate pressure will ease towards the end of the year, as there are expectations for the Fed to cut interest rates. Additionally, the government’s supportive policies, such as interest rate reductions, resolving difficulties in the real estate market, and tax cuts, have been, and will continue to be, a driving force for the economy and businesses in the coming years.

Regarding valuations, although they have increased compared to 2023, Mr. Minh believes that they are still reasonable and not overly expensive for long-term investments. While interest rates have risen slightly and may continue to do so, the expert from VinaCapital still considers the stock market an attractive option compared to savings deposits. Therefore, interest rates remain a supportive factor for the market.

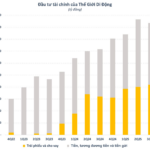

Commenting on the intense foreign selling since the beginning of the year, the expert attributed it to the Fed’s maintenance of high-interest rates, causing capital to flow into the US to enjoy higher and less risky returns. Additionally, investment trends in artificial intelligence and semiconductors have attracted capital to markets like the US, Taiwan, and South Korea.

VinaCapital identified several factors that could attract foreign capital to the Vietnamese stock market in the future: (1) Vietnam’s economy is recovering faster than expected, (2) Expectations for an early Fed rate cut, and (3) The progress towards an upgrade, as targeted by the government.

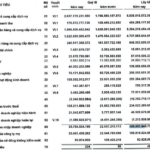

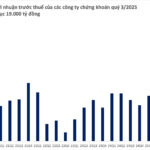

Discussing the performance of banking stocks, the expert noted that they performed well in the first quarter but declined in the second quarter. Initially, the market expected banks to have passed the most challenging phase, but the asset quality has not fully recovered. However, with economic data indicating a clear recovery, Mr. Minh expects a significant improvement in the banking sector’s business performance in the coming quarters. Therefore, VinaCapital’s funds will continue to maintain a relatively large proportion in the banking sector.

Additionally, the expert from VinaCapital shared that banking valuations, compared to the overall market and historical levels, are quite attractive and reasonably priced for long-term investments, with a horizon towards the end of this year and the beginning of 2025.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.