Illustration

Orient Commercial Joint Stock Bank (OCB) has just announced information about its shareholders owning 01% or more of its charter capital, based on information provided by the shareholders.

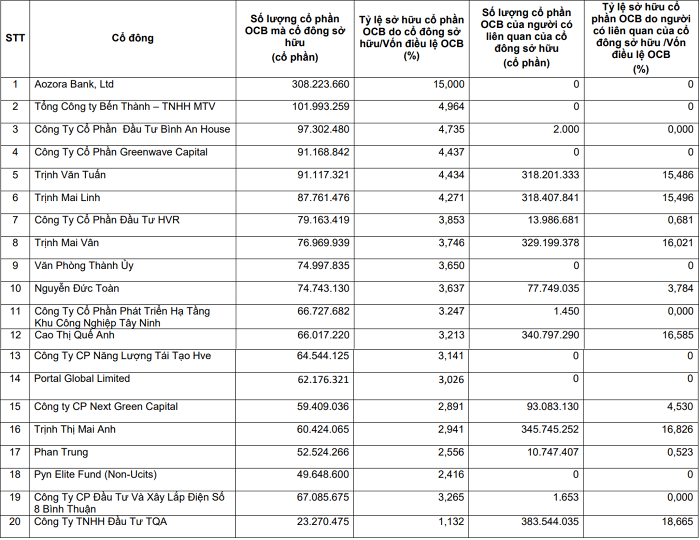

Specifically, the list published by OCB includes 20 shareholders owning 1% or more of its charter capital. Of these, there are 13 institutional shareholders holding a total of 1.46 billion OCB shares, representing 55.7% of the bank’s capital, and 7 individual shareholders owning 24.8%.

In total, these 20 shareholders hold 1.66 billion OCB shares, equivalent to 80.6% of the bank’s charter capital.

(Source: OCB)

According to the list released by OCB, its strategic shareholder, Aozora Bank, is currently the institution holding the most OCB shares, with 308.2 million shares, equivalent to 15% of the charter capital.

Ben Thanh Corporation owns 102 million OCB shares, or 4.96% of the charter capital.

Binh An House Joint Stock Company holds 97.3 million shares, equivalent to 4.74% of the bank’s capital.

Greenwave Capital Joint Stock Company owns 91.2 million shares, or 4.44% of OCB.

The list of shareholders holding more than 1% of OCB shares also includes: Office of the City Party Committee (owning 75 million shares or 3.65% of capital); Tay Ninh Industrial Park Infrastructure Development Joint Stock Company (owning 66.7 million shares, or 3.25% of capital); Hve Renewable Energy Joint Stock Company (owning 64.5 million shares or 3.14% of capital); Portal Global Limited (owning 62.2 million shares or 3.03% of capital); HVR Investment Joint Stock Company (holding 79.2 million shares or 3.85% of capital); Next Green Capital Joint Stock Company (holding 59.4 million shares, or 2.89% of capital); and Pyn Elite Fund (Non-Ucits) (owning 49.7 million shares, or 2.42% of charter capital).

Among the individual shareholders, Chairman Trinh Van Tuan currently holds 91.1 million OCB shares, or 4.43% of the charter capital. Meanwhile, related parties of Mr. Tuan own a total of 15.486% of OCB’s capital, or 318.2 million shares. In total, Mr. Tuan and related parties own 19.916% of the bank’s charter capital.

Mr. Tuan’s related parties include: Ms. Trinh Mai Linh (Mr. Tuan’s daughter, holding 87.8 million shares, or 4.27% of capital), Ms. Trinh Mai Van (Mr. Tuan’s daughter, holding 77 million shares, or 3.75% of capital), Ms. Cao Thi Que Anh (Mr. Tuan’s wife, holding 66 million shares, or 3.21% of capital), Ms. Trinh Thi Mai Anh (Vice Chairwoman and Mr. Tuan’s daughter, holding 60.4 million shares or 2.94% of capital), and TQA Investment Co., Ltd. (holding 23.3 million shares, or 1.13% of capital).

Along with Mr. Tuan, Mr. Phan Trung, a member of OCB’s Board of Directors, currently owns 52.5 million OCB shares, equivalent to 2.56% of capital. Related parties of Mr. Trung own about 10 million OCB shares.

In addition to the shareholders who are senior executives and related parties, OCB also has another “mysterious” shareholder with very little information about his identity, Mr. Nguyen Duc Toan, who owns more than 74.7 million shares, equivalent to 3.637% of the charter capital. Related parties to Mr. Toan also own more than 77.7 million OCB shares, or 3.784% of the charter capital. In total, this group of shareholders holds 152.4 million OCB shares, equivalent to 7.421% of the bank’s shares.

According to the amended Law on Credit Institutions, which took effect on July 1, shareholders owning 01% or more of a credit institution’s charter capital are required to provide the institution with their information and that of their related parties, including: Full name; Individual identification number; Nationality, passport number, date and place of issue for foreign shareholders; Business registration certificate or equivalent legal document for institutional shareholders; Date and place of issue of these documents.

In addition, shareholders owning 01% or more of the charter capital must also provide information on the number and proportion of shares owned by themselves and their related parties in the credit institution.

Shareholders owning 01% or more of the charter capital must submit written information to the credit institution for the first time and whenever there are changes to this information within seven working days from the date of occurrence or change. Regarding the proportion of ownership, shareholders owning more than 1% of the charter capital only need to disclose information when there is a change in the proportion of shares owned by themselves, or by themselves and their related parties, of 01% or more of the charter capital compared to the previous disclosure.

The amended Law on Credit Institutions also requires credit institutions to publicly disclose information about the full names of individual and institutional shareholders owning 01% or more of their charter capital, as well as the number and proportion of shares owned by such individuals and their related parties, on the credit institution’s website within seven working days from the date of receiving the information.

Also, in the amended Law on Credit Institutions, the concept of “related party” has been expanded to include grandparents, grandchildren, aunts, uncles, nieces, and nephews, i.e., five generations.

Previously, shareholders were only required to disclose information about transactions, ownership, and related parties when holding 5% or more of a bank’s capital (major shareholders).