|

SBG’s Business Targets for Q2 2024

Source: VietstockFinance

|

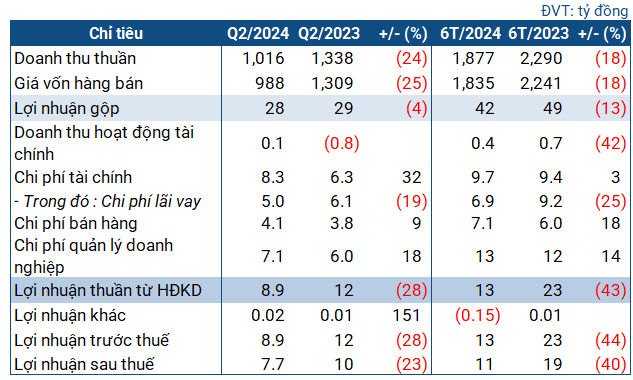

In the second quarter, SBG recorded over 1,000 billion VND in revenue, a 24% decrease compared to the same period last year. Gross profit stood at 28 billion VND, a 4% decline after deducting the cost of goods sold.

Despite the slight dip in gross profit, a surge in expenses during this period further dragged down SBG’s profits. Specifically, financial expenses rose by 32% to over 8.3 billion VND, while administrative expenses increased by 18% to more than 7.1 billion VND.

Ultimately, SBG’s profit after tax amounted to 7.7 billion VND, marking a 23% decline year-over-year.

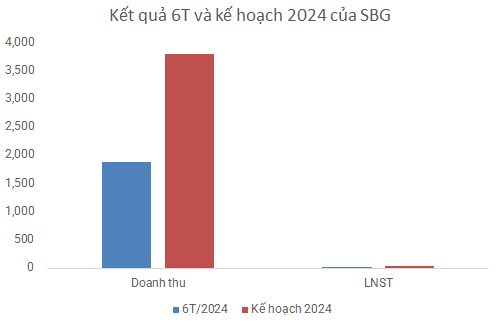

For the first six months, SBG’s revenue reached nearly 1,900 billion VND, an 18% decrease. Profit after tax stood at 11 billion VND, a 40% drop. Compared to the plan approved by the 2024 General Meeting of Shareholders, the company achieved 49% of its revenue target and 28% of its profit after-tax goal.

Source: VietstockFinance

|

As of the end of June, SBG’s total assets amounted to nearly 1,460 billion VND, a 23% increase from the beginning of the year. This included over 1,200 billion VND in short-term assets, a 30% rise. Cash holdings increased by 37% to nearly 60 billion VND, while inventory at the end of the period stood at approximately 304 billion VND, a 25% jump.

Accounts receivable from customers also witnessed a significant 36% increase, totaling over 635 billion VND. The main difference was in the amount receivable from High-Tech Livestock Breeding JSC (approximately 80 billion VND, five times higher than at the beginning of the year), which owns the Hai Dang farm cluster of BAF – a member of the Tan Long Group, similar to SBG. Additionally, the amount receivable from Cao Thang Import-Export JSC rose from 2.9 billion VND to nearly 134 billion VND.

Furthermore, the company had nearly 63 billion VND in uncompleted capital construction, unchanged from the beginning of the year. This expense is allocated for two projects: the SIBA High-Tech Mechanical Factory in Ba Ria-Vung Tau and Nghe An.

On the capital side, short-term debt accounted for the majority of the company’s total debt, reaching 941 billion VND, a 34% increase. The current ratio stood at 1.28, but the quick ratio was only 0.95, indicating a small risk if the company suddenly had to meet all its debt obligations.

SBG also had short-term loan debt of 106 billion VND, a 57% increase from the beginning of the year, and long-term loan debt of nearly 105 billion VND, a 70% jump. These loans were from banks and financial leasing organizations.