The market experienced a shocking turn of events towards the end of the continuous matching session this afternoon. The VN-Index fluctuated by 2.73% or over 34 points within 20 minutes. It plunged to its lowest point, down by nearly 25 points, before closing with a slight recovery at -12.52 points. Despite the recovery, the result was still shocking, with the number of declining stocks tripling the number of advancing stocks. A total of 26 stocks hit their daily limit down.

The sudden reversal caught many by surprise. Just before the market turned, the VN-Index had reached its intraday high, driven by a surge in banking stocks. MBB, for instance, even touched its ceiling price. It seemed like a spectacular trading session was on the cards, rather than a shocking decline. The banking group was performing exceptionally well, with the VN30-Index reaching a peak, up by as much as 1.63% from the reference price.

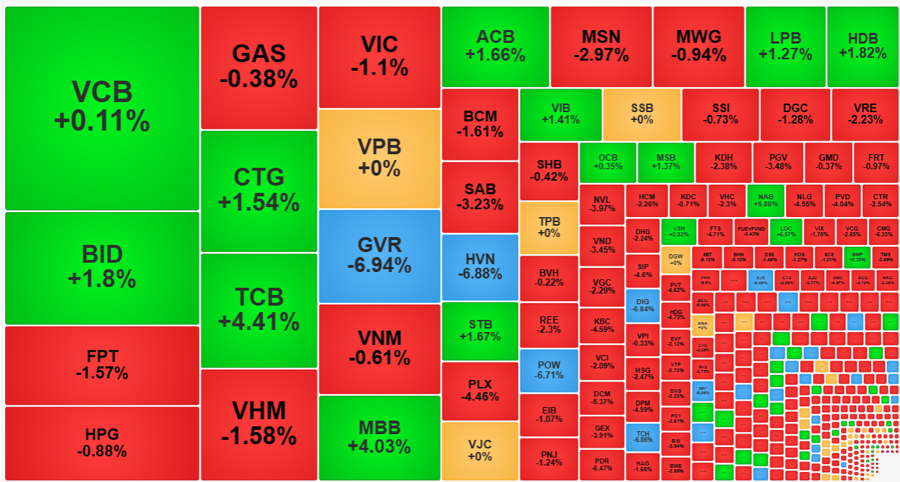

However, the tide turned as a wave of sell-offs hit a range of pillar stocks, sending their prices tumbling. The banking sector was not spared, with many large-cap stocks plunging and adding further pressure on the VN-Index. VCB, for instance, witnessed a sharp decline of 2.86% during the same period as the VN-Index’s fall. CTG dropped by approximately 3.84%, BID by 5.1%, and VPB by around 3.2%. Other pillars also took a hit: GAS plummeted by about 1.8% within 15 minutes, VHM slipped by 1.7%, HPG by 3.1%, FPT by 2.1%, and GVR by a staggering 3.9%…

Not all of these stocks dipped below the reference price during this volatile period. Some bank stocks, such as ACB, BID, CTG, STB, TCB, and VIB, remained in positive territory. When the market hit its low, only these banking stocks in the VN30 basket managed to stay slightly above the reference price, while GVR and POW hit their daily limit down. Nonetheless, the price fluctuations within this short period were significant, capable of wiping off dozens of points from the VN-Index. At the bottom, VIC fell by 2.19%, VHM by 2.9%, HPG by 3%, MSN by 4.1%, PLX by 6.9%, and FPT by 3.1%…

This wave of sell-offs pushed liquidity to remarkable levels. A quick look at the VN30 basket reveals that from its peak at 2:10 PM to its trough at 2:27 PM, the trading value reached VND 2,810 billion in terms of matching orders alone. Bottom-fishing forces emerged soon after, successfully “rescuing” many stocks, pushing their prices back up, and generating substantial liquidity. Combined, HoSE and HNX witnessed a successful matching value of VND 19,306 billion in the afternoon session, an 80% increase from the morning session, marking the highest afternoon liquidity in the past 40 sessions. HoSE alone accounted for an additional VND 18,087 billion.

Although bottom-fishing forces were present, the buyers’ ability to push prices higher was limited. The VN-Index breadth ended with 109 gainers and 369 losers, including 240 stocks falling by more than 1% and 26 at their daily limit down. The VN-Index closed down by 0.98%, a relatively mild decline, thanks to the resilience of banking stocks: MBB rose by 4.03%, BID by 1.8%, TCB by 4.41%, CTG by 1.54%, ACB by 1.66%, HDB by 1.82%, LPB by 1.27%, STB by 1.67%, NAB by 5.88%, and VIB by 1.41%. These 10 stocks contributed the most to supporting the VN-Index, and they all belong to the banking sector.

The group of stocks that hit their daily limit down witnessed extreme selling pressure, with DIG, POW, TCH, GVR, HVN, VOS, IJC, and BFC recording liquidity in the hundreds of billions of VND. Dozens of other stocks also witnessed high liquidity, with their prices declining by more than 4%. In fact, 128 stocks fell by more than 3% today, accounting for nearly 36% of the total HoSE floor stocks. This magnitude of decline is exceptionally strong, despite the relatively modest change in the index.

On the upside, excluding banking stocks, only a handful of stocks reliably went against the downward trend, such as BMP, which rose by 2.28% with a liquidity of VND 66.6 billion; HBC, which climbed by 2.01% with VND 18 billion; and SGN, which inched up by 1.05% with VND 6.8 billion. The majority of advancing stocks had meager liquidity, ranging from a few billion to a few million VND.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.