Hai Phat Joint Stock Company (Hai Phat Invest, code: HPX) has released its consolidated financial report for Q2 2024, revealing a 55% decline in net revenue compared to the previous year, totaling VND 331 billion. Despite this, the company managed to maintain a gross profit of VND 95 billion, reflecting a 42% decrease from the same period last year.

A notable surge in financial revenue was observed during this quarter, climbing from nearly VND 2 billion to almost VND 13 billion. On the expense side, both financial costs and enterprise management expenses witnessed a reduction of approximately 23%, settling at VND 28 billion and VND 13.5 billion, respectively. Conversely, sales expenses witnessed a significant increase, surging by 90% to reach VND 28 billion.

Consequently, Hai Phat recorded a net profit of VND 31.4 billion for Q2 2024, indicating a 62% drop from Q2 2023. Out of this, the profit attributable to the parent company stood at VND 29 billion.

HPX attributed this decline in profit to a lower volume of products delivered to customers for revenue recognition in Q2 2024 compared to the previous year, coupled with certain fixed costs that remained unchanged.

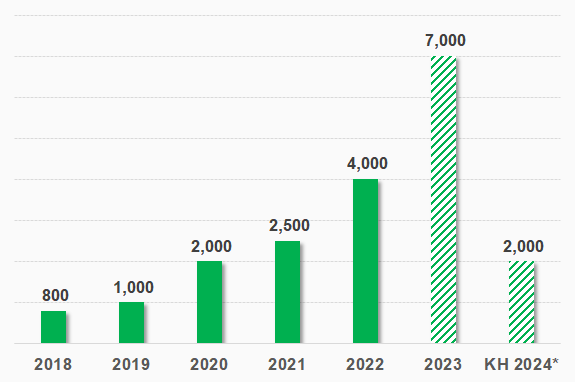

For the first six months of 2024, Hai Phat’s net revenue exceeded VND 655 billion, a 27% decrease from the same period last year, while its net profit reached VND 47 billion, reflecting a 17% drop. Thus, the company has accomplished 48% of its full-year 2024 net profit target of VND 105 billion.

As of June 30, 2024, Hai Phat’s total assets amounted to VND 8,460.5 billion, representing a nearly 2% increase from the start of the year. Short-term receivables constituted the largest portion of total assets, totaling VND 3,636 billion, a 9% rise from the beginning of the year. Meanwhile, inventory levels decreased by 7.5%, settling at VND 2,756 billion, which included VND 2,176 billion in costs of unfinished production and business operations.

Cash and cash equivalents witnessed a significant drop, falling by 46% to just over VND 13 billion, accompanied by VND 6 billion in term deposits.

On the liabilities side, Hai Phat’s total debt increased by more than VND 128 billion, reaching VND 4,837.7 billion. Notably, short-term prepayments from buyers surged by 92% to VND 1,101 billion.

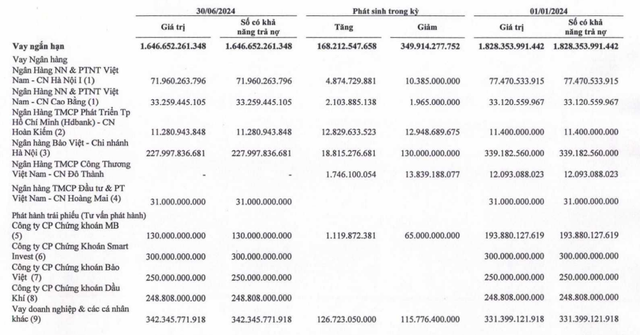

Short-term financial borrowings decreased by 10%, totaling VND 1,646.6 billion. This included VND 300 billion in bonds held by Smart Invest Securities, maturing on December 31, 2024, and VND 249 billion in bonds held by PetroVietnam Securities, maturing on October 28, 2024.

Source: HPX

Long-term borrowings witnessed a slight increase to over VND 648 billion, including nearly VND 500 billion in bonds held by Smart Invest Securities, and an additional VND 13.5 billion loan from SHB Nam Dinh Branch.

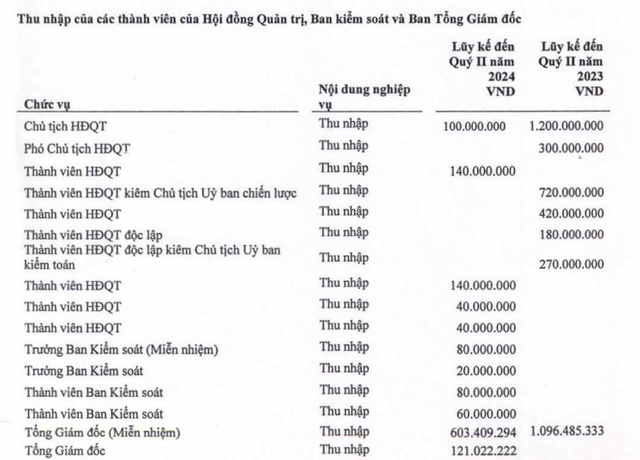

The financial report also disclosed the income of Hai Phat’s leadership team. In the first half of 2024, the company disbursed over VND 2.5 billion in remuneration to 24 members of the Board of Directors, Supervisory Board, and Executive Committee.

Source: HPX

Notably, Chairman Do Quy Hai earned VND 100 million in the first six months of 2024, equivalent to VND 16.6 million per month. This income represents a significant decrease from his total income of VND 1.2 billion during the same period last year.