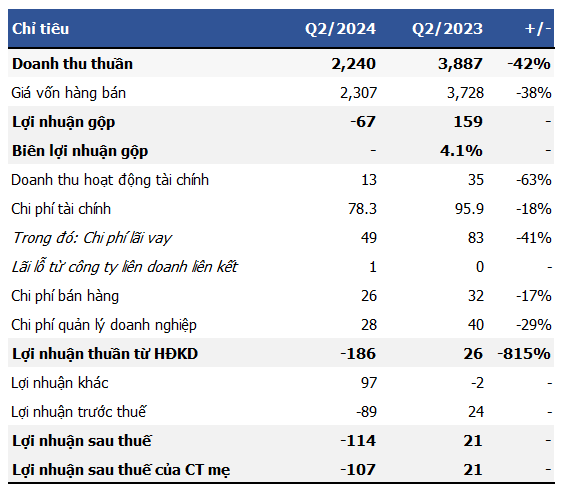

SMC’s Q2 2024 financial report revealed a 42% decrease in revenue, amounting to 2,240 billion VND. This decline reflects the company’s struggles, with 1 trillion VND trapped in non-performing loans, severely impacting their operations.

SMC’s Q2 2024 Business Results

Unit: Billion VND

Source: VietstockFinance

|

Of greater concern is the company’s gross loss of 67 billion VND, indicating that SMC’s business segments remain challenging despite the steel industry’s recovery and improved fortunes for some competitors.

During an April meeting, CEO Đặng Huy Hiệp acknowledged the difficulties faced by their business segments and the need for a shift in strategy. “SMC’s strength used to lie in construction projects, but we have now transitioned to the civil segment, which is less profitable. Our focus is on maintaining market share and customer relationships,” he said, adding that they are downsizing their steel pipe and coated steel production.

On top of the core business downturn, SMC continues to incur significant financial costs, amounting to 78 billion VND (a reduction of 18% from the previous year), with over half comprising interest expenses.

HQ Sale Yields 100 Billion VND Profit

Against this backdrop, the sale of SMC’s headquarters and asset liquidation served as a temporary solution to alleviate their financial woes, generating a profit of nearly 100 billion VND from the sale of their office at 681 Dien Bien Phu, Ward 25, Binh Thanh District.

Another positive sign is the reduced need for bad debt provisions, reflected in lower management costs. However, these measures have not been enough to pull SMC out of its spiral of losses. In Q2 2024, the company incurred a net loss of 107 billion VND, marking the sixth loss-making quarter out of the past eight.

First Half Profit Attributed to Asset Sales; Looming Provision Risk

Expanding our perspective to the first half of the year, SMC reported a net profit of 77 billion VND. However, this was primarily due to asset liquidation and the sale of financial investments rather than their core business operations.

Consequently, SMC’s business performance remains lackluster, and the company now faces the prospect of making substantial provisions. As shared by Vice Chairman Ý Nhi in the April 2024 meeting, failing to resolve the debt issue could result in a provision of nearly 300 billion VND for the full year. “This provision will impact our profits, and so SMC is working intensively with Novaland and other partners,” she stated, emphasizing the urgency of addressing this matter by the end of the year.

Another challenge SMC faces is the entrapment of nearly 1,300 billion VND in non-performing loans, leading to a shortage of capital for their commercial operations, which require substantial working capital. To address this, SMC plans to raise 730 billion VND by privately offering 73 million shares at 10,000 VND per share. The buyer of these shares remains undisclosed.

As of the end of June 2024, SMC held nearly 3,300 billion VND in short-term assets, including 775 billion VND in cash and short-term financial investments. Their accounts receivable stood at approximately 1,470 billion VND, a reduction of nearly 200 billion VND from the start of the year. Inventory levels decreased to 745 billion VND from 840 billion VND at the beginning of the year.

On the liabilities side, short-term debt exceeded 4,300 billion VND, including 2,250 billion VND in short-term loans and financial leases.