The latest report from DKRA Group on the Central real estate market reveals that in the second quarter, 677 condotel units were offered for sale, but the absorption rate was only 0.1% of the total primary supply.

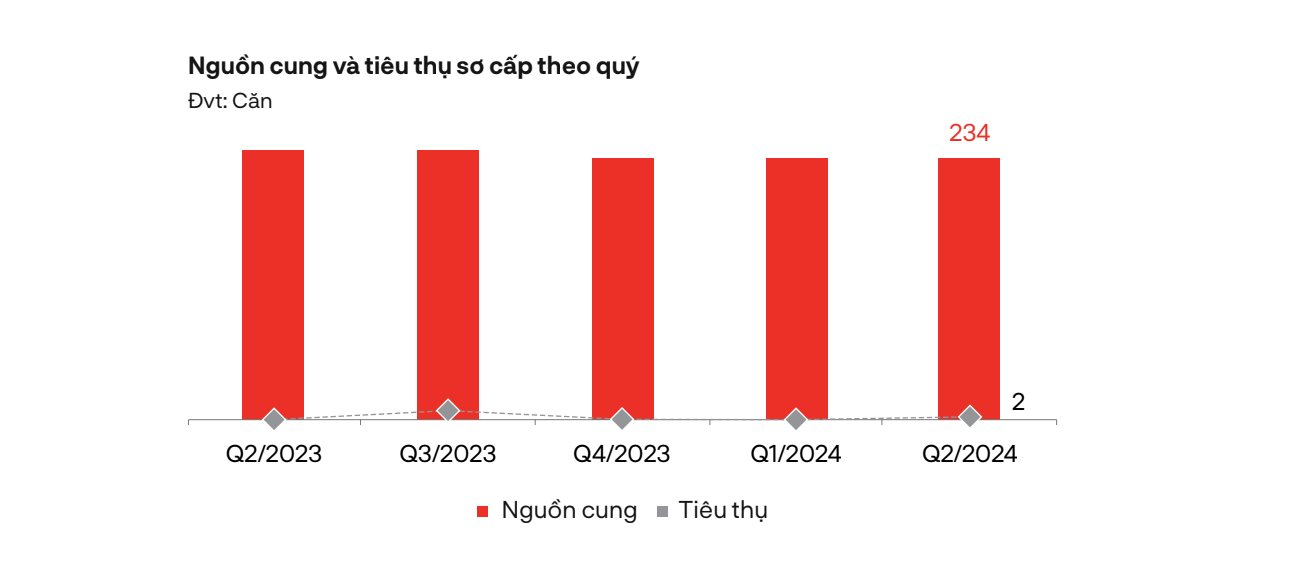

Similarly, the absorption rate for vacation villas was a modest 0.9% of the total 234 units offered. As for resort townhouses/shophouses, none of the 36 units introduced to the market in the past three months were sold. Shophouse prices in Da Nang and Quang Nam range from VND 7-16 billion per unit.

According to DKRA, of the three aforementioned property types, only condotels saw a 2% increase in primary supply in the second quarter, while the other types lacked new supply. A common challenge across these property types is subdued demand. Most projects have closed their order books amid difficulties.

Although the tourism industry has shown signs of recovery, many real estate projects are facing legal issues, construction delays, and difficulties in liquidation, which has dampened investor confidence. As a result, the market has remained subdued and shows no signs of short-term recovery.

Real estate absorption in Da Nang and its vicinity remains modest in the first half of 2024. Source: DKRA Group

Currently, many shophouse projects have been left abandoned, and there are no signs of them being put into operation, which has impacted investor confidence and led to liquidity challenges without any signs of recovery.

In the short term, the vacation real estate market remains in a “dark period.” However, in the long term, the 2023 Law on Real Estate Business has introduced new regulations related to the vacation real estate market, such as capital control, license evaluation, and clear classification of property types like condotels and officetels in the Government’s Decree No. 10/2023/ND-CP. These adjustments are expected to contribute to the recovery of the vacation real estate market.