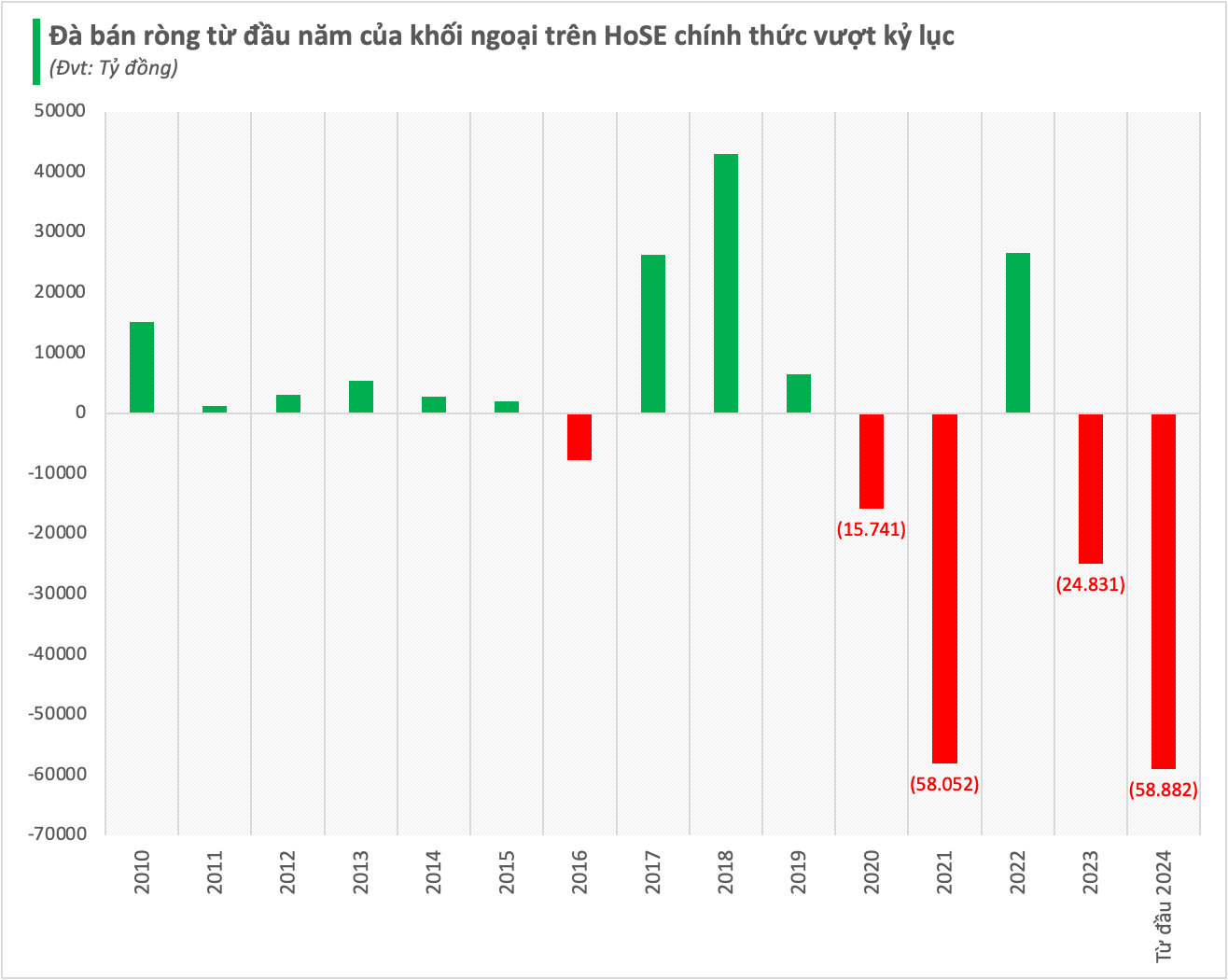

The Vietnamese stock market is facing significant pressure from foreign investors as they consistently sell off large volumes of stocks across the board. The net selling value on HoSE from the beginning of 2024 until July 12th, 2024, reached VND 58,882 billion (~USD 2.3 billion), breaking the previous record of over VND 58,000 billion set in 2021.

Thus, just past the halfway point of the year, foreign capital outflows have set a new record. It is possible that larger milestones will be reached soon as foreign investors show no signs of stopping their sell-off, consistently selling off thousands of billions of dong each session.

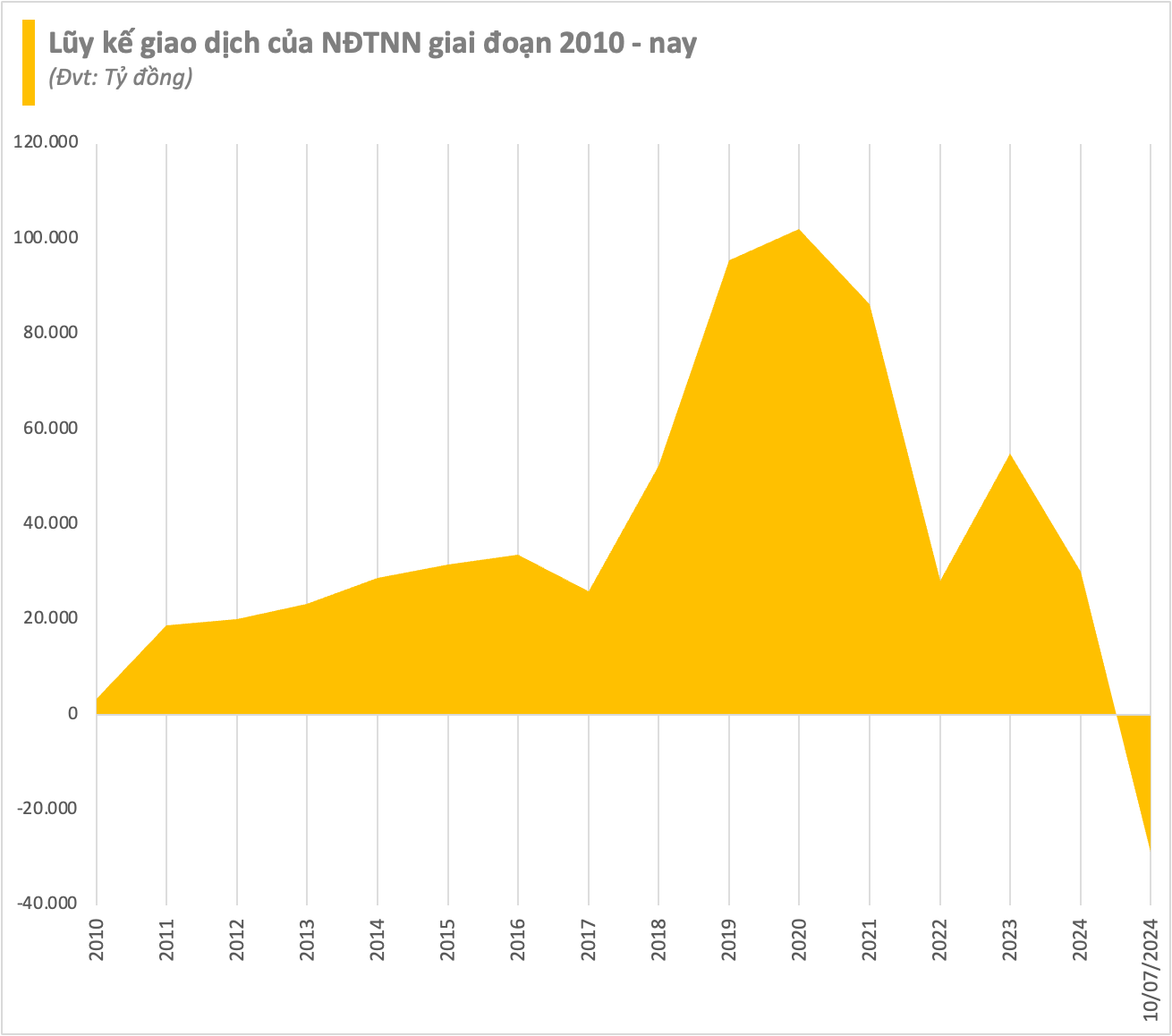

Statistics from the decade between 2010 and 2019 show that foreign investors mainly net bought Vietnamese stocks, with the only exception being 2016, when net selling was not significant. Notably, in 2018, foreign investors net bought over VND 43,000 billion worth of stocks on HoSE.

However, this trend started to reverse in 2020, and the intensity of the sell-off has become overwhelming compared to previous buying activity. In just over four years, the net selling of foreign investors has completely offset the net buying of the previous ten years. As a result, the cumulative foreign capital flow from 2010 to the present has turned into a net selling position of nearly VND 29,000 billion.

Many knots remain to be untied

While foreign transactions no longer hold as much influence over the market as before, their persistent net selling does impact the psychology of domestic investors.

Looking back, periods of strong net buying by foreign investors were mostly opportunistic, taking advantage of bottom-fishing when valuations dropped after market corrections. This capital inflow was rapid but short-lived, leaving the Vietnamese stock market lacking momentum for a sustainable uptrend.

It is worth mentioning that the disparity in interest rate environments, monetary policies, and exchange rates has significantly influenced foreign investor behavior in the past. This has led to a restructuring of capital flows globally, with capital being withdrawn from weaker-performing markets, depreciating currencies, or frontier markets and redirected to more efficient markets. Not only Vietnam but also regional markets such as Thailand and China have been affected by this trend.

Additionally, the net selling trend indicates a certain level of caution among foreign investors towards the Vietnamese stock market. The story of market upgrades attracting foreign capital remains only an expectation. In reality, the market has stagnated in the same range for years, with the VN-Index fluctuating around 1,200-1,300 points, and market capitalization failing to break out significantly.

VN-Index hovering below the 1,300-point threshold

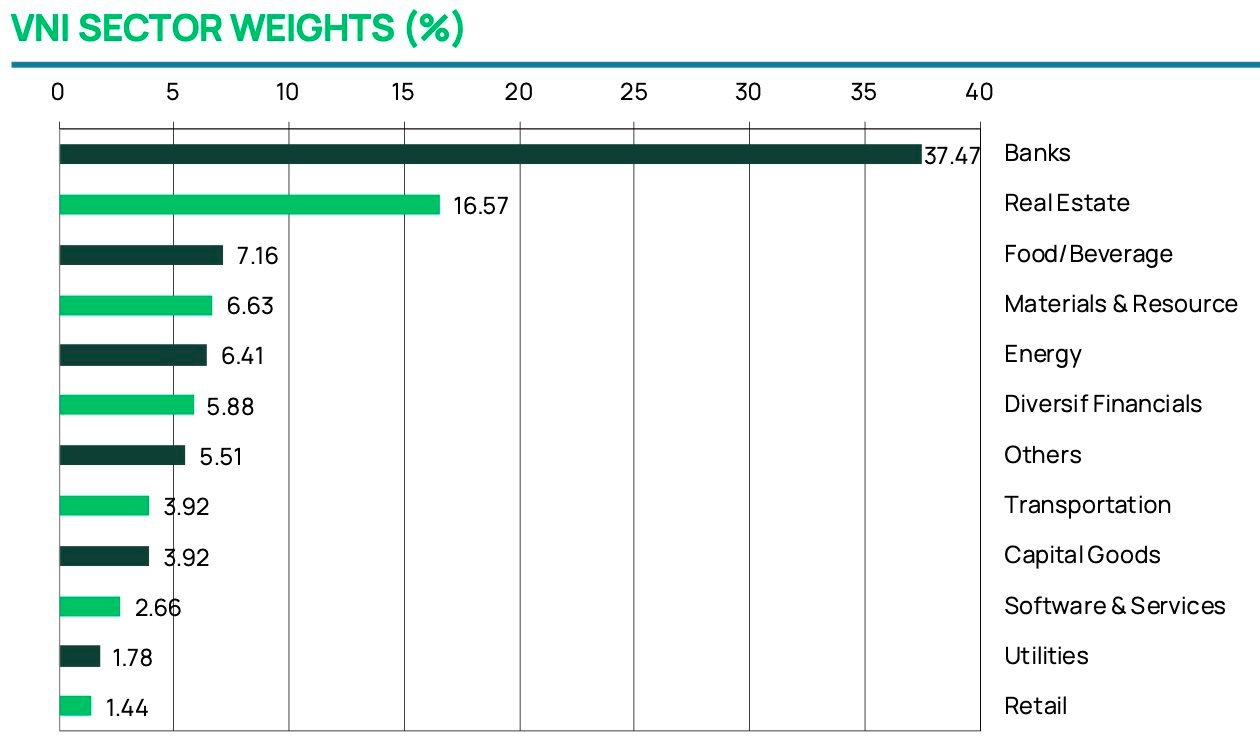

Furthermore, some specific factors could negatively impact foreign investors, such as the imbalance in sector weights on the exchange, and a lack of attractive investment opportunities. Financial stocks (banks, securities companies, and insurance) and real estate stocks dominate in terms of quantity and market capitalization (around 60% of the total market). These sectors are highly cyclical and dependent on credit growth.

Meanwhile, sectors that have become “hot trends” globally, such as technology, healthcare, pharmaceuticals, retail, and utilities, have a much smaller weight and a limited number of stocks. These sectors attract significant interest from foreign investors and are typically valued higher by investors. This shortage is one of the barriers hindering foreign investors’ access to the Vietnamese stock market.

How long will the net selling last?

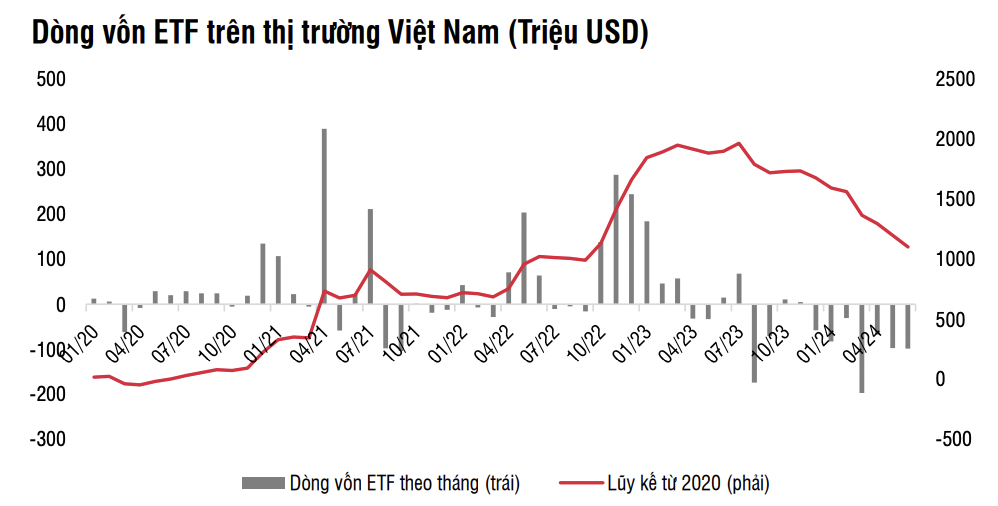

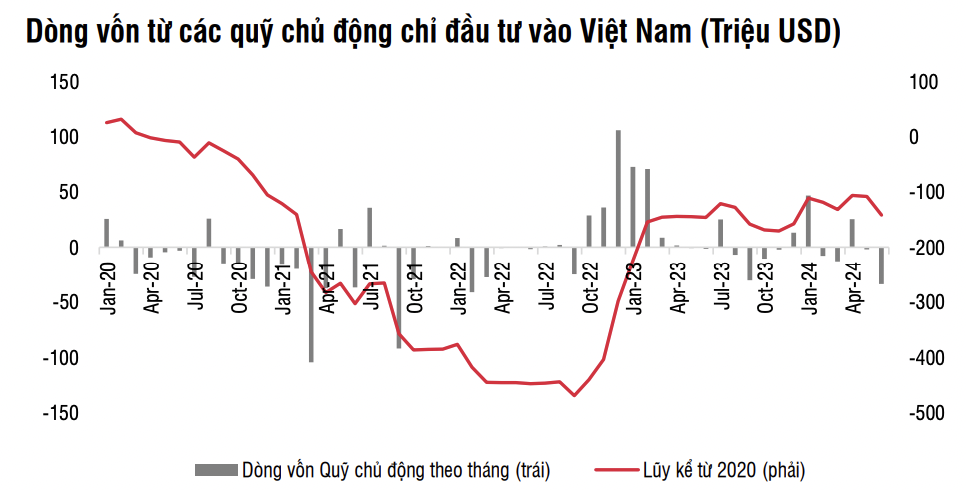

In a recent report, SSI Research assessed that investment flows in the Vietnamese stock market have experienced significant outflows. Since the beginning of the year, ETFs have withdrawn a total of VND 15,700 billion, equivalent to a reduction of about 21% of total assets at the end of 2023, bringing the total assets of ETFs to VND 66,000 billion. SSI also observed capital outflows from actively managed funds investing in Vietnam.

According to SSI, with the remaining asset size not being too large, the intensity of net withdrawals by ETFs in the coming time will be much more limited than in the second quarter. Regarding actively managed funds, with a limited number of investable enterprises, especially in the sectors of interest such as technology, and the risks associated with interest rates and exchange rates being the most significant factors affecting capital inflows into Vietnam at present.

On a more positive note, according to Mr. Bui Van Huy, Executive Director of the Southern Branch of DSC Securities Joint Stock Company, while foreign investors have net sold over VND 50,000 billion since the beginning of the year, the impact on the Vietnamese market has not been significant. Despite the persistent net selling, the market has remained resilient above the 1,280-point level. The trading volume of foreign investors accounts for only around 18-20% of the total trading volume in the entire market, much lower than the pre-2020 period, when it reached 30-50%.

Some reasons for the net selling pressure from foreign investors in the past time include interest rate differentials between economies, foreign fund managers’ assessment of valuation and expected profit differentials between investment regions, the withdrawal and liquidation of some ETFs, the lack of diversity in Vietnam’s stock market in terms of investment products and sectors.

However, Mr. Huy noted that the net selling pressure from foreign investors has eased recently. He expects this pressure to subside and even reverse as Vietnam’s market upgrade story draws closer.

The upcoming launch of the KRX system will provide the necessary infrastructure to implement the central counterparty clearing (CCP) model, addressing a critical bottleneck in the pre-funding requirement for the market upgrade. With the efforts of the management agency in the past time, the expectation of upgrading Vietnam’s stock market in 2025 is highly feasible.