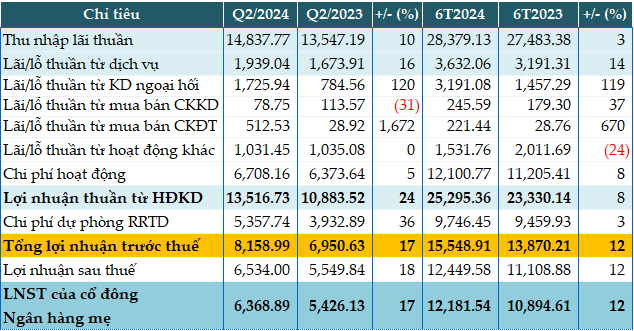

In Q2, most of BIDV‘s business activities witnessed growth compared to the same period last year. The main revenue stream increased by 10%, earning nearly VND 14,838 billion in net interest income.

Non-credit income sources saw significant increases, including service interest (+16%), foreign exchange trading interest (2.2 times), and investment securities trading interest (17.6 times).

As a result, the bank’s profit from business operations increased by 24% to VND 13,517 billion. Despite a 36% increase in provisions for credit risks, amounting to VND 5,358 billion, BIDV still recorded a pre-tax profit of nearly VND 8,159 billion, a 17% increase year-on-year.

For the first six months of the year, BIDV reported a pre-tax profit of nearly VND 15,549 billion, a 12% increase.

|

Q2/2024 Business Results of BID. Unit: VND billion

Source: VietstockFinance

|

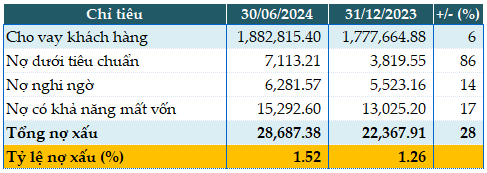

BIDV‘s total assets as of the end of Q2 expanded by 10% from the beginning of the year to over VND 2.52 quadrillion. Customer lending and deposits both increased by 6%, reaching VND 1.88 quadrillion and VND 1.8 quadrillion, respectively.

The bank’s total non-performing loans as of June 30, 2024, stood at VND 28,687 billion, a 28% increase from the beginning of the year. The non-performing loan ratio also increased from 1.26% to 1.52% during this period.

|

Loan Quality of BID as of June 30, 2024. Unit: VND billion

Source: VietstockFinance

|

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)