Fitch’s first review of Sacombank reflects the bank’s consistent improvements during its restructuring process, solidifying its position in both domestic and international markets.

Vietnam’s economy grew by 6.4% in the first half of 2024, building on the positive 5.1% growth achieved in 2023. The global economic recovery and effective solutions for the domestic real estate market will boost Vietnam’s economic growth, which Fitch predicts will hover around 7% in the medium term. These favorable conditions bode well for the banking sector in general and Sacombank in particular.

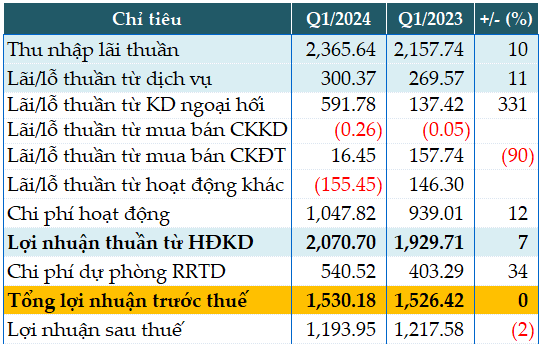

Fitch has assigned Sacombank a ‘b+’/Stable Asset Quality rating. The bank’s Funding and Liquidity rating stands at ‘bb-‘/Stable. The expansion of the loan portfolio towards production and business activities and consumer stimulation earns it a ‘b+’/Stable Risk rating. Sacombank’s equity and profitability are expected to improve significantly in the coming years as it completes its restructuring and ramps up core business operations.

After more than seven years of implementing the restructuring plan, Sacombank has resolved most of its legacy issues and substantially achieved its key objectives. The bank has recovered and handled over 80% of its non-performing loans and stagnant assets, and fully complied with regulatory provisions, including 100% provisioning for unhandled VAMC-sold debts. Asset quality has consistently improved, with the proportion of profitable assets in total assets rising to over 91%. Business scale has been continuously enhanced, growing at an average rate of 10-13% per year. Digital transformation has been accelerated to boost governance capabilities and develop multi-utility products and services, catering to customers’ digital banking needs. Profits soared 62 times, from VND 156 billion in 2016 to VND 9,595 billion in 2023.