The market experienced a sudden and extreme volatility spike this afternoon, with a sharp shift from enthusiastic highs in the banking sector to a panic sell-off across the board. Unless there was some quietly spreading negative news, this must have been an incredible shake-up, as previous sessions with expanded limits had only seen one-sided movements.

Prior to this free fall, the market recovered very positively, with bank stocks aggressively pulling the indices back above the reference levels and posting strong gains. However, the strength was limited to the banking sector, as other stocks only saw modest gains, and the breadth remained firmly in favor of decliners.

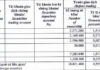

The subsequent decline also saw selling pressure in bank stocks, but the impact was more pronounced in other large-cap stocks. While bank stocks did retreat, most of them managed to stay above the reference levels, while hundreds of other stocks plunged deeply. According to today’s low statistics, approximately 55% of traded stocks lost more than 3% of their value during this decline. If we consider a threshold of a 2% loss, this figure rises to over 68% of the market. This magnitude of decline suggests that it was not driven by normal supply and demand dynamics but rather by a sell-off.

In the face of such volatility spikes, the market often scrambles to find a reason. Chat rooms remained eerily silent for several hours after the market closed, as they typically do when no clear cause is identified. However, even if a reason is found, it ultimately falls on the market to provide proof. If the market regains its composure, there is nothing to worry about, and this shake-up will be forgotten. On the other hand, if the pressure persists, the market will likely need to undergo further adjustments.

I maintain the view that there is nothing inherently wrong with the market. Despite today’s shocking volatility, there is no need for panic. While hot stocks carry higher risks, those that have already undergone corrections are less concerning. Today’s sharp decline presents an opportunity to buy back stocks and increase exposure. However, there is no need to chase the market higher. The late-session recovery had limited amplitude and modest volume, indicating a rather indifferent buying sentiment. Times like these, when chaos reigns, offer a great opportunity to observe and assess the pressure. Tomorrow’s futures expiration and the week’s end may bring continued weakness, but a decrease in volume would be a reassuring sign.

An enormous volume of stocks changed hands today (1.3 billion shares), with cash inflows into the matching orders on the Ho Chi Minh Stock Exchange (HSX) and Hanoi Stock Exchange (HNX) exceeding VND 30 trillion, matching the levels seen on June 24. It’s possible that some of this total volume could be attributed to active trading strategies. It’s also worth noting that the downward pressure was extremely rapid, making it very challenging to adjust passive orders. Only the recovery phase allows for the placement of new orders.

Today’s action in the futures market was indeed terrifying. The best segment for short sellers was not easy to play due to the rapid decline, as there was no signaling phase, just a sharp peak. Short sellers who chased the market were at a disadvantage because the intensity was so high that the visible price might not have been the actual price.

Tomorrow, the F1 contract will expire, but it is likely that the underlying market will remain calm. If nothing significant emerges overnight, the odds of a recovery tomorrow are high. The strategy remains one of flexible long and short positions.

The VN30 index closed today at 1305.37. Tomorrow’s nearest resistances are 1309, 1318, 1326, 1331, and 1339. Supports are at 1298, 1291, 1286, 1279, and 1271.

“Blog chứng khoán” reflects the personal views of the author and does not represent the opinions of VnEconomy. The views, interpretations, and predictions contained herein are those of the author and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for any issues arising from the investment opinions and interpretations presented in this blog.