Foreign investment funds and foreign investors are an important component of institutional investors in the Vietnamese stock market. However, this group has been net sellers consecutively since 2023. Since the beginning of 2024, foreign investors have sold a net $2 billion, and since 2023, they have sold about $4 billion.

At the July Dialogue on “Upgrading, Fundraising and Developing Institutional Investors” organized by the Securities Journalists Club this morning, July 19, Mr. Nguyen Quang Thuan, Chairman of FiinGroup, revealed three main reasons for the net selling of foreign investors.

First, foreign investors reallocate their assets withdrawn from emerging markets as they do not expect the Fed to cut interest rates, and when rates go up quickly, they come down slowly, so they are disappointed.

Second, they realize profits as the risk of Vietnam’s exchange rate is significant, and they have already made profits of several tens of percent, so they sell to avoid potential losses due to exchange rate fluctuations.

Third, they are concerned about the unique characteristics of Vietnam’s stock market and worried about the prospects of the real estate and foreign exchange markets.

Mr. Dominic Scriven, Chairman of Dragon Capital, said that foreign investors had sold a net $4 billion in the past four years, with $2 billion in 2024 alone. In the past, when foreign investors thought of Vietnam, they thought of Hanoi and Ho Chi Minh City for tourism and business. Still, recently, they have not found many new and exciting factors in Vietnam to attract their interest. Meanwhile, many other markets offer these attractions.

However, it is necessary to admit that there are objective factors that are difficult to influence. The most significant factor is the US interest rate hike in the past two years, which has significantly impacted investors’ psychology and investment strategies. Additionally, the concept of frontier markets, not just Vietnam, has completely failed for index investors.

When it comes to Vietnam specifically, it is challenging to ignore the fact that the country has not yet been upgraded in terms of investment grading. This makes it difficult to convince financial institutions to invest in Vietnam, as the country is not included in the major indices, and potential investments are considered exceptions.

Some events in the past one or two years have also affected the perception of risk, and it is hoped that this will improve in the future.

To understand the role and importance of institutional investors, the Chairman of Dragon Capital presented the following figures: The State Treasury has been very successful in raising capital for the state budget at an interest rate of 2%/year. In contrast, private enterprises must pay 8-10% when issuing corporate bonds. This significant gap between the treasury and corporate bond interest rates is a reality that we should acknowledge.

“It is clear that to develop institutional investors effectively, we must address these arguments,” he emphasized.

Mr. Le Thanh Tuan, Deputy General Director of the State Capital Investment Corporation (SCIC), shared SCIC’s plan to divest from large enterprises to create new and high-quality supply in the market and increase its attractiveness to domestic and foreign institutional investors. He said that it is not easy for institutional investors to participate in buying and selling state-owned shares. While they want to buy the state’s shares, and the state also wants to sell to increase supply, divestment and equitization are currently challenging to attract institutional investors.

Mr. Tuan added, “Recently, many foreign investors have wanted to participate in SCIC’s divestment deals, but we must go through an auction process that does not follow international procedures, which is a significant obstacle for institutional investors looking to participate in the state’s divestment.”

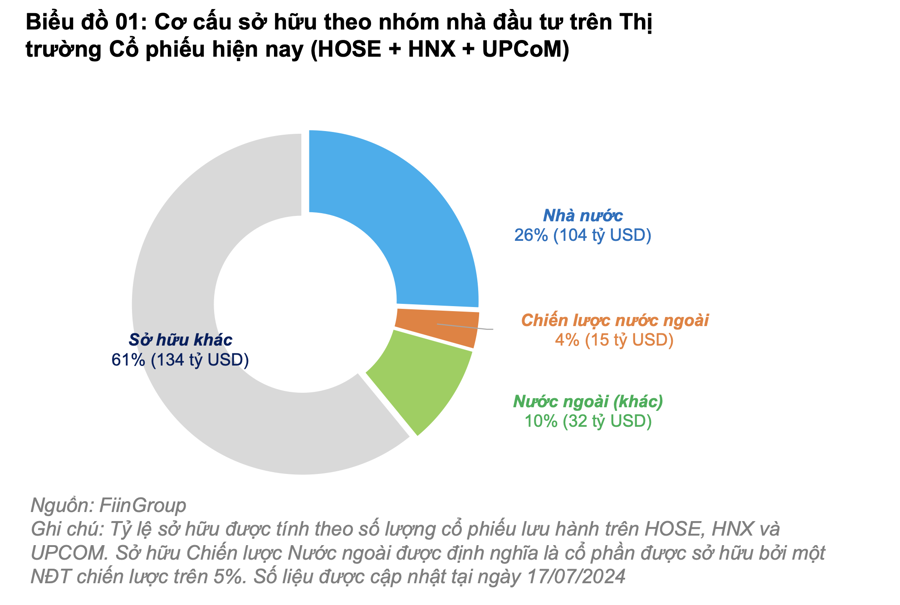

According to FiinGroup statistics, foreign investors currently own about 14% of the Vietnamese stock market. Specifically, they hold 17.3% on HOSE, 5.4% on HNX, and 3% on UPCoM. At the end of 2023, the foreign ownership ratios were 19.83% (HOSE), 10.99% (HNX), and 4.24% (UPCoM), respectively.

While the attractiveness of specific stocks in terms of size, quality, and liquidity is essential in attracting institutional investors, the percentage of freely transferable shares (free-float) in the Vietnamese stock market is relatively low, estimated at 45.5%. Therefore, with the state’s divestment process from many enterprises, there is still a vast potential to attract more domestic and foreign institutional investors.