The market weakened again in the final trading session of the week, with matched order liquidity on the two exchanges up slightly by 5.5% compared to the previous day. Selling pressure was not strong, with buyers mainly refusing to push prices higher and only waiting to catch the bottom. The “test” of supply seems to be continuing.

The late afternoon rally yesterday was quite strong, coinciding with the derivatives expiration. But by this morning, the signal was poor and there was a lack of consensus among large-cap stocks, causing the market to weaken again. By 10:30 am, the important indices had fallen below the reference level with a poor breadth. In the afternoon, sellers clearly pushed prices down, and buyers only appeared at very low prices.

Having over a hundred stocks closing more than 1% lower indicates a weak market. Of course, the range of most stocks has not yet reached a lower level than the lowest of the previous two sessions. In other words, this downward movement is still equivalent to the recent dip. This is still a good condition to test bottom-fishing money.

This tug-of-war situation is quite frustrating, but the market always tests patience in this way. When selling, there is a panic, and when buying, there is a rush to chase prices, which is typical of emotional behavior. The current phase is still a sideways accumulation within a range. When these ranges are not violated in either direction, patience is necessary to avoid price losses.

The view remains that the market is performing normally and that this correction is nothing special. The reaction may be a bit chaotic, but it will pass quickly. Just as the VNI approaching the 1300 peak was not important, the same is true now. What needs to be done is to observe the supply and demand of stocks in the target range. The market looks scary in red, but there are stocks with supportive money flow. When the market falls, it is a better time to accurately assess the strength of money flow.

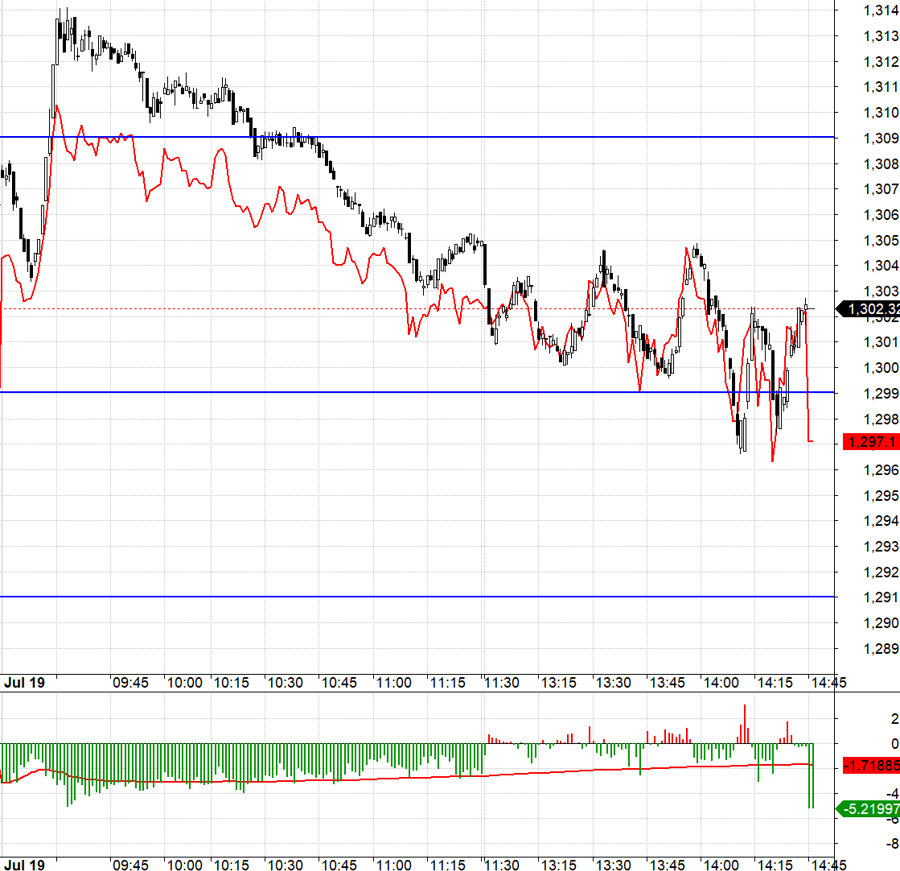

Today, the derivatives market switched periods, and except for the early rally, the F1 basis expanded its discount and refused to follow VN30. The index rose above 1309.xx very quickly, and above this level is 1318.xx. However, there was no consensus among the blue-chip group, with banks differentiating again and many pillars lacking demand at high prices. When VN30 turned down and broke below 1309.xx, the basis was still discounted by more than 2 points, enough to qualify for a short position with a stop loss when VN30 returns above 1309.xx. Below 1309 is an open range to 1299.xx. Lower than 1299.xx is another open range to 1291.xx. However, to break these two wide range boundaries consecutively, the pillars would need to collapse. So depending on the risk appetite, maintain the bet to the desired level. It’s best to close half the position around 1299.xx, and if the script doesn’t play out, you’ll just have less profit on the remaining half.

Demand for high prices today was very scarce, while sellers continued to lower prices. It was only when prices fell significantly that thick buy orders appeared below. This ensures that prices will be supported at lower levels. VN30, which corrected slightly more than other indices today, remains above the low of the last three sessions. The strategy is to selectively buy stocks, and be flexible with long/short positions in derivatives.

VN30 closed today at 1302.32, right at a milestone. The next resistance levels are 1309, 1316, 1320, 1326, 1332, and 1339. Supports are at 1290, 1279, 1272, and 1260.

“Stock Market Blog” reflects the personal views of the author and does not represent the opinions of VnEconomy. The views, assessments, and investment opinions expressed are those of the individual investor, and VnEconomy respects the author’s views and writing style. VnEconomy and the author are not responsible for any issues arising from the published assessments and investment opinions.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.