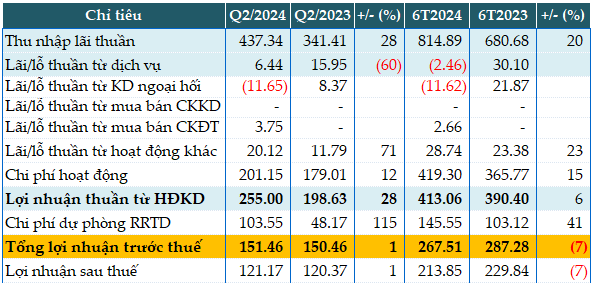

For Q2 alone, net interest income increased by 28% compared to the same period last year, reaching over VND 437 billion.

In terms of non-interest income, while service activities (down 60% in profit) and foreign exchange trading (turning from profit to loss) declined; investment securities trading activities (profit of VND 4 billion) and other activities (+71% profit) grew.

As a result, net profit for the quarter increased by 28%, reaching VND 255 billion. However, due to the Bank’s provision for risk doubling from the previous year (VND 104 billion), pre-tax profit increased slightly by 1%, reaching over VND 121 billion.

For the first six months of the year, net profit reached over VND 413 billion, up 6% compared to the same period. PGB set aside nearly VND 146 billion for risk provisioning (+41%), bringing the pre-tax profit to nearly VND 268 billion, down 7%.

Thus, PGB achieved 48% of its full-year target of VND 554 billion in pre-tax profit after two quarters.

|

PGB’s Q2/2024 Business Results. Unit: Billion VND

Source: VietstockFinance

|

As of the end of Q2, the Bank’s total assets were recorded at over VND 59,715 billion, up 8% from the beginning of the year. While funds deposited with the SBV decreased by 62% (to VND 610 billion), funds deposited with other credit institutions increased by 29% (VND 18,490 billion), and loans to customers increased by 4% (VND 36,703 billion). Meanwhile, customer deposits increased by 5% to VND 37,391 billion.

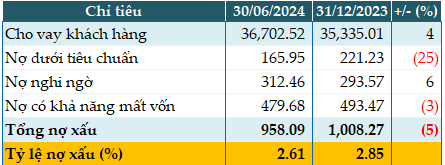

The improvement in loan quality was a bright spot in PGB’s Q2 business picture. Total non-performing loans as of June 30, 2024, decreased by 5% from the beginning of the year to VND 958 billion. Substandard debt and debt with potential losses also decreased. As a result, the ratio of non-performing loans to total loans decreased from 2.85% at the beginning of the year to 2.61%.

|

PGB’s Loan Quality as of June 30, 2024. Unit: Billion VND

Source: VietstockFinance

|

Han Dong

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.