Bright Spots from the First Bank to Report Second Quarter Profits

Yesterday (July 18), LPBank, the first bank to release its second-quarter earnings report, posted impressive results with a triple-digit profit growth. This sets a positive tone for the industry as we head into the second half of 2024.

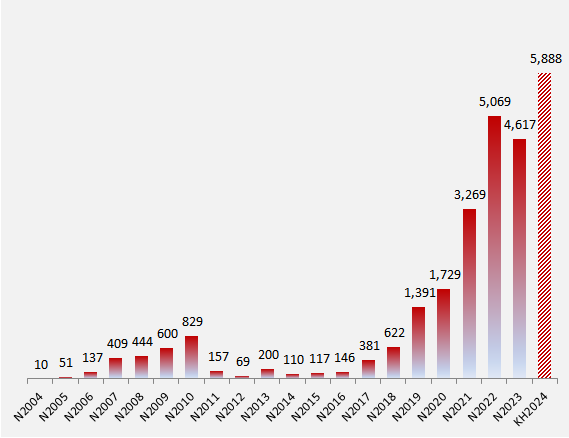

LPBank’s pre-tax profit for the first six months reached VND 5,919 billion, a remarkable 142% increase year-on-year. Breaking it down, the bank recorded a pre-tax profit of over VND 2,886 billion in the first quarter, followed by an impressive performance in the second quarter, surpassing VND 3,033 billion. This consecutive growth puts LPBank’s profit nearly 3.5 times higher than the same period last year.

Although Nam A Bank has not disclosed specific figures, its leadership shared that they are on track to surpass their annual plan by over 50%. With a pre-tax profit target of VND 4,000 billion for 2024, the bank has already secured VND 1,000 billion in the first quarter, indicating a very successful year ahead.

Several banks reported high profits in the second quarter of 2024

According to financial experts, robust credit growth has been a key driver of the banking industry’s profit surge in the second quarter and the first half of 2024.

SSI Research recently released a report projecting the profits of 13 banks, including Vietcombank, BIDV, MB, VietinBank, Techcombank, ACB, VPBank, HDBank, Sacombank, TPBank, VIB, MSB, and OCB. Notably, only two banks are expected to witness a decline in profits for the second quarter of 2024, while the remaining 11 banks are projected to experience positive growth.

Specifically, SSI Research forecasts a 60% increase for VPBank, an 8-10% rise for Vietcombank, a 10-11% jump for Techcombank, a 9% climb for ACB, a 21.8% surge for MB, a 12% improvement for BIDV, a 17% hike for VietinBank, a 10% gain for HDBank, a 3.9-8.8% boost for MSB, a 5.4% lift for Sacombank, and an 11.2-17.4% advancement for TPBank.

Analyzing the industry’s prospects, Dr. Le Anh Tuan, Strategy Director at Dragon Capital, noted that except for 2023, the banking sector has consistently achieved double-digit profit growth since 2016. With a weight of over 35% in the VN-Index’s market capitalization and contributing more than 60% to its total profits, banking stocks have always attracted the attention of foreign investors. This group of stocks has seen an average price increase of about 14% since the beginning of the year, outperforming the 10.2% rise in the VN-Index. Additionally, attractive valuations (P/B of approximately 1.7 times) coupled with NPAT growth of around 15-18% and ROE of approximately 18-20% provide a strong growth trajectory for the industry.

Overall Industry Profit Growth May Not Be Significant

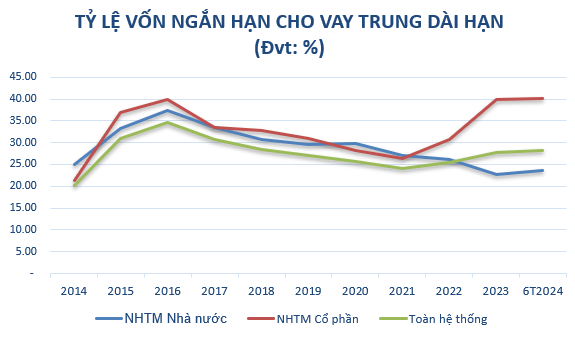

Despite these bright spots, some experts remain cautious. MSB Securities assesses that after-tax profits among banks vary, with growth rates not being exceptionally high, and some banks even facing the possibility of negative profit growth due to high comparative figures in the previous year. They forecast a 12% increase in industry profits, lower than the previous year. This is attributed to the continued pressure on net interest margins as lending rates decrease further per the State Bank’s requirements, while deposit rates have slightly increased across most banks.

Banks are diversifying their services to attract customers

Sharing a similar sentiment, Rồng Việt Securities (VDSC) predicts that 2024 will remain challenging for the industry, but some credit institutions will witness improved profit growth. They anticipate an average after-tax profit growth of 18% for the banks on their watchlist, with a 19% rise in net interest income.

The expected improvement in profits is attributed to better credit growth starting in the second quarter, as lending rates become more reasonable and the economy continues its recovery, boosting demand for production, business, and consumer loans. While deposit rates have increased, they remain relatively low, leading to a slight recovery in the industry’s net interest margin (NIM) and contributing to the growth of net interest income. With the total operating income on the rise, banks will have the flexibility to increase provisions to enhance bad debt handling and maintain asset quality.

Similarly, the State Bank’s recent survey on business trends revealed that the overall business situation and pre-tax profits of the banking system in the second quarter showed improvement but fell short of expectations and the credit institutions’ projections for the first quarter. Approximately 70-75.5% of credit institutions anticipated a more favorable business situation in the third quarter and the whole of 2024. For the full year, 86.2% of credit institutions expected pre-tax profit growth, while 11% feared negative growth, and 2.8% estimated no change.

Based on their business performance, credit institutions reported that the demand for banking services from customers, including deposits, payment services, and cards, witnessed only a slight recovery in the second quarter, falling short of expectations. Among these, the demand for deposits and payment services showed more improvement compared to the demand for loans in the same period. At the end of the second quarter, the demand for loans from enterprises was assessed to be higher than that of individual customers and other credit institutions.

In the second quarter of 2024, credit institutions observed a slight increase in non-performing loans, falling short of their expectations of a decrease as seen in the first quarter. As a result, the industry’s profit growth in the second quarter is not expected to be significant.

VPBank strengthens its system in 2023, laying the foundation for sustainable growth

By 2023, VPBank has made significant strides in expanding its customer base and scaling up its operations. The bank has managed to make progress amidst challenging macroeconomic conditions, focusing its resources on strengthening its system and building momentum for sustainable growth in 2024 and beyond.