The Duc Long Gia Lai Group has announced a restructuring of its investment in Mass Noble Investments Limited (Mass Noble). The company intends to divest its entire stake in this subsidiary.

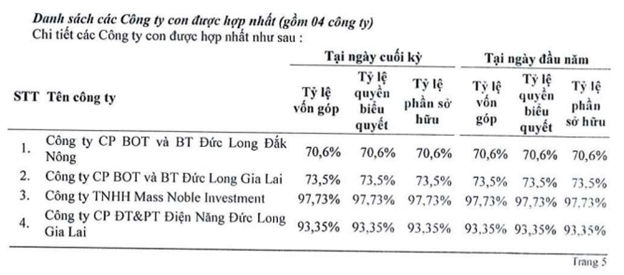

DLG has invested more than VND 249 billion, equivalent to 97.73% of Mass Noble’s charter capital. After completing the divestment, Mass Noble will no longer be a subsidiary of DLG.

As of March 31, 2024, DLG had four subsidiaries, including Mass Noble.

Source: DLG

|

The DLG Board of Directors has authorized the CEO to search for and engage a valuation firm to reassess the value of Mass Noble in line with the current market. Simultaneously, they are seeking suitable partners to transfer the company’s entire stake in the subsidiary, provided that the transfer price is not lower than the par value and DLG’s ownership value in Mass Noble.

Looking back almost a decade ago (May 2015), Duc Long Gia Lai acquired Mass Noble through a share swap. Specifically, DLG issued nearly 20 million shares to Mass Noble’s shareholders at a swap price of VND 12,500 per share, valued at VND 249 billion. The swap ratio was 1:1.4 (i.e., one DLG share for 1.4 Mass Noble shares). Following this transaction, DLG held a controlling stake in Mass Noble with a 97.73% ownership interest, as it does today.

Mass Noble specializes in manufacturing electronic components for ANSEN, an American company, with its factory located in Dongguan City, Guangdong Province, China. This large-scale manufacturing facility is built on a 40,000-square-meter site (five stories) and focuses on producing and processing high-tech telecommunications electronic products, such as premium LED lights for interiors, automobiles, streets, and highways, as well as LCD screens. Their products are marketed in Europe, the United States, Japan, South Korea, and China.

|

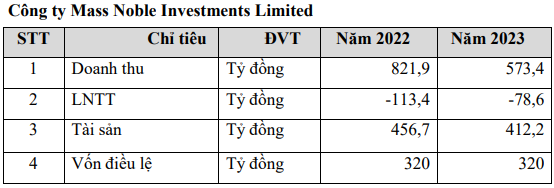

Financial highlights of Mass Noble

Source: DLG

|

In terms of business performance, DLG aims for VND 1,400 billion in revenue in 2024, a 25% increase compared to the previous year, and VND 120 billion in after-tax profit (after a loss of nearly VND 579 billion in 2023).

| DLG’s financial performance from 2017 to 2023 |

DLG has reported losses for two consecutive years (2022-2023). If the company fails to turn a profit in 2024, it will face delisting in the following year.

In addition to the 2024 plan, DLG has also set goals for 2025 and 2026, targeting revenue of VND 1,550 billion and after-tax profit of VND 170 billion for 2025, representing increases of nearly 11% and almost 42%, respectively, compared to 2024. For 2026, they aim for revenue of VND 1,700 billion, a nearly 10% increase over 2025, and an after-tax profit of VND 250 billion, a surge of over 47%.

Duc Long Gia Lai targets 42-47% profit growth for 2025-2026

Businesses Struggle as Companies Rush to Divest Investments in 2023

Taseco Land has withdrawn from the West Lake urban area project, while VNDirect Securities has sold its entire stake in IPAAM to IPA… These are among the notable divestment deals in 2023.