Imported steel at low prices continues to show an upward trend from 2023 to the first half of 2024. The volume of imported steel has consistently outpaced domestic production, causing a decline in the market competitiveness of many local steel businesses. Without timely intervention and protective measures, there is a high likelihood that the domestic steel market could be entirely dominated by foreign imports.

Imported Steel Volume 1.7 Times Higher than Domestic Production

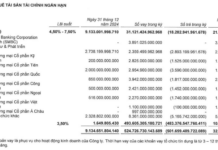

Currently, the demand for hot-rolled steel (HRC) in Vietnam is approximately 12-13 million tons per year, while the capacity of domestic manufacturers stands at around 9 million tons annually. However, according to statistics from the Vietnam Steel Association (VSA), there are times when imported HRC volume reaches nearly 200% of domestic production. For instance, the market share of HRC sales for Hoa Phat and Formosa decreased from 42% in 2021 to 30% in 2023 and continues to decline. This situation not only prevents local steel companies from fully utilizing their designed capacity but also forces them to compete with similar imported products at lower prices.

“In 2023, the production capacity of Vietnamese HRC manufacturers reached only 6.7 million tons, equivalent to 79% of the designed capacity, a significant drop from the 86% achieved in 2021,” shared a VSA representative. “In contrast, the volume of imported HRC in 2023 soared to 9.6 million tons, 1.5 times higher than domestic production. This worrying trend continued in the first half of this year, with imported HRC volume 1.7 times higher than local production.”

Imported steel exceeds domestic demand and production capacity

Mr. Phan Dang Tuat, Chairman of the Vietnam Supporting Industry Association, shared that in the past, Vietnam was unable to produce HRC due to the massive investment and advanced technology requirements. However, Formosa Ha Tinh and Hoa Phat have now successfully ventured into the manufacturing of this product.

“When domestic companies couldn’t produce HRC, importing it was inevitable. But now that local manufacturers can produce high-quality HRC, there is no reason for this product to continue flooding our market in such large quantities,” Mr. Phan Dang Tuat warned. “Recently, there have been signs of HRC being sold below production costs, which warrants investigation as it will significantly impact local manufacturers and may lead to the loss of our market share.”

Given the surge in low-priced imported steel, businesses and experts believe that relevant authorities should continue to develop and improve technical standards, quality management systems, and technical barriers. Additionally, reasonable protective measures should be implemented to prevent steel products that do not meet technical, safety, and environmental standards from entering the Vietnamese market.

Establishing Technical Barriers in Line with International Standards

As early as April 2024, Deputy Prime Minister Le Minh Khai instructed the Ministry of Industry and Trade to coordinate with the Ministry of Finance and related agencies to review and monitor the situation of increasing HRC imports. Based on this review, appropriate, timely, and effective measures should be implemented within the scope of authority and legal regulations to protect the legitimate interests of the domestic production industry, in alignment with international practices and a competitive equal environment.

Mr. Nghiem Xuan Da, Chairman of VSA, expressed that the Ministry of Industry and Trade needs to expedite the development and submission of the Vietnam Steel Industry Development Strategy for the period up to 2030, with a vision towards 2050, along with specific policies to promote green and sustainable growth in the steel industry. The Ministry should also continue guiding and supporting steel exporting businesses to effectively respond to trade remedy cases related to steel production in foreign countries.

Dr. Nguyen Thi Thu Trang, Director of the WTO and Integration Center (VCCI), shared that out of all the trade remedy cases for steel, none have been rejected. To date, the Center has not received any feedback from partners or other WTO members regarding Vietnam’s inappropriate or non-compliant application of WTO requirements.

Authorities need to establish technical barriers based on international standards to prevent low-quality imported steel

According to a report by the WTO and Integration Center, 12 out of 28 trade remedy cases in Vietnam involved steel products, accounting for approximately 46% of the total trade remedy cases for all product types in the country so far. Conversely, 73 trade remedy cases have been initiated by other countries against Vietnamese steel exports, indicating their extensive use of trade remedy measures to safeguard their domestic markets.

Therefore, Dr. Trang emphasized the need to establish technical barriers that align with international standards to prevent the influx of low-quality imports. Additionally, she suggested developing procedures for inspecting the quality of steel imported into Vietnam, requiring imported steel to be accompanied by certificates of compliance with Vietnamese quality standards.

According to the Trade Remedies Authority (Ministry of Industry and Trade), the Authority is in the process of evaluating the petitions of domestic steel companies requesting an investigation and the imposition of anti-dumping duties on imported HRC from China and India. The evaluation process, as stipulated, takes 45 days from the official date of receiving the complete dossier (June 14, 2024).

The surge in imported HRC, coupled with dumping practices, has created significant challenges for local businesses, leading to reduced revenue and impacting the livelihoods of many. Therefore, initiating an anti-dumping investigation and imposing corresponding duties are crucial steps to protect domestic production, curb unfair competition, and eliminate low-quality imported goods, thereby fostering a fair competitive environment in the market.

According to customs data, in June alone, Vietnam imported 886,000 tons of hot-rolled steel coils (HRC), equivalent to 151% of domestic production, with 77% of this volume originating from China. Cumulatively, in the first six months of the year, HRC imports reached nearly 6 million tons, a 32% increase compared to the same period in 2023. This import volume represents 173% of domestic production, with China accounting for 74% of the total, followed by South Korea, India, and Japan…

The import value of HRC in the first six months reached USD 3.46 billion, of which China accounted for USD 2.5 billion. Notably, the average price of HRC imported from China was only USD 560 per ton, lower than the domestic offering price by USD 15-20 per ton and significantly lower than prices from other countries by USD 45-108 per ton.

Prime Minister’s report on rampant illegal import of chickens and pigs into Vietnam

According to livestock associations, there are still many loopholes in Vietnam’s regulations on the importation of livestock products that are creating conditions for low-quality livestock products to flood the country. With the current rate of imports, Vietnam will become a super importer of livestock products in just 3-5 years.

The Steel Industry’s Challenge: Navigating the Threats of Imports

“The domestic steel industry is at a critical juncture. Without timely and adequate support, coupled with protective measures, the local market is at risk of falling into the hands of foreign producers. This is a crucial time to bolster our domestic steel sector and ensure its survival and prosperity in the face of global competition.”