The VN-Index ended a tumultuous week on a positive note, climbing 8.92 points to the 1,242-point region after a disastrous start to the week. While liquidity has yet to show significant improvement, investor sentiment has turned more positive, resulting in a broader market advance with 284 gainers outnumbering 129 decliners.

Most sectors finished in the green, except for retail. Information Technology led the gains, surging 2.56% with FPT up 2.4%, CMG rising 5.82%, and CTR adding 3.1%. Banks rose 0.32%, Oil & Gas climbed 1.55%, and Fisheries and Securities both increased by over 0.5%. Real Estate also contributed to the rally with a 0.35% gain.

Top performers that boosted the market included MSN, adding 1.10 points; FPT with a 1.06-point gain; CTG and MBB, each contributing 1.1 points; and HVN and POW. On the flip side, the retail sector declined by 0.40% as FRT dropped 1.69% and MWG traded sideways. LPB, VRE, and NVL were the top drags on the market, each shaving off 1 point.

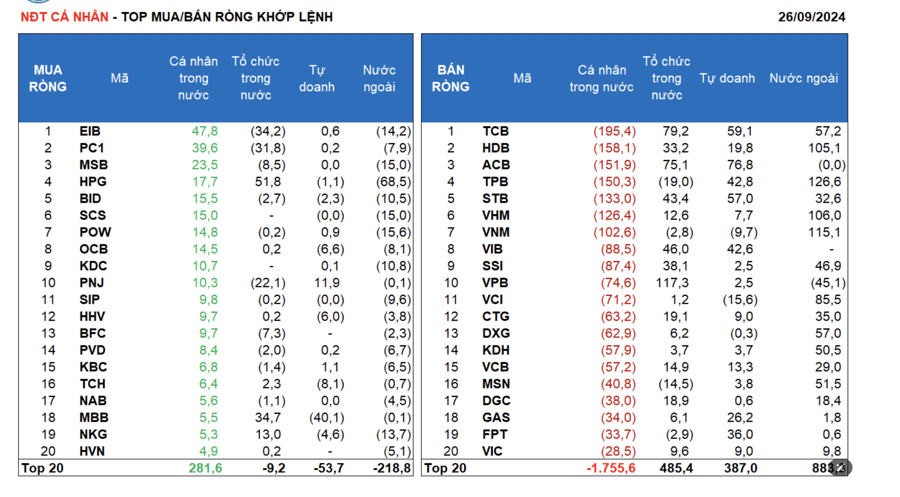

Total trading volume on the three exchanges remained modest despite a slight increase from the previous day, reaching VND 13,300 billion. Foreign investors net bought VND 375.3 billion, while they net sold VND 280.7 billion in the matched orders.

Foreign investors’ main net buys in the matched orders were in the Food & Beverage and Information Technology sectors. Top net bought stocks by foreign investors included MSN, FPT, BCM, LPB, VNM, VCB, GMD, CTG, CTR, and PLX.

On the sell side, their main net sells in the matched orders were in the Financial Services sector. Top net sold stocks included DGC, MWG, SSI, HPG, VHM, VPB, VIX, HAH, and VIC.

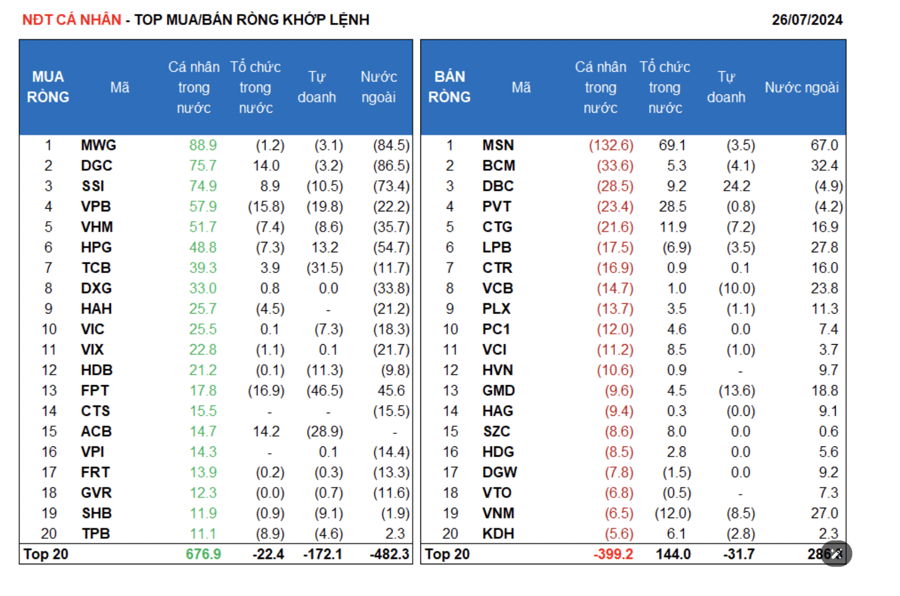

Individual investors net sold VND 51.2 billion, with a net buy of VND 388.9 billion in the matched orders. In the matched orders, they net bought 11 out of 18 sectors, mainly in Banks. Their top net bought stocks included MWG, DGC, SSI, VPB, VHM, HPG, TCB, DXG, HAH, and VIC.

In terms of net sells in the matched orders, they net sold 7 out of 18 sectors, primarily in Food & Beverage and Oil & Gas. Top net sold stocks included MSN, BCM, DBC, PVT, CTG, LPB, VCB, PLX, and PC1.

Proprietary trading arms of securities firms net sold VND 277.7 billion, with a net sell of VND 274.6 billion in the matched orders. In the matched orders, they net bought 3 out of 18 sectors. Their top net bought sectors were Food & Beverage and Basic Resources. Top net bought stocks included DBC, HPG, SAB, FUEVFVND, POW, SCS, PHR, BMI, GAS, and BVH.

On the sell side, Banks were the top net sold sector. Top net sold stocks included FPT, TCB, ACB, STB, VPB, PNJ, GMD, HDB, MBB, and SSI.

Domestic institutional investors net sold VND 59.8 billion, with a net buy of VND 166.4 billion in the matched orders.

In the matched orders, domestic institutions net sold 5 out of 18 sectors, with the highest value in Construction and Materials. Their top net sold stocks were SAB, FPT, VPB, VNM, VGC, TPB, GAS, VHM, HPG, and NAB. Their top net bought sector was Food & Beverage. Top net bought stocks included MSN, PVT, STB, ACB, DGC, CTG, REE, VHC, DBC, and SSI.

Block deals today totaled VND 1,928.5 billion, down 11.5% from the previous session and accounting for 14.5% of the total trading value.

Notably, there was a block deal in KDC, with over 8.6 million shares (worth VND 500 billion) sold by an individual investor to a foreign institution.

Additionally, there was a block deal involving domestic institutions selling to an individual investor in FPT, with over 1.5 million shares (valued at VND 180.3 billion) changing hands. Individual investors continued to be active in the Banking sector (VCB, BID, HDB, MSB, EIB), as well as MWG and KOS.

The money flow showed a decrease in allocation to Banks, Real Estate, Securities, Steel, Retail, Warehousing & Logistics, and an increase in allocation to Food & Beverage, Chemicals, Software, Construction, Agro-Forestry-Fisheries, Power Production & Distribution, and Oil & Gas, and Mobile Telecommunications.

In the matched orders, the money flow showed an increase in allocation to mid-cap stocks (VNMID) and a decrease in large-cap (VN30) and small-cap (VNSML) stocks.