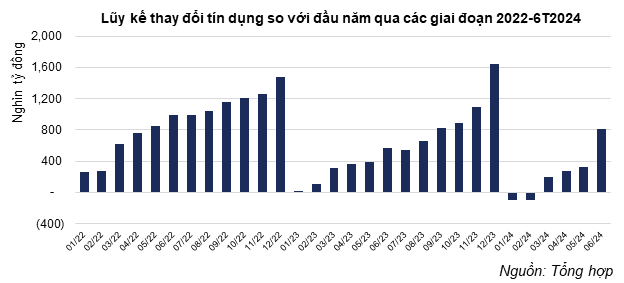

Credit growth as of May reached 2.41% compared to the end of 2023 (equivalent to an additional VND 326,800 billion). By the end of June, total credit outstanding of the system reached approximately VND 14.3 quadrillion, up 6% compared to the end of 2023. Thus, in just one month, more than VND 400,000 billion was injected into the economy, growing by about 45% compared to the same period last year. The chart below shows the cumulative credit injection for the 12-month period from 2022-2024. Typically, credit only surges in the last month of the year, but this time it surged unexpectedly in June. This makes the 14% credit growth target for this year more feasible, and the pressure to race for growth in the last months of the year, as in 2023, has been significantly reduced.

Credit growth from the supply side

According to the latest statistics from the State Bank of Vietnam on the interest rate movements of credit institutions, lending rates remain low, with loans at 7.3-9.5%/year compared to 8.0-10.1%/year at the end of 2023. Against the backdrop of the manufacturing industry’s gradual recovery, credit for businesses is still the main driver of credit growth at this time, especially as household credit faces many challenges to recover. Although interest rates have fallen to attractive levels, households are still in a tight-budget phase to manage their spending in the context of economic difficulties, so business credit is more sensitive to attractive interest rates from banks.

The credit picture also shows a significant divergence among banks. Based on the Q1/2024 financial reports, seven banks had negative credit growth, and the outstanding loans of these seven banks accounted for 20% of the total outstanding loans of the 27 listed commercial banks. Updating the credit growth data to mid-May, compared to the end of Q1, the credit growth rate has improved significantly, but the ability to inject credit remains weak in some bank groups, and growth momentum is only concentrated in certain banks. Many banks have a lower growth rate than the average, and six banks recorded negative growth compared to the end of 2023.

State-owned banks continue to maintain a cautious growth trend, with Vietcombank having the lowest growth rate as of May. Commercial banks specializing in lending to enterprises have performed better, and this group has become the main growth driver in the industry. Banks with a high proportion of real estate and construction loans, such as LPB (10.6%), Techcombank (9.94%), and HDBank (8.28%), have shown outstanding growth compared to the industry average. Meanwhile, there have not been many positive signals in retail credit. Banks oriented towards retail lending, such as VIB and Sacombank, still have very low growth rates. ACB’s credit growth is a bright spot among banks, maintaining a stable growth rate in the first five months of the year, shifting from retail lending to lending to larger enterprises with strategic orientations for each industry group.

Meanwhile, the Forecasting and Statistics Department (SBV) said that, as of the beginning of Q3/2024, enterprises’ loan demands had grown positively. The credit trend survey for Q3/2024 also showed a more optimistic sentiment from credit institutions. Accordingly, credit institutions will continue to reduce lending rates to support individuals and businesses in accessing credit and investing in production and business expansion. Based on the low lending rate level, the total outstanding loans of the system are expected to increase by an average of 3.7% in Q3/2024 and 14.1% in 2024, adjusted up by 0.47% compared to the previous forecast of 13.6%.

Credit flow from credit demand

The strong credit growth in June is similar to the surprise in economic growth. However, unlike real economic activity, it is crucial to monitor and evaluate where the actual capital flow goes, even after the credit has been disbursed. Credit is like the bloodstream of our economy; thus, the speed of circulation also depends on the economy’s absorption capacity and not just on the desire to accelerate it in a short period.

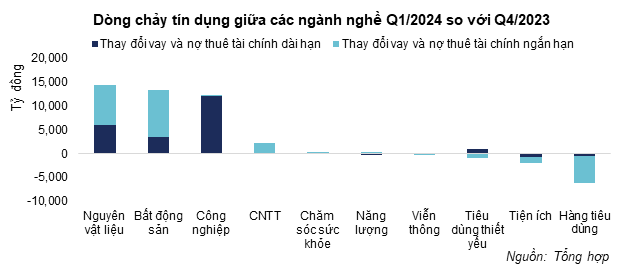

We can tentatively divide credit growth into that from individuals and that from enterprises. To maintain the credit growth target of nearly 14% in 2023, most of the growth must come from the enterprise group. Promoting enterprise credit growth will be easier for banks with preferential interest rate policies and streamlined procedures. The high growth rate in the coming months will likely come from the enterprise group. However, the difference in the first six months of 2024 compared to 2023 is that the contribution of industries such as industry, construction, and materials has been higher, unlike the previous year’s focus on real estate businesses.

According to the financial statements of listed companies, the materials sector had the highest increase in borrowings, at VND 14,500 billion, with the industry mainly balancing the use of short-term and long-term debt. Meanwhile, the real estate sector ranked second in terms of increased borrowings, with a scale of more than VND 13,300 billion. Notably, the real estate sector’s debt is mainly in short-term capital, in contrast to industrial enterprises, which have almost all additional borrowings in long-term capital. Part of the credit capital of real estate enterprises may also be used to pay off maturing bonds, so the growth of borrowings of these enterprises may be much lower than the actual disbursed amount.

In the credit trend survey last month, “Wholesale and retail,” “Export and import,” “Steel and other metals,” and “Processing and manufacturing industry” were the four economic sectors that many credit institutions chose as the main drivers of credit growth in 2024 and are expected to continue in 2025. For corporate customers (especially in production and business lending), the overall lending conditions and terms will be relaxed. This also reflects the banks’ more open mindset in extending loans to production industries such as manufacturing, as many macroeconomic factors indicate favorable prospects, from private investment to FDI inflows. Meanwhile, the credit risk of investment and business lending in the real estate sector is potentially higher, which also explains the trend of most loans in this sector being short-term.

In addition, the credit growth data for consumer lending for people’s livelihoods surprisingly recorded a sharp increase of 10% at the end of May compared to the end of last year. Against the backdrop of weak demand from weak consumption, the rapid credit growth in this area is also a matter of concern. According to the Forecasting and Statistics Department, in the remaining months of 2024, the demand for consumer loans (mainly for home purchases) from the people will improve. Statistics show that the debt for land use rights in Q1/2024 also increased significantly compared to the previous quarter and the same period, by 13.6% and 16.4%, respectively. In fact, we have also noticed that the frequency of people receiving calls from consumer credit packages with very favorable conditions has increased significantly, and credit may also partly increase from this channel. Another worrying point that we also need to pay attention to is that to meet the 6% credit growth rate, commercial banks have likely used the trick of credit growth through the pledge of savings books. In this case, savings deposits are pledged for loans, and then the money is deposited back into the bank in the next round. With the Q2 reports of the banks to be announced soon, the reassessment of the value of the collateralized savings books by the banks will be able to confirm the appropriateness of the above assumption.

Strong economic growth and credit recovery are positive signs. However, behind the rapid growth numbers, there are always limitations to be aware of. Credit growth not based on real economic activity needs to be closely monitored by the SBV to ensure the system’s stability in the long term.

Le Hoai An, CFA – Nguyen Thi Ngoc An, HUB