After a positive bottom-fishing session and a strong reversal yesterday, the market lacked the momentum to sustain its gains today. The VN-Index briefly turned green but soon fell back into negative territory, with the decline accelerating towards the end of the trading day.

The VN-Index closed down 9.66 points, or -0.76%. This was not the lowest point of the session (the index fell nearly 14 points at its lowest), and the recovery was muted compared to yesterday’s session.

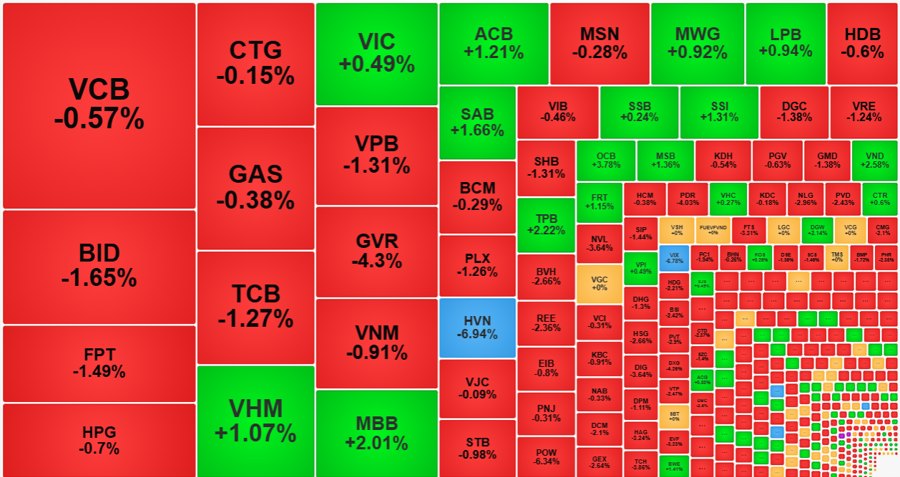

The VN30-Index closed down 0.31% with 9 gainers and 21 losers. VIC led the gainers with a 1.12% increase, followed by TCB, which recovered 1.3% but still closed down 1.27% from its reference price. MWG gained 1.39% to close up 0.92%, while CTG’s 1.98% gain reduced its loss to 0.15%. Meanwhile, VCB and VPB closed at their intraday lows, down 0.57% and 1.31%, respectively. VHM, HPG, and BID saw modest recoveries.

The breadth of the market confirmed the lack of a clear recovery trend. The VN-Index hit its intraday low at 2:10 PM with 93 gainers and 355 losers. By the closing bell, the index had recovered slightly, but the breadth remained negative with 126 gainers and 324 losers. Of these, 170 stocks fell by more than 1%, and 21 stocks recorded liquidity of over VND 100 billion. This strong selling pressure was a key concern for investors.

Interestingly, not many large-cap stocks experienced sharp declines. Only 10 stocks in this category fell by more than 1%, with POW leading the losses, down 6.34%. GVR and BVH also fell sharply, decreasing by 4.3% and 2.66%, respectively. POW, in particular, has been under significant pressure, falling 6.34% today and 6.7% on July 17. This week, POW has declined by 12.5%, marking the most significant weekly loss in the last eight months.

Several mid- and small-cap stocks witnessed notable moves: DIG fell 3.64% with a liquidity of VND 285.4 billion; HSG decreased by 2.66% with a volume of VND 225.6 billion; GEX dropped 2.64% with a liquidity of VND 220 billion; PDR fell 4.03% with a volume of VND 166.8 billion; TCH declined 3.86% with a liquidity of VND 161.1 billion; HDG decreased by 2.21% with a volume of VND 158.9 billion, and NVL fell 3.64% with a liquidity of VND 149.2 billion. The Midcap index closed down 0.87%, while the Smallcap index fell 1.4%, both underperforming the VN30-Index.

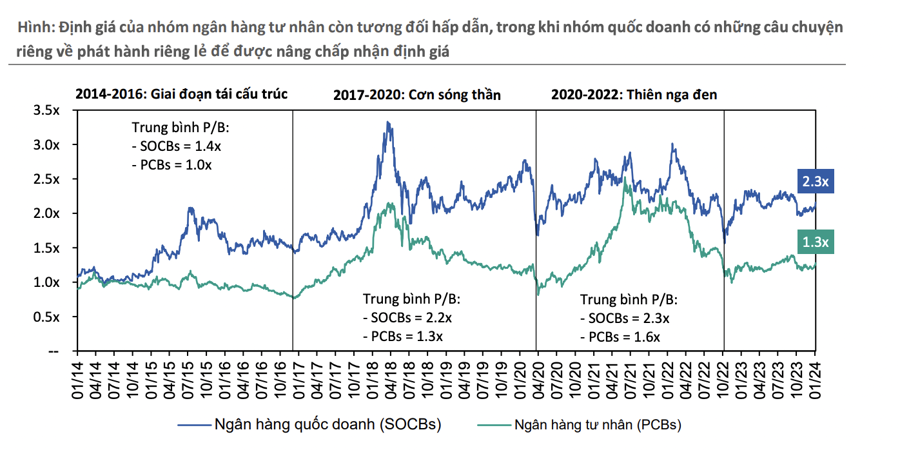

The ability of large-cap stocks to sustain the market is uncertain, despite nine stocks in this category trading in positive territory. Banking stocks are also starting to falter, with only nine out of 27 stocks in the green. MBB and ACB were the standout performers, increasing by 2.01% and 1.21%, respectively. In contrast, VPB, BID, SHB, and TCB fell by more than 1%. Securities stocks followed a similar pattern, with only SSI, VND, SHS, and MBS in positive territory, while the majority of stocks in this sector declined, with VIX even hitting its daily lower limit.

Overall, the market failed to maintain a clear differentiation in stock performance. While there were still 126 gainers on the HoSE, including 52 stocks that increased by more than 1%, trading was concentrated on a few stocks, such as MBB, TPB, SSI, ACB, DGW, VHM, VND, MSB, and ANV, which accounted for over 90% of the liquidity in this group. With the number of declining stocks far outpacing the gainers, the likelihood of investors incurring losses today was significantly higher than the potential for profits.

Foreign investors continued to be net sellers, offloading a net VND 350.2 billion worth of stocks today. However, the selling pressure eased in the afternoon session, resulting in a slight net buying position (VND 7.7 billion). This improvement was due to a large block trade of SBT worth VND 419 billion. MWG also attracted strong buying interest, with net purchases of approximately VND 120 billion for the day, bringing the total net buying value to VND 176.6 billion. On the other hand, several stocks witnessed increased selling pressure, including FPT (VND -228.2 billion), VHM (VND -158.9 billion), TCB (VND -194.9 billion), MSN (VND -92.5 billion), and HSG (VND -66.4 billion).

With a loss of nearly 10 points today, the VN-Index closed at 1,264.78 points. While this level is slightly above the lows of the previous two sessions, it is not significantly higher than the June-July lows of around 1,240 points. Additionally, the index has dropped below its 20-day moving average (MA20), indicating a technical disadvantage.