According to a recent report by the Vietnam Real Estate Brokers Association (VARS), real estate transactions in the first half of 2024 increased by 300% compared to the same period in 2023. One of the driving forces behind this growth, especially in the secondary housing market, is the decline in bank lending rates to their lowest levels in two decades. This has made it easier for both homebuyers and investors to access bank financing at reasonable costs. A notable example is VIB’s apartment and townhouse loan package, offering an interest rate of only 5.9%/year with a principal grace period of up to 5 years.

Ultra-preferential interest rates, fixed for up to 2 years, make this an attractive choice for both investors and homebuyers.

VIB offers three preferential interest rates of 5.9%, 6.9%, and 7.9%/year for its townhouse and apartment purchase loans. These rates are fixed for 6, 12, and 24 months, respectively, giving borrowers the flexibility to choose an option that suits their financial situation and needs. Investors can opt for the 5.9%/year rate fixed for 6 months to reduce financial costs and boost profits. On the other hand, homebuyers might prefer to fix their rate for a longer period of up to 2 years to protect themselves from market interest rate fluctuations. After the promotional period, the interest rate margin is only 2.9%, with a maximum loan-to-value ratio of 80%, and a repayment period of up to 30 years.

Borrowers with existing loans at other banks can enjoy an additional 0.4% interest rate discount, resulting in rates as low as 5.5% – 7.5%/year when they transfer their loans to VIB. VIB also offers pre-disbursement support to help borrowers settle their existing loans.

Principal grace period of up to 5 years, with flexible repayment options to suit individual borrower needs.

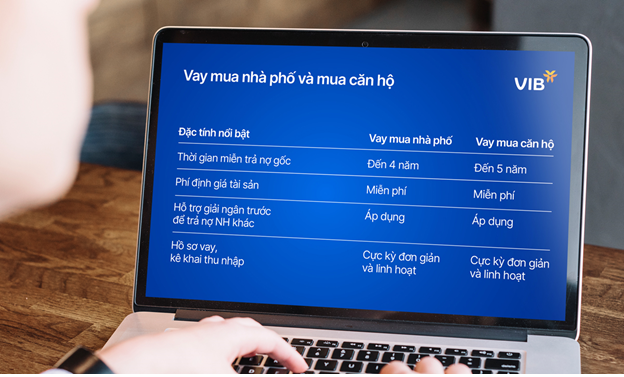

VIB’s borrowers can choose their principal repayment frequency based on their financial capabilities, with a grace period of up to 5 years for apartment purchases and 4 years for townhouse purchases. For instance, homebuyers can opt for a longer grace period to reduce financial pressure, giving them more time to manage their cash flow and increase their future income.

Investors also have the flexibility to choose from monthly, quarterly, or stepped principal repayment options for townhouse purchases. The stepped repayment option is a unique feature of VIB’s loan package, not commonly offered by other banks in the market, allowing borrowers to adjust their principal repayment schedule and reduce the pressure of high initial payments.

The real estate market is showing positive signs in the third quarter, with interest rates at their lowest levels in two decades. This has stimulated a rapid increase in retail credit demand, especially in the secondary housing market, where legal safety is assured and the market is growing strongly.

A VIB representative stated that the townhouse and apartment purchase loan packages are the largest-scale and most competitive loan offerings the bank has ever introduced. Instead of providing universal credit packages, VIB is developing specialized products tailored to meet the diverse needs and financial capabilities of its customers. This approach not only helps VIB target the right customer segments but also assists borrowers in choosing the most suitable loan package, ensuring optimized financial costs and peace of mind for long-term borrowing. Top of Form Bottom of Form Contact hotline: 1800 8180, or apply for a home loan here.

Easier mortgage interest rates

Starting from the beginning of the year, banks have been implementing various low-interest credit packages, offering loans to pay off debts from other banks… with the aim of stimulating the demand for home loans.

Reflecting on a year of free-falling interest rates

Savings interest rates in 2023 witnessed a race to the lowest levels in 20 years, dropping from a peak of 12% per year for the 12-month term in early 2023 to below 5% per year by the end of the year. Let’s take a closer look at the unprecedented interest rate developments of the past year with Tiền Phong.