Information on biometric authentication was announced at the Press Conference on the Banking Sector’s Operating Results for the first half of 2024 and the deployment tasks for the last six months of 2024, held on the morning of July 23, 2024.

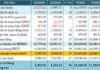

Mr. Le Van Tuyen, Deputy Director of the Payment Department, State Bank of Vietnam, said that as of July 22, 2024, 26.3 million customers had authenticated biometrically through the citizen identity card with a chip.

Of these, 22.5 million users authenticated via the application, and 3.8 million customers did so at the counter. In addition, 37 credit institutions have officially deployed mobile applications, 47 credit institutions have implemented counter services, 25 credit institutions have sent data to the Police Administration for Social Order (C06, Ministry of Public Security), and 22 credit institutions have implemented the VNeID platform.

The new Law on Credit Institutions and Decree 52 also contain several provisions to promote cashless payments. The State Bank has issued seven circulars and detailed laws guiding credit institutions. Circulars 17 and 18 regulate the use of payment accounts and bank cards. These circulars stipulate that electronic means can only be used to withdraw money from a payment account after completing a comparison and matching it with the account holder’s identity card or biometric data.

Mr. Doan Thanh Hai, Deputy Director of the Information Technology Department, State Bank, said that since Decree 2345 took effect on July 1, 2024, there have been cases of fraudsters impersonating bank employees and calling customers to assist with biometric authentication. These individuals trick customers into authenticating through unfamiliar links and applications to gain control of their phones and steal their money. The State Bank has issued guidance and warnings to banks, which have taken measures to address this issue.

The State Bank has directed credit institutions to warn customers to update their biometric data only through the bank’s official application or at the counter and never through unfamiliar links or applications. Customers should also be educated about basic security practices, such as not clicking on unknown links, installing unfamiliar applications, granting permissions to malicious actors, or providing personal information or OTP codes to anyone. Additionally, they should ensure that their software is up to date to protect themselves.

The banking sector has also implemented several measures to combat fraud in cyberspace, including account cleaning, strong authentication methods (biometrics, OTP, digital signatures, etc.), and monitoring abnormal transactions for timely handling.

Currently, the State Bank is piloting the monitoring of suspicious accounts for fraud or impersonation of credit institutions. These institutions will notify the State Bank of any suspected fraud, and this information will be used to block or require additional authentication for potentially fraudulent transactions.

Bank Bonus 2024: 4-Month Salary Surprise, Where…0 VND

Amidst the declining business results of many banks in 2023, the Tet bonus for employees has also significantly decreased. In fact, some branches do not have any Tet bonus or only give symbolic bonuses to their employees.