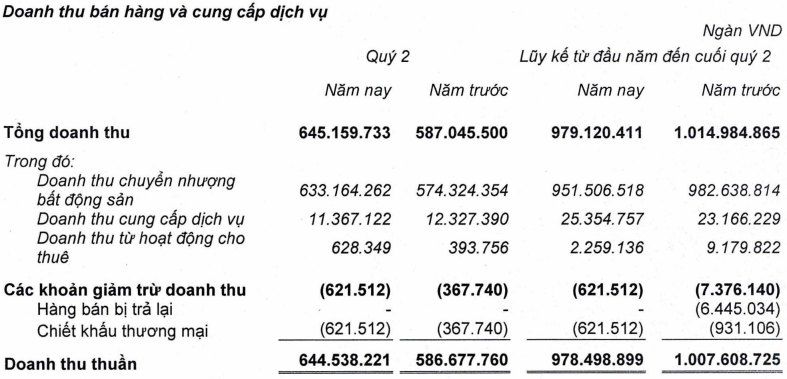

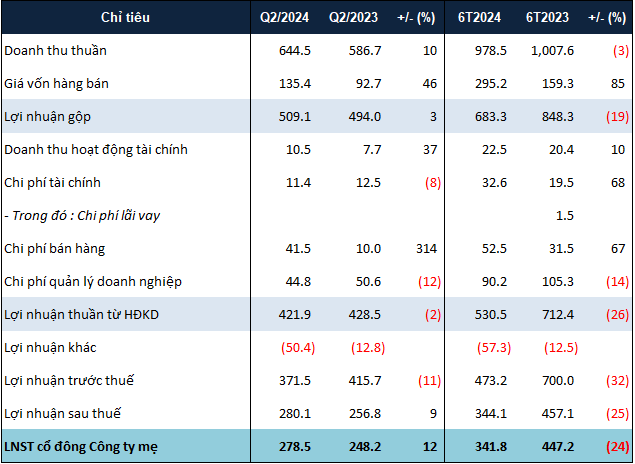

In Q2, KDH recorded nearly VND 645 billion in net revenue, up 10% year-on-year. This includes over VND 633 billion from real estate transfers, also up more than 10%. However, this result was soon offset by a 46% increase in cost of goods sold, leading to only a 3% rise in gross profit, which totaled over VND 509 billion.

|

Breakdown of KDH‘s revenue structure in Q2 2024

Source: KDH

|

Financial revenue saw a positive increase of 37%, reaching nearly VND 11 billion, all of which came from interest income. On another note, the company’s selling expenses surged to nearly VND 42 billion, more than four times the amount from the previous year.

A bright spot for the company was the reduction in other expenses, including an 8% decrease in financial expenses and a 12% drop in management expenses. Notably, the income tax expense for the period was approximately VND 100 million, compared to nearly VND 636 billion in the same period last year.

Thanks to the lower income tax expense, KDH reported a net profit of nearly VND 279 billion, an increase of 12%.

However, for the first six months of the year, the company’s net profit was nearly VND 342 billion, down 24%. Nonetheless, compared to the full-year net profit plan of VND 790 billion for 2024, KDH has achieved nearly 44% in just six months.

|

Business results of KDH in Q2 2024

Source: VietstockFinance

|

On the balance sheet, KDH‘s total assets as of June 30, 2024, were over VND 28.4 trillion, up 7% from the beginning of the year. Short-term receivables and inventory increased by 11% and 14%, respectively, reaching over VND 2 trillion and nearly VND 21.5 trillion. In contrast, the company’s cash holdings decreased by 31%, to nearly VND 2.6 trillion.

According to the explanatory note on inventory, the value of construction in progress at the Binh Trung Dong ward project with a scale of 5.8ha (Binh Trung Dong 1) of KDH increased by over VND 1 trillion from the beginning of the year and stood at nearly VND 4.2 trillion as of the end of June. The value of the Binh Hung 11A residential area project also increased by over VND 900 billion, to over VND 1.5 trillion.

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.