Services

APH reports 5.4x higher profit for the first half of the year compared to the same period last year

An Phat Holdings Joint Stock Company (HOSE: APH) has just announced its business results for the first half of 2024. Accordingly, APH recorded consolidated revenue of VND 6,640 billion, a slight decrease compared to the same period last year. Of this, manufacturing revenue accounted for 49%, an increase of 4%, mainly due to increased sales volume and the consolidation of the biodegradable plastic pellet production segment. Revenue from the industrial real estate and services segment accounted for 2%, an increase of 30% over the same period last year.

According to APH leaders, financial revenue increased by 22% over the same period last year, as exporting companies benefited from favorable exchange rates, while interest expenses decreased by 33% due to lower debt.

The report shows that APH recorded a gross profit of VND 878 billion, up 38% over the same period. The gross profit margin reached 13.2%, a significant increase from 8.6% in the first half of 2023.

Notably, at the end of the first six months of the year, the Group recorded a net profit after tax (NPAT) of VND 242 billion, 5.4 times higher than the same period in 2023.

Thus, as of Q2/2024, APH has completed 47% of its revenue plan and 77% of its profit plan.

Subsidiaries reported significant increases in net profit

In addition to the parent company, the subsidiaries of APH also reported positive business results in the first half of 2024.

Accordingly, An Phat Green Plastic Joint Stock Company (HOSE: AAA) recorded consolidated revenue of VND 5,746 billion and gross profit of VND 690 billion (up 43% over the same period).

An Phat Green Plastic reports a profit of VND 253 billion, 2.2 times higher than the same period last year

|

Due to the absence of high-priced inventory and the effectiveness of inventory optimization, sales, and debt management policies, the gross profit margin reached 12%, a significant increase from 7.5% in the previous year.

Notably, AAA recorded a net profit from business activities of VND 310 billion and a net profit after tax of VND 253 billion, 2.2 times higher than the same period last year.

According to AAA representatives, in the first six months of the year, the company has boosted production, effectively managed its commercial operations, and maintained stable sales volume. As a result, the company has achieved 48% of its revenue plan and 67% of its profit plan.

Another APH member, Hanoi Plastic Joint Stock Company (HOSE: NHH), also reported significant profits in the first half of 2024. Accordingly, NHH recorded a net profit from business activities of VND 91 billion, an increase of 75% over the same period last year. Net profit after tax reached VND 75 billion, up 85% over the same period.

According to the report, NHH‘s revenue in the first half of 2024 was VND 949 billion, a slight decrease from the previous year, mainly due to the optimization of the customer base and higher-profit products in the plastic components segment, and lower revenue in the mold segment.

As of June 30, 2024, Hanoi Plastic’s total consolidated assets reached VND 2,228 billion, an increase of 7% from the beginning of the year.

Thus, at the end of Q2, NHH has completed 43% of its revenue plan and 55% of its profit plan.

Hanoi Plastic completes 43% of revenue plan and 55% of profit plan

|

Similarly, the business results of An Tien Industries Joint Stock Company (HOSE: HII) for the first half of 2024 showed that consolidated revenue reached VND 3,331 billion, a decrease of 21% over the same period last year. The main reason was lower commercial output and the processing of high-priced plastic pellet inventory from 2022 in the first half of 2023.

HII recorded a gross profit of VND 258 billion, an increase of 23% over the same period last year. The gross profit margin reached 7.7%, a significant improvement from 5% in the first half of 2023.

The company recorded a net profit after tax of VND 27 billion, a decrease of 43% over the same period last year, mainly due to a VND 12 billion increase in financial expenses for the divestment of a loss-making associated company. Excluding this loss, HII recorded a net profit from business activities of VND 65 billion, a significant increase of 39% over the same period last year.

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.

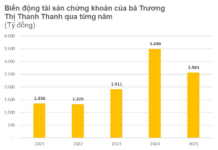

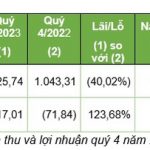

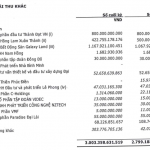

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.