Gold and Real Estate Markets

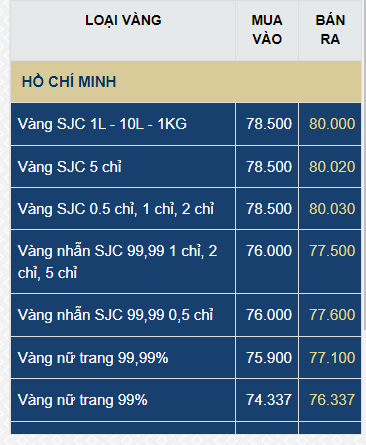

On July 14, the price of gold rings was recorded at 75.9 – 77.1 million VND per tael for buying and selling, while SJC gold bars were traded at 74.9 – 76.9 million VND per tael. Gold ring prices have been continuously adjusted to closely follow the global gold market, while SJC gold bars have remained stagnant for the past month. This is also the first time that gold ring prices have surpassed gold bar prices. Traditionally, SJC gold bars, bearing the national brand, have been favored by the public and are often in short supply, leading to instances where their prices exceeded gold ring prices by up to 10 million VND per tael and global gold prices by 20 million VND per tael.

However, following the intervention of the State Bank of Vietnam, SJC gold bar prices witnessed a significant drop and have since remained stagnant, showing no fluctuations in line with global prices. Conventionally, gold bars are expected to be priced higher than gold rings and are the preferred choice due to their advantages, including their association with the national brand, higher trustworthiness, and lower susceptibility to counterfeiting.

On the other hand, gold rings come in various brands, making them more prone to counterfeiting compared to gold bars. The only advantage gold rings hold is their availability in smaller weight categories (ranging from one to a few taels), making them more affordable for a larger portion of the population. In contrast, gold bars are currently only available in the one-tael category, limiting their accessibility to those with higher purchasing power.

Gold ring prices closely follow global gold prices and surpass SJC gold bar prices. Photo: Nhu Y

According to Mr. Nguyen Quang Huy, a finance and banking expert from Nguyen Trai University, the high gold ring prices are influenced by international factors. In the past few days, global gold prices have been trading at around 2,410 USD per ounce, slightly lower than the previous session but still within the peak range for this year. In May 2024, global gold prices surged to their highest level, reaching nearly 2,450 USD per ounce.

To stabilize the gold market, experts suggest promptly amending Decree 24 on the management of gold business activities. This could involve the State Bank relinquishing its monopoly on the SJC gold bar brand. Alternatively, if the State Bank intends to maintain its monopoly on the SJC gold bar brand (given that it already holds a 90% market share, and multiple gold bar brands may still lead to a preference for SJC gold bars), it should ensure sufficient supply to meet market demands.

Mr. Huy pointed out that after the State Bank’s intervention to stabilize SJC gold bar prices, they have remained relatively stagnant, only slightly higher than global gold prices by over 3 million VND per tael. However, reports indicate that the supply of SJC gold bars in the market is limited, making it challenging for buyers to acquire them. As a result, people have turned to purchasing gold rings. Nevertheless, they also face difficulties in obtaining gold rings from several major gold companies at this time. At certain shops, customers who wish to buy gold rings have to wait for 10 to 15 days to receive their purchase.

“The higher gold ring prices compared to SJC gold bars are only a short-term phenomenon. If this situation persists, it calls for the State Bank’s intervention using flexible tools,” said Mr. Huy. He added that, fundamentally, domestic gold bars and gold rings will closely follow the upward and downward movements of global gold prices and the State Bank’s policies on supply and demand regulation. Regarding the amendment of Decree 24, the Fed’s anticipated interest rate cut, and the escalating Russia-Ukraine conflict, these factors are expected to drive gold prices higher and potentially sustain them at the peak levels witnessed in the past.

Enhancing Tax and Invoice Control in Gold Transactions

In terms of tightening control over gold transactions, statistics from the General Department of Taxation show that there are currently 12,500 businesses and individuals, along with over 5,500 households, engaged in gold, silver, and gemstone trading and processing activities nationwide. To curb potential distortions in the gold market, the tax agency has implemented various solutions, including controlling electronic invoices for gold trading activities.

Since July 1, 2022, electronic invoices have been mandatory nationwide for businesses and business households. All enterprises operating in the gold and silver sector have adopted electronic invoices, with over 5,830 gold and silver trading establishments utilizing over 1.06 million electronic invoices across the country.

However, in the gold and silver processing sector, some individual buyers do not request invoices, creating challenges for the tax authority in monitoring transactions.

Mr. Dang Ngoc Minh, Deputy General Director of the General Department of Taxation, stated that the tax agency coordinates with the State Bank to inspect the gold market. Currently, there are 38 enterprises and organizations licensed to trade SJC gold. “The tax agency assigns officers to participate in inspection teams, extract tax payment data, and apply electronic invoices for 16 SJC gold trading units. The authorities are in the process of inspecting and will announce the results as per regulations,” said Mr. Minh.

A survey by Tien Phong Newspaper at gold shops in Hanoi, such as Doji and Phu Quy, revealed that customers purchasing plain gold rings must present their citizen identification cards. For shops that accept advance payments, customers receive a voucher and have to wait from 10 days to a month to receive their gold. After receiving the gold, the shop issues an electronic invoice to the customer. Currently, in addition to meeting business conditions, gold enterprises are subject to two types of taxes: Value-Added Tax (VAT) and Corporate Income Tax. As a special commodity, VAT on gold is calculated using the direct tax calculation method.