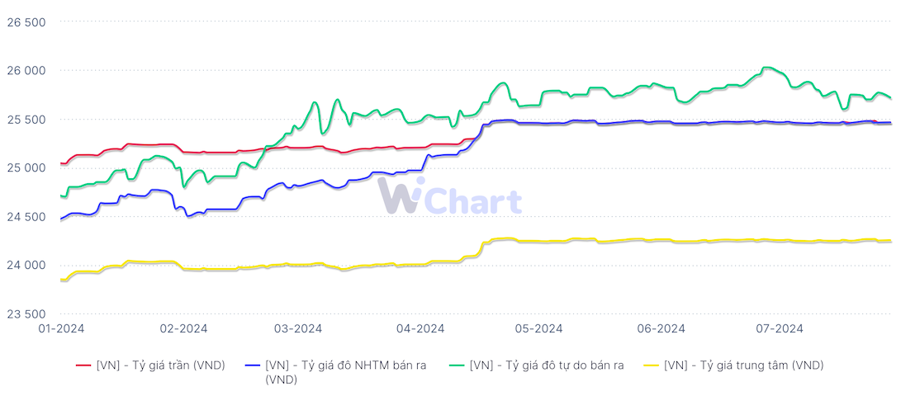

The State Bank of Vietnam adjusted the exchange rate center strongly in the first session of the week from July 22-26, then decreased it in the last session of the week. By July 26, the exchange rate center was listed at 24,249 VND/USD, only 3 units higher than the previous week’s session (July 19)

Exchange rates await Fed news

USD/VND exchange rates fluctuated within a narrow range on Friday of the previous week and closed near the 25,300 mark. Last week, the exchange rate slightly decreased by about 10 units, although there was a time when it increased to nearly 25,400 on Wednesday, but quickly cooled down again as the selling pressure of USD in the interbank market often increased strongly when the exchange rate exceeded 25,350, while the demand for foreign currency payment also decreased again at the end of the week. Exchange rate is still under quite large pressure to weaken this week as the Fed considers loosening monetary policy again.

Interbank exchange rates in the week of July 22-26 slightly increased at the beginning of the week and then decreased, fluctuating within a narrow range. At the end of the July 26 session, the interbank exchange rate closed at 25,310 VND/USD, a slight decrease of 8 units compared to the previous week’s session.

Exchange rates in the free market fluctuated slightly in the sessions last week. By the end of the July 26 session, the free exchange rate increased by 20 units in both buying and selling prices compared to the previous week’s session, trading at 25,690 VND/USD and 25,770 VND/USD, respectively.

At 9:00 am on July 29 (Vietnam time), the US Dollar Index, which measures the strength of the US dollar, recorded a decrease of 0.22 percentage points compared to July 28. Currently, the USD Index fluctuates around the 103.9 mark. The US dollar weakened ahead of information consolidating the possibility of the Fed considering loosening monetary policy from September 2024.

On the morning of July 29, the State Bank of Vietnam announced the exchange rate center at 24,252 VND/USD, a slight increase of 3 units compared to the previous week (July 26). According to the current regulation on the +/- 5% margin, the ceiling exchange rate is 25,464 VND/USD, and the floor exchange rate is 23,039 VND/USD.

On July 29, Vietcombank, BIDV, Agribank, and Viettinbank listed the exchange rate at 25,094 – 25,464 VND/USD (buying – selling), close to the ceiling rate.

In the free market, the USD price decreased by 70 units in the buying price and 50 units in the selling price compared to the previous week, trading at 25,260 – 25,720 VND/USD.

The US Personal Consumption Expenditure (PCE) Price Index for June increased by 0.1% as expected, after remaining unchanged in May, indicating that inflation continues to be well controlled. This confirms the possibility that the Fed may start cutting interest rates in September. Compared to the same period last year, the PCE price index increased by 2.5% after increasing by 2.6% in May. The Federal Reserve aims to bring inflation down to 2%, and PCE is the policy-making body’s preferred measure.

The CME FedWatch tool shows a more than 90% chance that the Fed will keep interest rates at their current high level after its July policy meeting this week, while also signaling a specific start to cutting in September. Fed Chairman J.Powell stated that in addition to inflation, Fed policymakers are increasingly focusing on the health of the US labor market, as the agency’s dual goal is to protect people’s purchasing power while promoting sustainable job growth. The unemployment rate, although slightly increased in June, remains low at 4.1%. The US non-farm payrolls report for July will be released this Friday, along with data on consumer confidence and PMI manufacturing activity, which will provide further insight into the health of the US economy after the benchmark interest rate has been consistently maintained at a high level of 5.25% – 5.5% in the past year.

INTERBANK INTEREST RATES RISE TO 5%

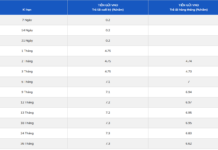

In the week of July 22-26, VND interbank interest rates tended to increase for all terms of 1 month and below. By the end of July 26, VND interbank interest rates fluctuated around the following levels: overnight 4.93% (+0.39 pp); 1-week 5% (+0.36 pp); 2-week 5% (+0.22 pp); 1-month 5.02% (+0.06 pp).

USD interbank interest rates remained stable last week. On July 26, USD interbank interest rates closed at the following levels: overnight 5.3% (unchanged); 1-week 5.34% (-0.01 pp); 2-week 5.39% (-0.01 pp); 1-month 5.43% (unchanged)

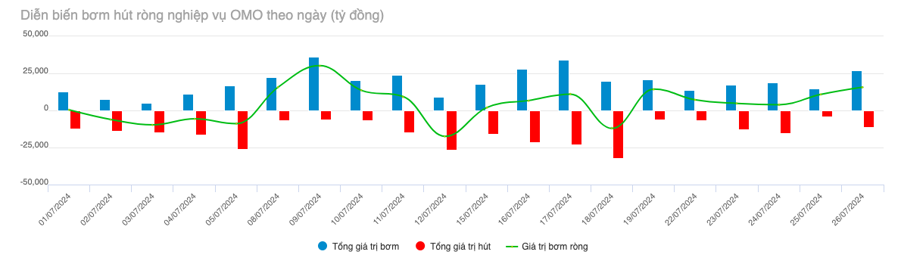

In the open market operations channel last week from July 22-26, the State Bank offered a 7-day term with a volume of 61,000 billion VND and an interest rate of 4.5%. There were 59,044.97 billion VND in successful bids, and 34,304.39 billion VND in maturities for the week.

The State Bank offered a 14-day term treasury bill, auctioning interest rates in all sessions. By the end of the week, there were a total of 16,200 billion VND in successful bids, with the winning interest rate remaining at 4.50%; 33,650 billion VND matured during the week.

Thus, the State Bank net injected 42,190.58 billion VND into the market last week through the open market operations channel. The volume of bills in circulation in the collateral channel was 59,044.97 billion, and the volume of treasury bills in circulation was 64,300 billion VND.

From July 8 to July 26, the State Bank has net injected capital for 3 consecutive weeks, with a total value of more than 109,665 billion VND.

On July 24, the State Treasury successfully called for 4,850 billion VND out of the 12,000 billion VND of government bonds offered, with a bid-winning rate of 40%. Specifically, the 5-year term successfully mobilized the entire 500 billion VND offered, the 10-year term mobilized 2,300 billion VND out of the 7,000 billion VND offered, the 15-year term mobilized 1,000 billion VND out of the 3,000 billion VND offered, and the 20-year term mobilized 1,050 billion VND out of the 1,500 billion VND offered.

The winning interest rate for the 5-year term was 1.9% (+0.05 pp), 10 years was 2.76% (unchanged), 15 years was 2.96% (+0.01 pp), and 20 years was 2.98% (unchanged)

The trading value of Outright and Repos in the secondary market last week averaged 17,299 billion VND/session, a sharp increase compared to the previous week’s level of 10,411 billion VND/session. Government bond yields last week fluctuated slightly for all terms except the 30-year term. By the end of the July 26 session, the government bond yield fluctuated around the following levels: 1 year 1.88% (+0.01 pp compared to the previous week’s session); 2 years 1.89% (+0.01 pp); 3 years 1.91% (+0.01 pp); 5 years 1.98% (+0.01 pp); 7 years 2.30% (+0.01 pp); 10 years 2.80% (+0.01 pp); 15 years 2.96% (+0.004 pp); 30 years 3.19% (unchanged)

This week, on July 31, the State Treasury plans to offer 11,500 billion VND of government bonds.

4 Factors Putting Pressure on USD/VND Exchange Rate in Q1/2024

With the currency exchange rate fluctuating in the first few weeks of 2024, Mr. Ngo Dang Khoa, Director of Foreign Exchange, Capital Markets and Securities Services at HSBC Vietnam, highlights four factors putting pressure on the USD/VND exchange rate in Q1/2024…