SHB Bank has increased its deposit interest rates for July 2024, offering customers attractive returns on their savings. The bank’s latest survey reveals an increase of 0.2% p.a. for terms of one month and above compared to the previous month.

Illustration

SHB Bank’s Counter Deposit Interest Rates for July 2024

The bank offers a tiered savings plan with two deposit tiers: below VND 2 billion and VND 2 billion and above. For the below VND 2 billion tier, interest rates range from 0.5% to 5.8% p.a., with specific rates depending on the term. The shortest term of less than one month earns 0.5% p.a., while longer terms offer higher rates, with the highest rate of 5.8% p.a. for terms of 36 months and above.

For deposits of VND 2 billion and above, SHB Bank offers slightly higher interest rates, ranging from 0.5% to 5.9% p.a. The shortest term of less than one month earns 0.5% p.a., while the highest rate of 5.9% p.a. is offered for terms of 36 months and above.

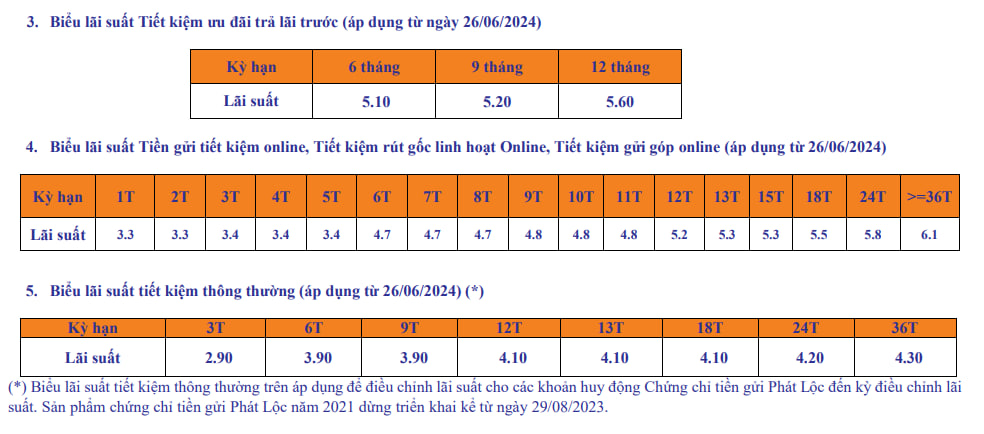

Customers can choose from various interest payment options, including end-of-term, upfront, monthly, quarterly, semi-annual, and annual payments.

SHB Bank’s Online Deposit Interest Rates for July 2024

For online deposits, SHB Bank offers competitive interest rates ranging from 3.3% to 6.1% p.a., with an increase of 0.2% p.a. across all terms compared to the previous month. The one-to-two-month term now earns 3.3% p.a., while the highest rate of 6.1% p.a. is offered for terms of 36 months and above.

SHB’s Latest Savings Interest Rates (Source: SHB)