|

Source: VietstockFinance

|

By the end of the trading session, the market breadth became more balanced, although sellers still had the upper hand. Today, the market recorded 350 gainers and 400 losers. The real estate, construction, manufacturing, and transportation sectors regained some ground and closed in the green.

In the real estate sector, VIC led the gains, although the upward momentum eased compared to intraday levels. BCM also posted an increase of more than 3%. Several stocks witnessed notable gains, including AGG, BCE, CEO, HPX, and LHG…

However, the number of declining stocks still outnumbered the advancers in this sector, with 38 out of 82 stocks closing in the red (21 stocks were unchanged). LDG and QCG continued their downward spiral, hitting the daily limit-down.

In the transportation and warehousing sector, stocks like HAH, ACV, VTO, and SCS recorded decent gains. Conversely, HVN plummeted and hit its daily limit-down.

The manufacturing sector, encompassing plastics and chemicals, and machinery equipment production, rebounded during the afternoon session.

Market liquidity remained subdued, with a total trading value of just 13 trillion VND. Foreign investors offloaded Vietnamese shares, resulting in a net sell value of over 522 billion VND. The stocks that witnessed the most substantial net selling by foreign investors included SSI, TLG, VHM, HPG, and MWG. On the other hand, SBT was the most actively bought stock by this group.

| Top stocks with the most significant foreign net buying and selling for the trading session on July 25, 2024 |

Morning Session: Weak trading volume dragged the VN-Index deeper into negative territory

At the morning session’s close, the VN-Index stood at 1,227.86, representing a decline of 10.6 points. Meanwhile, the HNX-Index lost nearly two points to close at 234.28.

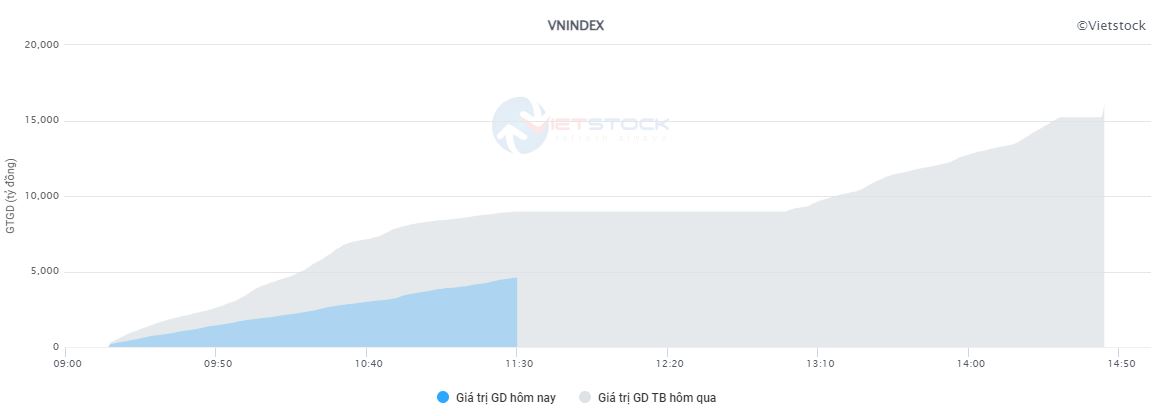

The lackluster trading volume during the morning session hindered any potential market recovery. The total trading value across all exchanges barely surpassed 5.6 trillion VND. Sellers dominated the market, with 440 declining stocks versus 230 advancing stocks.

Trading volume on the HOSE during the morning session of July 25, 2024. Source: VietstockFinance

|

Rubber product manufacturers, including BRC, CSM, DRC, and SRC, witnessed steep declines, with SRC hitting the daily limit-down.

Securities companies had a dismal performance, with 23 out of 27 stocks in this sector trading lower, posting average losses of 2-3%. PSI was the lone gainer, swimming against the market tide.

Large-cap stocks faced intensified selling pressure compared to the early trading hours. CTG, BID, TCB, MWG, MBB, HPG, FPT, SSI, LPB, and ACB collectively pushed the VN-Index down by approximately five points. On the flip side, VIC, with its impressive 2.5% gain, emerged as the primary pillar of support for the index, albeit seemingly fighting a losing battle.

LDG plunged to its daily limit-down in the morning session, with sell orders far exceeding buy orders. The People’s Court of Dong Nai province has recently decided to initiate bankruptcy proceedings against LDG Joint Stock Company, following a petition filed by Phuc Thuan Phat Trading and Construction Company, headquartered in District 12, Ho Chi Minh City.

10:40 am: The real estate sector showed signs of recovery but failed to lift the VN-Index

The morning session remained firmly in the grip of sellers, with the market breadth indicating a lopsided contest—360 declining stocks versus 230 advancing stocks.

As of 10:30 am, the VN-Index was hovering around its intraday low, down more than seven points to just above 1,230. The HNX-Index also slipped by over one point to 235.

Financial and banking stocks continued to languish in negative territory. SSI shed over 2%, while MBB, TCB, STB, and ACB all posted losses of more than 1%.

Against this backdrop of pervasive selling pressure, the real estate sector displayed some resilience. The Vingroup trio—VIC, VRE, and VHM—all traded in the green, with VIC surging by a remarkable 3%. However, their collective efforts were insufficient to counter the broad-based market sell-off.

The plastics and chemicals sector also witnessed a resurgence of buying interest, with stocks like BFC, CSV, DPR, HVT, NET, and NTP making solid gains. Nevertheless, this sector was not immune to the broader market weakness, as evidenced by the declines in stocks such as RDP, TNC, PBP, PSW, and AAA.

Market liquidity remained subdued, with the total trading value for the first half of the morning session barely surpassing 4 trillion VND.

Opening Bell: Sellers dominated the market at the opening bell on July 25

The Vietnamese stock market extended its decline at the opening bell on July 25, with the VN-Index plunging nearly seven points in early trading.

The downward pressure was pervasive across various sectors, with large-cap stocks in industries such as banking (CTG), construction and infrastructure (GVR), technology (FPT), retail (MWG), and manufacturing (TCB and HPG) exerting considerable drag on the VN-Index. The top ten stocks with the most negative impact on the index contributed to a decline of approximately 3.5 points.

On the flip side, VCB, VIC, and BID attempted to stem the tide, but their collective efforts only managed to cushion the index by around 0.2 points.

The rubber sector, along with retail, securities, and information technology, bore the brunt of the selling pressure. In the rubber sector, SRC hit the daily limit-down, while DRC and CSM also posted significant losses.

The retail sector also faced headwinds, with prominent stocks like MWG, PNJ, and FRT retreating by 1-2%.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.