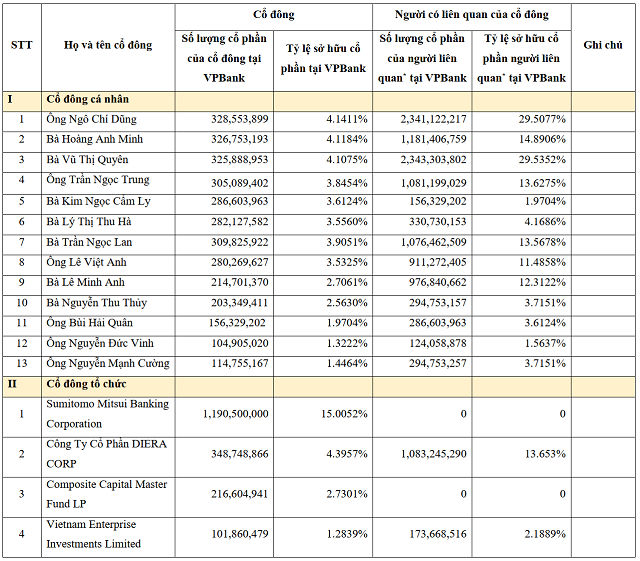

As of July 19, 2024, VPBank has 13 individual shareholders and 4 institutional shareholders owning 1% or more of its capital, totaling nearly 5.1 billion shares of VPB, or over 64% of its charter capital.

The Chairman of the Board of Directors, Mr. Ngo Chi Dung, currently holds 328.5 million shares, equivalent to 4.14% of the capital. Individuals related to Mr. Dung also hold 2.34 billion shares, accounting for 29.5% of the charter capital, bringing the total ownership of the group related to the Chairman to 33.64%.

Among them, Mr. Dung’s wife, Mrs. Hoang Anh Minh, owns 326.75 million shares, or 4.11% of the capital, while his mother, Mrs. Vu Thi Quyen, holds 325.9 million shares, equivalent to nearly 4.11%.

VPBank’s CEO, Mr. Nguyen Duc Vinh, holds over 104.9 million shares, representing 1.3% of the capital. Individuals related to Mr. Vinh hold 1.56% of the capital, bringing the total ownership of Mr. Vinh and related individuals to 2.88%.

Shareholders related to the Vice Chairman of the Board of Directors, Lo Bang Giang, include Mr. Giang’s mother, Ly Thi Thu Ha, who currently holds nearly 3.6% of the capital (282.1 million shares), and his wife, Nguyen Thu Thuy, who holds nearly 2.6% (203.34 million shares).

Mr. Bui Hai Quan, Vice Chairman of the Board of Directors of VPBank, owns 156.3 million shares, or 1.97% of the charter capital. His wife, Mrs. Kim Ngoc Cam Ly, holds 286.6 million shares, equivalent to 3.61%. In total, the group related to Mr. Quan owns 5.59% of the bank’s capital.

Additionally, VPBank’s list of individual shareholders includes: Mr. Tran Ngoc Trung (holding 305.1 million shares, 3.85%), Ms. Tran Ngoc Lan (309.8 million shares, 3.9%), Mr. Le Viet Anh (280 million shares, 3.53%), Ms. Le Minh Anh (214.7 million shares, 2.71%), and Mr. Nguyen Manh Cuong (114.8 million shares, 1.45%).

The four institutional shareholders of VPBank are: Sumitomo Mitsui Banking Corporation (SMBC), the bank’s strategic partner, holding nearly 1.2 billion shares, or 15% of the charter capital; CTCP DIERA, with 348.8 million shares, or 4.39%; and two investment funds, Composite Capital Master Fund and Vietnam Enterprise Investments, holding 216.6 million shares and 101 million shares, respectively, equivalent to 2.73% and 1.28% of the capital.

The reason VPBank and other banks disclose the ownership ratios of shareholders holding 1% or more is to comply with the Law on Credit Institutions (amended in 2024), which came into effect on July 1, 2024.

According to Article 49 of the 2024 Law on Credit Institutions, credit institutions are responsible for disclosing comprehensive information about shareholders holding more than 1% of their charter capital, including information about the shareholder, related individuals, and ownership details.

Article 63 of the same law stipulates that individual shareholders cannot own more than 5% of a bank’s capital, while institutional shareholders are limited to 10%. Shareholders and their related individuals cannot own more than 15% of the bank’s shares. If their ownership exceeded the cap before July 1, 2024, they are not allowed to increase their stake until they comply with the regulations, except in the case of receiving dividends in shares.

However, the ownership ratio of foreign investors remains subject to Decree No. 01/2014 until the government issues new regulations.

“Japanese Executive Appointed as VPBank’s Deputy CEO”

“VPBank is proud to announce the appointment of Mr. Kamijo Hiroki as Deputy General Director, effective July 27th. With a wealth of experience and a strong track record of success, Mr. Kamijo Hiroki is set to play a pivotal role in driving the bank’s strategic initiatives and propelling its growth to new heights.”