According to the General Statistics Office, in the first half of 2024, asset accumulation grew by 6.72%, outpacing the GDP growth rate of 6.42%. This marks a shift from the lower growth rates seen in 2023 (asset accumulation: 4.09%, GDP: 5.15%) and 2022 (asset accumulation: 5.40%, GDP: 8.12%).

SHIFTING DYNAMICS

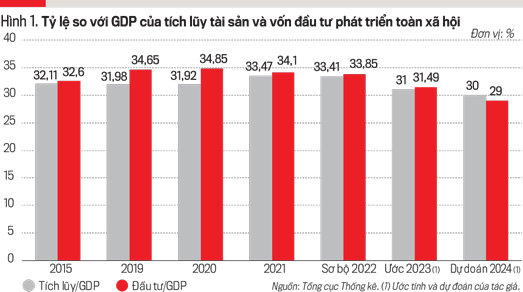

Asset accumulation is the foundation for societal development investment. However, in recent years, the ratio of societal development investment to GDP has typically been higher than that of asset accumulation (Figure 1).

As investment has outpaced accumulation, public debt, government debt, and national debt have increased. Meanwhile, state budget revenues and expenditures have often resulted in deficits, negatively impacting the country’s financial safety. In the first half of 2024, asset accumulation outpaced GDP growth, while societal development investment growth, in real terms, reached only 6.8%. Excluding price factors, this figure falls to less than 3%, significantly lower than the GDP growth rate.

The ratio of societal development investment to GDP in the first half of 2024 stood at 27.67%, notably lower than in previous years. This ratio is expected to remain lower than the asset accumulation to GDP ratio for the full year. This shift carries both positive and negative implications. On the positive side, it reduces the burden of public debt, government debt, and national debt. However, the negative consequence is a decrease in development investment, which is the direct material factor determining GDP growth.

MITIGATING NEGATIVE IMPACTS

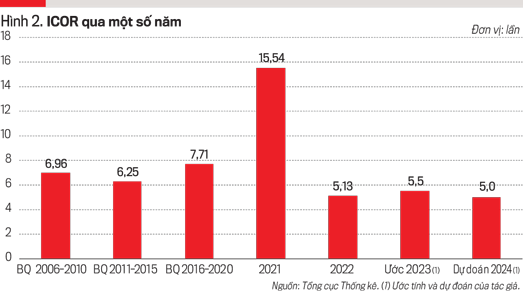

To address the negative impact, it is essential to enhance investment efficiency by lowering the ICOR coefficient (a measure of the additional investment required to generate one additional unit of GDP, both calculated in comparable prices). Although the statistics sector has not yet calculated the ICOR coefficient for the first half of the year, the “investment growth rate” (calculated by dividing the societal development investment to GDP ratio by the GDP growth rate) is relatively low (27.67 : 6.42 = 4.3). This indicates a positive sign for higher investment efficiency in 2024 compared to previous years (Figure 2).

Along with improving investment efficiency, it is crucial to achieve a surplus in state budget revenues and expenditures. In the first half of 2024, Vietnam strived to attain a budget surplus (total revenue: VND 1,020.6 trillion, expenditure: VND 803.6 trillion, resulting in a temporary surplus of VND 217 trillion, while the full-year estimate projected a deficit of VND 419 trillion). It is unlikely that a high surplus will be maintained for the full year, and a deficit may even occur due to salary increases from July 1, 2024.

An important solution is to increase the pre-tax profit margin for businesses, as the average profit margin in Vietnam is lower than bank interest rates. Many businesses have profit margins lower than bank deposit rates, and some even operate at a loss or fail to meet bank lending requirements.

This article was published in the Vietnam Economic Review, Issue 31-2024, released on July 29, 2024. To read the full article, please visit: https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam